Spectre of 'Grexit' stalks G7 finance meeting

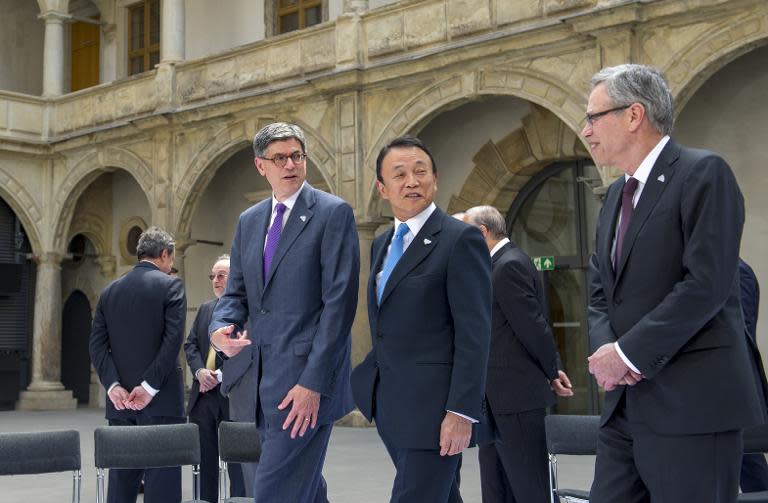

The possibility of Greece quitting the eurozone cast a long shadow over a meeting of finance ministers from the Group of Seven leading industrialised nations Thursday, with the International Monetary Fund appearing to warn that such a scenario was possible. A so-called "Grexit", or Greek exit from the euro, was "a potential," IMF chief Christine Lagarde -- who is attending the meeting -- told the daily Frankfurter Allgemeine Zeitung. Such a scenario would not be "a walk in the park" for the single currency area, but would "probably not be an end to the euro," she said in comments translated into German. "It's a complicated issue and it's one that I hope the Europeans will not have to face because hopefully they will find a path to agree with the future of Greece within the eurozone," she said in a subsequent statement issued in Washington to clarify her comments. Lagarde dismissed Athens' assertion that a deal with its creditors was imminent. "It is very unlikely that we'll reach a comprehensive solution in the coming days," she said, after a Greek government spokesman had said that Athens hoped for a deal by Sunday. Following positive signals from Greece just 10 days ago, the three institutions involved in the negotiations -- the IMF, the European Central Bank and the EU Commission -- had had to "sober" their expectations, Lagarde said. There was still a lot of work to be done, she said, and the IMF was not prepared to pay out more funds without a clear reform pledge. "We have rules. We have principles. There will be no half-baked programme review," Lagarde said. On Wednesday, Athens had announced that it was close to a loan deal with its creditors that would unlock badly-needed bailout funds for its struggling economy. But the Greek government subsequently back-pedalled after German Finance Minister Wolfgang Schaeuble -- who is hosting the talks in Dresden -- retorted that no significant new breakthroughs had been achieved. - Making progress - The EU's commissioner for economic and monetary affairs, Pierre Moscovici, said negotiations were "making progress" and more had been achieved "in the past three weeks than in the previous there months." But "there is not much time, there is still a way to go," he told reporters. Moscovici rejected Athens' assertion that the eurozone was "three quarters of the way down the road to a deal." "We are working day and night to find a solution. It's certainly possible, but there is still a way to go," Moscovici said. Greece is not actually on the official agenda of the meeting in Dresden, which is a preparation session for a wider summit of G7 leaders starting on June 7. The official topics range from the state of the global economy, to financial regulation, fighting tax evasion and ways of starving jihadist groups like the Islamic State of funding. But it was the Greek crisis that was at the forefront of everyone's minds, especially with all of the key players present -- Lagarde, Moscovici, ECB president Mario Draghi and Eurogroup president Jeroen Dijsselbloem. Greece itself was not represented since it is not a member of the G7. It is not just the Europeans who insist that Greece's fate in the eurozone is a matter of urgency. "Everyone has to double down, and treat the next deadline as if it's the last deadline and get this resolved," said US Treasury Secretary Jack Lew. The ECB warned that the Greek crisis could pose a risk to financial stability in the euro area in the future. Separately, Greece's Prime Minister Alexis Tsipras held a teleconference with German Chancellor Angela Merkel and French President Francois Hollande. - Top economists present - For the first time at a G7 finance meeting, a number of the world's leading economists -- such as Nouriel Roubini, Kenneth Rogoff and former US treasury secretary Larry Summers -- are among those invited. Over the two days of talks, the G7 ministers will also examine the current high level of volatility on the financial markets. The Chinese currency, the yuan or renminbi, could also feature in discussions, as Beijing continues to push for it to play a greater role in the world financial system, such as being included in the basket that makes up the IMF's own "special drawing rights" reserve currency. Washington has long claimed that the yuan was manipulated, but the IMF said on Tuesday that the currency is "no longer undervalued". The meeting began late Wednesday with a short ceremony in Dresden's rebuilt Frauenkirche church, and it was scheduled to wrap up on Friday.

Yahoo Finance

Yahoo Finance