FTSE 100 hits one-week low as oil slump persists; Pound rises after UK factories have best month for orders since 1988

Oil languishes near 10-month lows on gut fears

Pound holds gains after Bank of England's Haldane strikes hawkish

European shares open lower as oil slide weighs

UK factories have best month for orders since 1988

European shares close mixed as oil weakness limits gains

The persistent oil price weakness put European shares under pressure yesterday, resulting in a mixed close across the region.

By close of play:

FTSE 100: -0.11pc

DAX: +0.22pc

CAC 40: +0.16pc

IBEX: -0.21pc

Joshua Mahony, of IG, said: "The FTSE is trading in the red at the close of business today, as the decline in crude prices continued to drag sentiment. Coming on a day which is largely devoid of any major market moving events, we have seen a degree of stability that has been lacking amongst recent political instability. Improved consumer confidence in the eurozone continues the theme of recent months, with investors seeing Europe as a high growth region for the coming years despite Brexit uncertainty. This paves the way for an end of the week that will be heavily focused on the eurozone, with PMI surveys expected to continue the strength seen in recent months."

ING: Hawkish BoE comments nothing to get excited about just yet

ING strategist Viraj Patel reckons the hawkish commentary from the Bank of England is "nothing to get excited about" just yet.

He said: "Conflicting messages from key BoE officials this week have left markets in a state of confusion when it comes to understanding what UK monetary policy means for the pound. The bottom line is that nothing has changed and even under the most hawkish of scenarios – that the post-Brexit 25bp rate cut is reversed later this year – a very shallow Bank Rate path means that a sustained period of GBP appreciation is unlikely."

ING's expectation for a slowdown in the UK economy should make the case for rate hike less compelling, Mr Patel said.

He also said the slightly more bearish outlook means that ING's base case is still for the pound to fall to $1.24 against the US dollar.

His comments follow a bold call from Nomura, who have changed their view on rate hike expectations. They now expect the Bank of England to raise rates in August.

Nomura sees Bank of England raising rates in August

Following a shock split vote on rates at the last Bank of England MPC meeting and Andy Haldane shifting from dove to hawk yesterday, Nomura has become the first bank to see a rate rise in August.

In a note released this afternoon, strategists said: "We have changed our view on the BoE and now expect the MPC to raise rates for the first time in a decade at its next meeting on 3 August. This supports our bearish call on 10yr rates outright and cross market.

"Given the FX markets remain uncertain about UK politics and doubtful about the BoE, we argue risk-reward remains to be long sterling at these low levels of market optimism."

*NOMURA SEES BOE INCREASING RATE BY 25BPS TO 0.5% ON AUG. 3 - first call of a rise so far

— World First (@World_First) June 22, 2017

After a rollercoaster week of Bank of England commentary from Carney and Haldane, the bank now expects the MPC to raise rates by 25 basis points at the August meeting.

Eurozone consumer confidence jumps in June

Eurozone consumer confidence jumped much more than expected in June, rising to -1.3 points from -3.3 points in May, a flash estimate from the European Union's statistics office Eurostat showed this afternoon.

Forecasts expected to rise to -3 points.

Eurozone Consumer COnfidence (-1.3 vs -3e vs -3.3 prev) = best since June 2001 pic.twitter.com/h6zLxfJX25

— Mike van Dulken (@Accendo_Mike) June 22, 2017

Claus Vistesen, of Pantheon Macroeconomics, described the reading as "another solid headline".

He added: "It is now within a whisker of the cyclical peak in 2007, signalling robust growth in retail sales and consumers’ spending. Based on this survey alone, we would expect household consumption in the Eurozone to rebound smartly from the slowdown in Q1. The counter-argument is that real wage growth is slowing due to higher inflation. On balance though, the sharp increase in headline consumer sentiment since February point to upside risks for consumption and retail sales data in the near term."

