GBP/USD Daily Fundamental Forecast – November 9, 2017

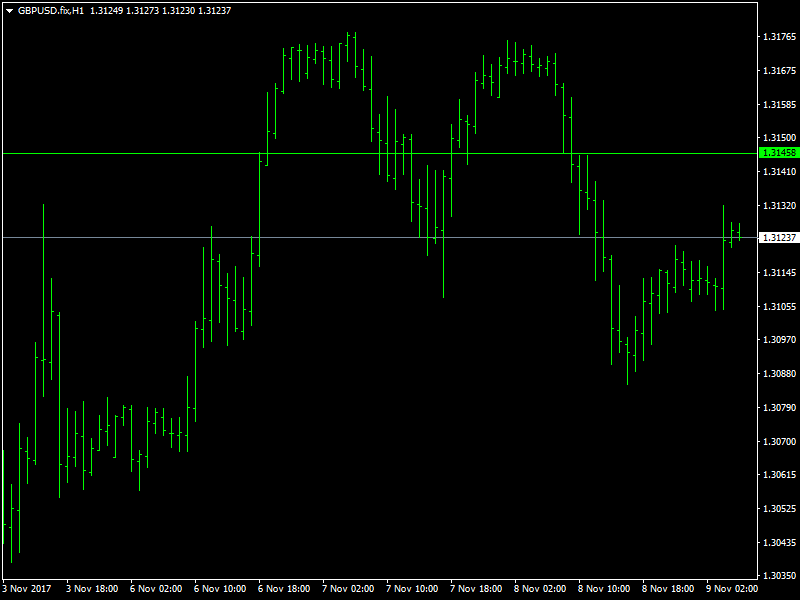

The pound dropped lower during the course of the day yesterday as concerns continue to weigh on the pound with regard to the Brexit process and the capability of the UK economy to sustain itself through this period. The pound dropped through the 1.31 region for a brief while before bouncing from there and managed to end the day above 1.31 but it continues to look weak as of this writing.

GBPUSD Falls On London Fix Selling

Another reason for the GBPUSD pair dropping lower is the continued strength in the dollar which has been propped up by all the talk about the tax reform bill. The dollar has been trading with a bit of strength ever since the tax reform bill was pushed through by Trump and his team. But nothing is confirmed as yet as the bill is being brought into law and there are reports that say that the actual implementation might be delayed by over a year. This is something that Trump is unlikely to favor and there is still some uncertainty around this which is likely to weigh on the dollar in the short term.

The pound has been underpinned by all the talk about lack of progress in the Brexit process which continues almost on a daily basis. The pound has also been weighed by the grim outlook of the UK economy that was given by the BOE in its last rate announcement and that is the reason why we are seeing the GBPUSD pair continue to trade near the lows of its range despite the hike in the rates. The market, having already priced in the hike, was looking for much more from the BOE and the lack of positive commitment from the BOE is obviously weighing on the pound.

Looking ahead to the rest of the day, we do not have any major news from the UK or the US and hence we are likely to see some consolidation on either side of 1.31 during the day. The support just below 1.31 seems to be very strong and the bounces from that region have been quick and strong as well, which means that the pound is unlikely to fall too much anytime soon.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance