Gabriel Gan: Bank Stocks In Bear Market?

On 3 July 2018, I contributed a piece “Property Stocks Are In Bear Market?” to this financial portal that attracted more than 1 million users in 2017. Some or most of the property stocks were already in bear market territory on that day. Two days later on 5 July, the government announced property cooling measures to stop property prices from escalating. Such a move more or less condemned property counters to bear market territory.

When I say bear market territory, it means that the stock must have fallen by at least 20 percent from its peak – either closing high or intraday high – on the day when the price was the highest.

What other stocks are in a bear market territory? We can safely say that oil & gas stocks have been in bear market territory for the longest time. Just check out Keppel Corporation and Sembcorp Marine. What about Venture Corporation and Hi-P International? Bad too.

Since most stocks, especially the key Straits Times Index (STI) components are bad, is the STI really that bad? Not really, it seems. There are several component stocks that outperformed the STI so to speak as these stocks either held up well or fell less than the rest.

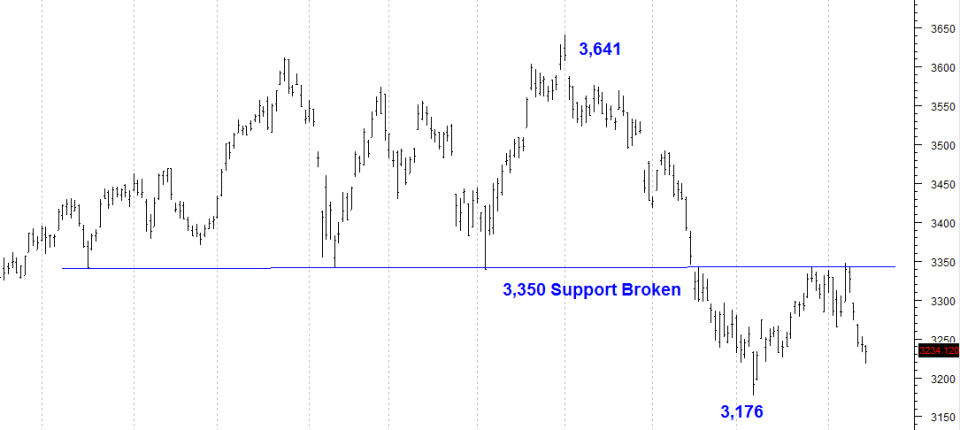

Jardine Matheson did very well, so did Ascendas REIT, CapitaLand Mall Trust, ComfortDelgro and Wilmar International. These stocks fared better than the 12.7 percent fall in the STI from its peak of 3,641 to its close 3,234 on 15 August.

Straits Times Index

On 2 May 2018, the Straits Times Index traded as high as 3,641 points and closed slightly lower at 3,615 points. The index has failed to see daylight ever since, dropping to as low as 3,176 points on 6 July before closing at 3,191 on the same day.

This day marks a short-term turning point as the index staged a strong rebound to go as high as 3,347 points on 7 August – a 156-point, or 4.9 percent gain. At the same time, 3,176 has become the short-term support that must hold in order to prevent the STI from slipping further.

Nevertheless, Donald Trump decided to slaughter Turkey way ahead of Christmas by imposing tariffs on Turkish metal finding its way to the US market. This, coupled with an already-battered Turkish Lira and high debt levels, sent global markets and the STI tumbling.

With all three banks trading ex-dividend during this period, the fall in the STI was further exacerbated.

At the time of writing, at 12pm on 16 August, the STI was trading at 3,217 with an intraday low of 3,207. The recent low of 3,176 beckons. Going below 3,176 exposes the STI to even more downside risk, with 3,120 providing the next cushion followed by the psychological 3,000-level offering some support.

Do remember that the STI fell 12.7 percent from peak to its recent close on 15 August. We shall now look at the bank stocks to determine if they have outperformed or underperformed the STI. Most importantly, we want to know if the banks have fallen 20 percent – the key threshold in determining whether or not they are in a bear market.

DBS

DBS led the blood-letting in the banking universe. Its 1H2018 disappointed analysts despite the bank chalking up more than 20 percent jump in its net profit! Still, the share price tanked.

The share price of DBS surged to a high of $31.28 after a prominent analyst of a foreign brokerage upgraded his call with a buy target of $35. The share price has been on a slippery slope since then despite several meaningless rebounds. The correction “ended” on 6 July, similar to the STI, as the share price rebounded from around $25 to $27.28. It is now trading around $25 yet again, testing it recent low. Is it a double bottom? Optimistic, but unlikely. Any rebound from this level should be seen as an opportunity to exit the stock from a technical angle.

There should be some support at the $24.00 to $24.20 region. From a high of $31.28 to a recent low of $25.02, the share price of DBS lost $6.26 or 20 percent. It is now a borderline case. Any further dips will confirm that the bears are in firm control.

OCBC

OCBC delivered the best result among all the three banks, sparking off a relief rally after DBS led the drop. But earlier on, OCBC traded as high as $14.04 on 2 May before closing at $13.96 on the same day. That was the highest point we have seen in the past three months ago.

It is now trading at $11.26, $0.20 away from its recent low of $11.06 on 17 July. A rally took the share price above $12, to a high of $12.14 on 8 August, but a series of negative news knocked its share price back to $11.12 on 15 August.

From its high of $14.04 to its recent low of $11.06, shares of OCBC fell $2.98 representing a loss of 21.2 percent. It flirted with the bears for a while. Even at its trading price of $11.26 on 15 August, the loss counting from its high of $14.04 is still an eye-popping $2.78 or 19.8 percent.

From a technical point of view, both shares of DBS and OCBC are precariously close to embracing the hugs from the bears. What about UOB?

UOB

It seems that the share price of UOB outperformed DBS and OCBC on a May-to-date basis. From its intraday high of $30.37 on 30 April, the shares of the banks fell to an intraday low of $25.73 on 18 July shedding a total of $4.64 or 15.3 percent. From a peak-to-trough basis, UOB’s share price performed better than its two peers.

From a low of $25.73, the share price rallied to as high as $28.48 on 8 August! This is an impressive gain of $2.75 or 10.7 percent within a month. While the shares at still trading at $26.80 on 15 August and a good distance away from its recent low of $25.73, the same cannot be said of DBS and OCBC who are flirting with the bears.

Should DBS and OCBC continue to fall victim to bad sentiments sinking into bear territory, it is very likely that UOB’s shares may follow suit. Seasoned investors will often advise fellow investors not to fight the trend. It is probably better to stay sidelined as the banks are firmly on a downtrend.

Gabriel Gan was a Senior Vice President at AmFraser Securities. He left to join DMG Securities (now renamed as RHB Securities) to take on a similar role. During his stints at the stockbroking firms, he dealt in equities, performed advisory role and executed corporate finance deals for his clients.

Since 2001, he has been invited by the media (both Mediacorp and SPH) for his stock market opinions. On radio, he spoke on 95.8FM for more than a decade; he now speaks every Wednesday and Thursday mornings on SPH radio 96.3 FM, delivering his opinion in Mandarin. On TV, Gabriel appeared on Channel NewAsia, the former Channel U and various Channel 8 financial segments including Good Morning Singapore, Hello Singapore and MoneyWeek. On print media, he continues to give quotes and comments on the economy and stock market for Lianhe Zaobao, Lianhe Wanbao and Shinmin Daily. On top of that, Gabriel was a columnist for the now defunct My Paper.

Related Article:

Yahoo Finance

Yahoo Finance