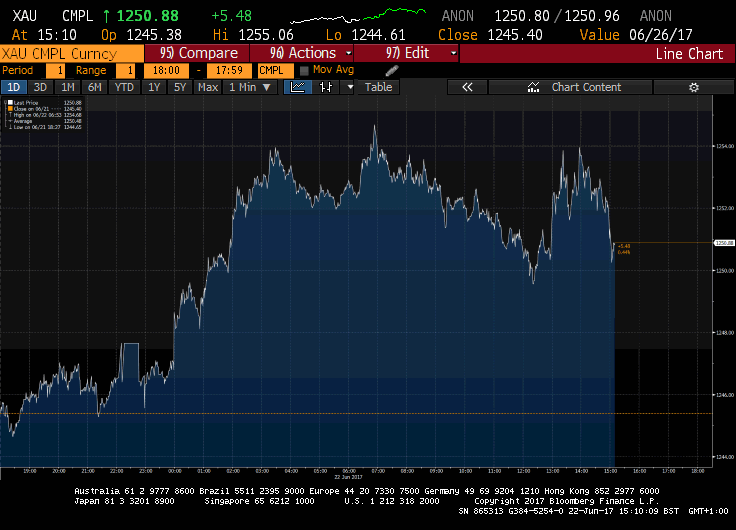

Gold rises as oil slump boosts demand for safe-haven assets

Gold became the biggest beneficiary of the renewed oil price slump, as investors sought safety.

The safe-haven asset climbed by as much as 0.78pc to $1,255.06 an ounce.

Gold is often seen as a safe-haven option at times of volatility in riskier markets such as stocks.

Theresa May arrives in Brussels for 'humiliating' Brexit talks as she makes EU citizens offer

Theresa May has arrived in Brussels for what EU officials have warned could be a “humiliating” encounter as she holds talks on Brexit with EU leaders for the first time since losing her majority at the general election.

The Prime Minister is expected to set out plans to give EU citizens legal rights in this country after Brexit to help curry favour with her European counterparts.

Arriving in Brussels, Mrs May struck a positive tone as she said Brexit negotiations had "started constructively".

But Angela Merkel, the German Chancellor, painted a much more sombre picture as she said the EU's future will be prioritised over the UK's withdrawal.

She said: "I want to say clearly that, for me, shaping the future for the 27 takes priority over the negotiations with Great Britain over withdrawal.

Head over to our live politics blog with Jack Maidment for the latest: Theresa May arrives in Brussels for 'humiliating' Brexit talks as she makes EU citizens offer

US stocks open little changed as oil prices remain under pressure

US stocks were little changed when the opening bell sounded on Wall Street this afternoon as oil prices remained under pressure.

At the opening bell:

Dow Jones: +0.02pc

Nasdaq: +0.1pc

S&P 500: +0.04pc

Landlords cut back borrowing as higher stamp duty bites

Taxes and limits on lending to landlords are squeezing the buy-to-let end of the housing market hard, as banks and building societies predict a sharp fall in lending.

Landlords will borrow £35bn in 2017 and £33bn in 2018, the Council of Mortgage Lenders (CML) predicts, down from £40.6bn in 2016.

It is also substantially below the £38bn that the CML had predicted at the start of this year for lending in both this year and next.

“Buy-to-let had a weak start to 2017, and the sector’s contribution to overall net mortgage lending has fallen considerably over the last year,” said the CML’s director general Paul Smee.

Read the full story by Tim Wallace here

US jobless claims rise, labor market still tight

The number of Americans filing for unemployment benefits increased slightly last week, but remains at levels consistent with a tight labor market.

Initial claims for state unemployment benefits increased 3,000 to a seasonally adjusted 241,000 for the week ended June 17, the Labor Department said.

Economists polled by Reuters had forecast first-time applications for jobless claims rising to 240,000 in the latest week.

US Cont Jobless Claims creep up for another week, albeit still v close to 28yr lows #usdpic.twitter.com/QhQf13R0iM

— Mike van Dulken (@Accendo_Mike) June 22, 2017

Jobless claims for the prior week were revised upwards by 1,000 to 238,000 from 237,000. This week's tally is the 120th consecutive week that claims have been below 300,000, the threshold associated with a strong labor market. It's the

longest stretch that the US jobs market has remained below that level since 1970.

The four-week moving average of claims, considered a better measure of labor market trends as it smoothes week-to-week volatility, rose 1,500 to 244,750 last week, the highest since early April.

US Jobless claims in line with expectations at 241k.

Canadian Retail Sales with a beat ex-autos 1.5% vs exp 0.7;% prev -0.1%#USDCAD— Sigma Squawk (@SigmaSquawk) June 22, 2017

The unemployment rate in May declined to a 16-year low of 4.3pc.

A Labor Department official said there were no special factors influencing the claims data. Only claims for Louisiana were estimated.

Thursday's claims report also showed the number of people still receiving benefits after an initial week of aid increased 8,000 to 1.94m in the week ended June 10.

The so-called continuing claims have now been below 2m for 10 straight weeks, indicating diminishing labor market slack.

Report by Reuters

Number of stocks trading ex-dividend

A number of stocks are trading without entitlement to their latest dividend pay-out today, which is also weighing on the FTSE 100. They include:

Experian

Land Securities Group

Mediclinic

United Utilities

B&M European Value Retail

Big Yellow Group

JD Sports Fashion

Paypoint

American Airlines says Qatar Airways interested in buying 10pc stake

Shares in American Airlines have jumped 5pc in pre-market trading after it received an unsolicited notice indicating that Qatar Airways intends to make an investment in the company.

Qatar Airways has indicated that it has an interest in acquiring approximately a 10pc stake in the airline, adding that the purchase of any common stock would be made in the open market.

BREAKING: American Airlines shares jump 5% after it says Qatar Airways has expressed interest in taking ~10% stake https://t.co/ja53UxPcIU

— CNBC (@CNBC) June 22, 2017

US stocks to open flat as oil weakness persists

US stocks are set to open little changed this afternoon as oil remains under pressure.

US crude futures were up 0.4pc at $42.70 per barrel. They closed down 1.6pc on Wednesday after touching their lowest level since August. Global benchmark Brent traded at around $45.24.

Iraq's total crude oil exports rise in May

Iraq's total crude oil exports rose in May, the country's oil ministry said today.

Exports totaled 100.4m barrels from south ports and 700,000 barrels exported from northern Kirkuk field, it said.

Oil export revenue totaled $4.623bn last month.

Boss of B&M Bargains doubles his pay with a bumper bonus

The boss of B&M Bargains has enjoyed a bumper bonus following a jump in the retailer's profits which has led to his payday doubling compared to the year before.

Chief executive Simon Aurora, who has built the discount retail chain with his brothers Bobby and Robin, was awarded a £678,692 bonus after the company met 80pc of his target award. As a result, Mr Aurora will take home £1.4m compared to a £601,638 pay package last year.

Earlier this month the Aurora family cashed in nearly £230m of shares after cutting their stake in the business to 15pc from about 21pc in a share placing. The brothers are now estimated to be worth almost £2bn as B&M's share rice has soared by a third since listing three years ago.

Last year B&M profits jumped by £182.9m in the year to March 25, while sales inched 3.1pc higher to £2.4bn as it continued its rapid expansion programme.

Read the full report by Ashley Armstrong here

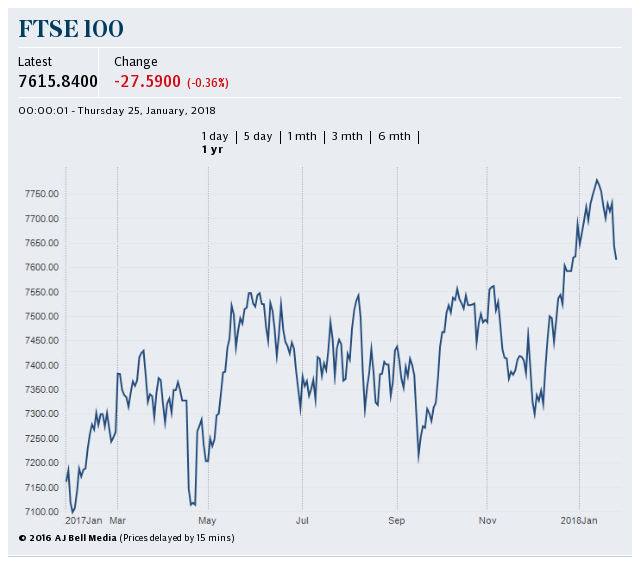

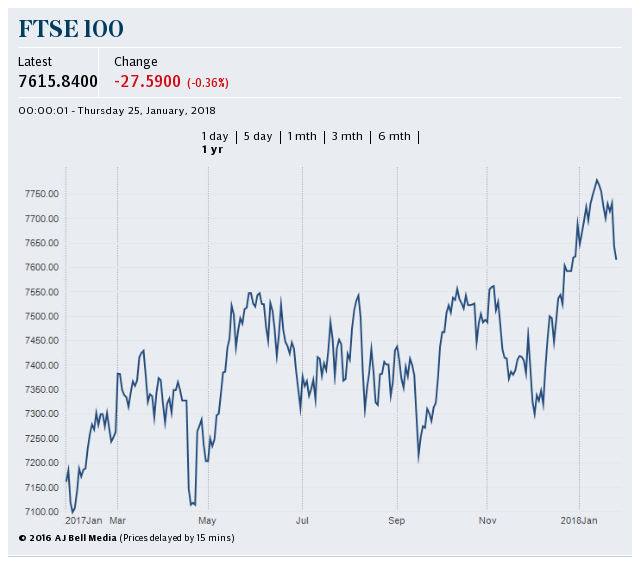

Half-time update: European shares slide as energy stocks weigh

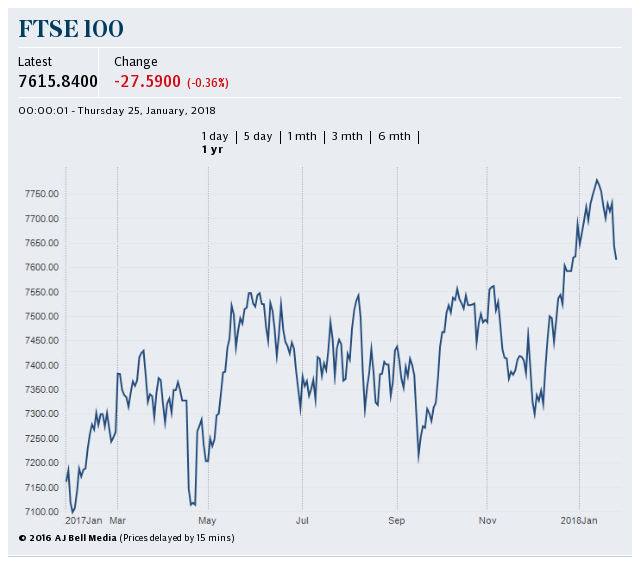

European shares remained in the red and the FTSE 100 wallowed at a one-week low as energy stocks weighed as the oil price slump persisted amid glut fears.

Just after midday:

FTSE 100: -0.35pc

DAX: -0.03pc

CAC 40: -0.33pc

IBEX: -0.53pc

Stoxx 600: -0.27pc

Mike van Dulken, of Accendo Markets, said: "Equity indices are nursing losses as sentiment remains under the cosh from political uncertainty (Trump, Brexit, Middle East) and Oil having taken another leg south to plumb 10-month lows on revived supply glut fears, hurting the FTSE more than peers. The UK's FTSE is being weighed down by Oil, Banks (uncertain outlook on growth and rates), Miners and FX sensitive internationals, overpowering strength within Healthcare (SHP approval, GSK legal) and precious metals miners (FRES, RRS) as the safe havens rally on reduced risk appetite."

UK factories have best month for orders since 1988: What the experts say

Howard Archer, Chief Economic Advisor to EY Item Club, said the June CBI industrial trends look "very good". However, he noted UK manufacturing surveys have recently been "much more upbeat" than actual ONS data.

