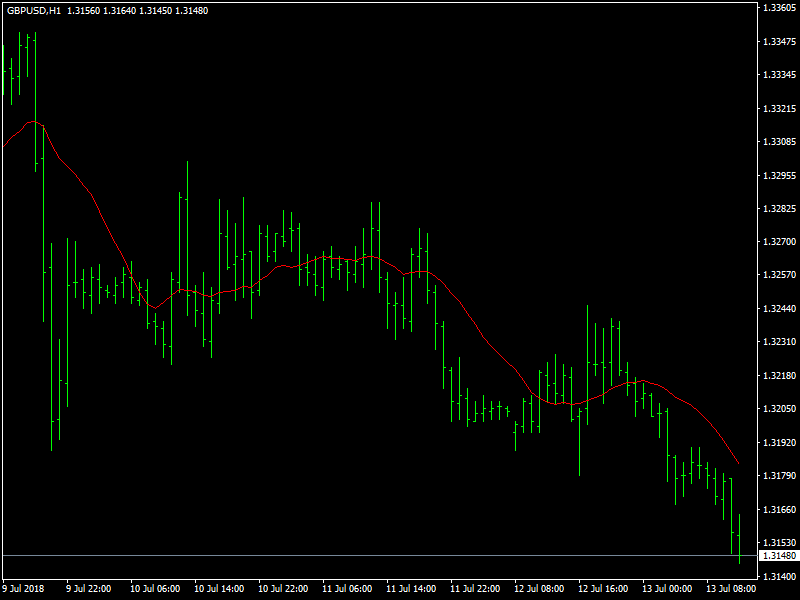

GBP/USD Daily Price Forecast – Brexit Woes Continue to Haunt GBP/USD

The GBP/USD continues to mark in new lows ahead of Friday’s London market session, and the pair continues to drop, hitting 1.3164 as Brexit concerns continue to drag the pair down. Prime Minister Theresa May’s government released the White Paper outlining the PM’s latest Brexit proposal, which has seen resignations from key Brexit ministers in protest over the proposals, which see May desperately hoping to avert a hard Brexit. EU leaders have yet to pass judgment on the latest proposals, but the hard-line negotiation tactics being employed by the EU see little wiggle room for Theresa May, who continues to struggle with wrangling vehement Brexiteers in her parliament. The White Paper came with little that will appease Brexiteers, hence the recent resignations and the EU will surely come back with further compromises at which point the Brexiteers will likely start rebelling in droves, throwing further uncertainties into the air and making a troublesome foundation for the BoE and indeed sterling bulls.

GBPUSD Under Pressure

This makes for an interesting parliamentary debate next week, which will throw up many of the risks facing PM May’s leadership later this year. The pair has been on steady decline post white paper release with 0.30% decrease in value since trading closed yesterday after hitting yesterday’s high at 1.3245, currently moving in range of 1.3164/68 handle. Another major factor that added to steep decline on Asian market hours was US President Trump’s comment on his wish to see a hard Brexit scenario as Prime Minister Theresa May’s current ‘soft-Brexit’ proposal would “probably kill” hopes of a US-UK trade deal. The US President also lamented to UK media outlets that PM May failed to take his advice on current Brexit negotiations, and Trump is dangling the potential for trade difficulties between the two nations if the UK maintains trade ties with the EU.

Cable has been tugged and pulled over a number of themes, from Brexit to M&A news and indeed economic US/UK data leading up to the BoE meeting next week. Firstly, the RICS house price index rose and posted a gain of 2, a little firmer than expectations of a -4 outcome (broader trend in UK house prices remains very soft). The market’s confidence in the Bank of England delivering an August rate hike can be underpinned by that data though and a 25bps hike is 80% priced in already. The US CPI m/m was a miss and slightly disappointing sending the dollar lower (June CPI rose 0.1% m/m, weaker than expected but still taking the y/y rate to 2.9% from 2.8%. Core CPI increased 0.2% m/m). Overall The Sterling has been trading into the downside this week, as Brexit political struggles hamper the GBP. The pair peaked at 1.3360 on Monday, a one-month high for the GBP/USD, but renewed Brexit concerns, and broader market sentiment flubbing on trade tensions, has seen the Sterling head back into bearish territory, with the year’s low close by at 1.3050.

This article was originally posted on FX Empire

More From FXEMPIRE:

Bitcoin and Ethereum Price Forecast – BTC Prices Continue to Range

USD/CAD Daily Price Forecast – USD/CAD Back on Track to Breach 1.32 Handle

Crude Oil Price Forecast – crude oil markets stabilize on Thursday

Price of Gold Fundamental Daily Forecast – Rising U.S. Dollar Could Spike Gold Prices to $1230.70

Yahoo Finance

Yahoo Finance