GBP/USD Daily Forecast: Pound Breaks to Fresh Monthly High

Boris Johnson Reaffirms Plans for Oct 31 EU Exit

Boris Johnson, who is almost certainly going to be the next British prime minister, once again committed to a departure from the EU by October 31st.

It has been three years since UK citizens voted to leave the European Union and Johnson promises to set forth action to make that happen. He commented on methods to prevent the Irish Backstop. He also discussed how the UK will pay the agreed-upon $50 billion exit fee.

Johnson stated that all possible attempts to make a deal will be made and that a no-deal Brexit would be used as a last resort. He added that putting a no-deal Brexit on the table shows how serious the UK is about leaving which should provide some additional negotiation power.

Fed Chair Powell Speaks Later Tonight

GBP/USD looks to be scaling some important resistance but the move is not confirmed yet. Perhaps Powell will provide dollar bears a catalyst to get the currency pair over the major hurdle.

Fed Chair Powell will have an opportunity to signal a July cut when he speaks later today, if it is the Fed’s intention to ease policy next month. Policymakers made a dovish shift at their last meeting which has been fueling a dollar decline.

The futures markets seem convinced that the Fed will ease in July and have fully priced in at least a 25 basis point cut. The odds of a 50 basis point cut stand around 40%. It is common for the Federal Reserve to communicate policy changes ahead of implementation. For that reason, it’s reasonably fair to believe Powell will send a signal in his speech later today.

Technical Analysis

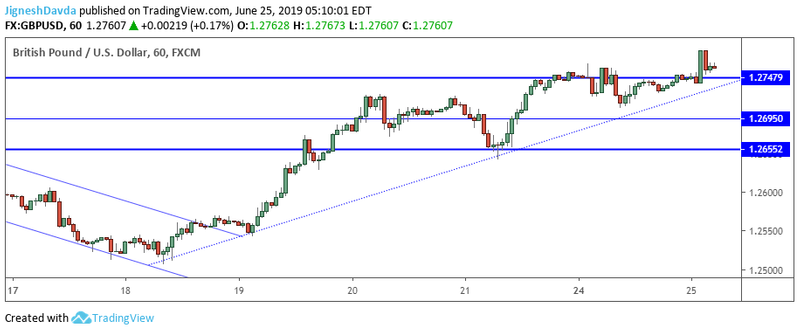

GBP/USD has been stuck at a major resistance level found at 1.2747. This level has held the pair lower since late May. The pair seems to be trying to make a bullish break in early European trading. However, the break is not confirmed yet.

If the pair manages to break higher from here, I think we will see some renewed strength to the upside. I think it’s very possible we can see the pair continue higher to the 1.2900/1.2950 area.

On the other hand, I don’t think bulls should get ahead of themselves considering how big of a hurdle the mentioned horizontal level is. In the event the pair fails to hold above it, I see some nearby support from a rising trendline originating from last weeks lows. Beyond that, I watching a horizontal level at 1.2695.

Bottom Line

Fed Powell’s speech can trigger renewed dollar weakness if he signals a move in July

A sustained hold above 1.2747 stands to renew upside momentum

A fall below the rising trendline signals a correction. First support is seen at 1.2695.

This article was originally posted on FX Empire

Yahoo Finance

Yahoo Finance