Jun #CBI#industrial trends looks very good but worth noting #UK#manufacturing surveys recently been much more upbeat than actual #ONS data

— Howard Archer (@HowardArcherUK) June 22, 2017

#CBI Jun survey shows #manufacturers' total #orders balance best since Aug 1988; #exports balance at 22-year high. #Prices still elevated

— Howard Archer (@HowardArcherUK) June 22, 2017

UK CBI Industrial Order Expectations (June): 16 vs 7 expected, prior 9

— David Madden (@dmadden_CMC) June 22, 2017

UK CBI +16 vs exp 7 prev 9

Highest since 1988.

BoE Carney "A time where risks to trade have increased"#Brexitpic.twitter.com/kbBsOsLZIY— Sigma Squawk (@SigmaSquawk) June 22, 2017

Meanwhile, Julian Jessop, Chief Economist at the Institute of Economic Affairs, said the CBI data is "further reassurance" that UK manufacturing continues to thrive following last year's Brexit vote.

Further reassurance that UK #manufacturing is continuing to thrive in the wake of the #Brexit vote. #CBI survey bodes well for Q2 GDP too. https://t.co/PBx9id8wRD

— Julian Jessop (@julianHjessop) June 22, 2017

Traders continue to test the resolve of oil producers

Risk aversion has returned to the markets once again, says Craig Erlam, of OANDA.

Mr Erlam said: "After falling into bear market territory – having fallen more than 20pc from a recent peak – oil appears to have found some support on Thursday, buoyed by Wednesday’s inventory data from EIA which reported a 2.451 million reduction in stocks. The number was roughly in line with that reported by API the day before but traders still appear a little unconvinced by these and tend to wait for the EIA release. While this has offered some near-term support, there’s little reason at the moment to believe that oil isn’t headed for further losses."

He also highlights that traders appear to be testing the resolve of those countries that signed up to the production cut, having been clearly disappointed with the decision not to deepen the cuts on top of extending them by nine months.

He added: "Oil is currently trading at seven month lows despite a commitment from a number of producers to bring the market back into balance. Ten of the last 11 inventory reports from EIA have been drawdowns and yet, traders appear unconvinced, with rising output in the US, Nigeria and Libya being touted as the reason behind this. Regardless of what’s driving these moves, the real question is how much more producers will stomach before they consider deepening the cuts?"

Pound climbs on factory orders data

The pound inched higher on the back of the factory orders data released by the CBI this morning.

It climbed to $1.2673 against the US dollar in choppy trade.

Yesterday, it surged above $1.27 as Bank of England chief economist Andy Haldane turned hawkish.

UK factories have best month for orders since 1988

British factory orders have hit their highest level in nearly 30 years, according to a monthly Confederation of British Industry survey. Reuters has the details:

The CBI said its factory order book balance jumped to +16 in June from +9 in May, hitting its highest level since 1988.

Total order books climbed to the highest since August 1988, while export orders improved to a 22-year high. #CBI_ITShttps://t.co/4HUMVYaHSApic.twitter.com/s6WDKSSPBA

— CBI Economics (@CBI_Economics) June 22, 2017

Export order growth was its strongest in 22 years, the CBI said, helped by the fall in the pound that was triggered by last year's Brexit vote.

The strong performance by manufacturers will be noted by the BoE, where three members of the eight-strong Monetary Policy Committee last week voted to raise rates, citing among other factors a pick-up in exports and investment which could help to offset a squeeze in spending for domestic consumers.

Output growth eased back to the pace seen at the start of the year, but firms expect it to rebound. #CBI_ITShttps://t.co/4HUMVYaHSApic.twitter.com/jDCkMzgND5

— CBI Economics (@CBI_Economics) June 22, 2017

On Wednesday, the BoE's chief economist, Andy Haldane, said he was likely to vote for a rate hike too later this year, as long as the economic data justified it.

Will the oil slide continue?

Yann Quelenn, of Swissquote Bank, says there have been growing concerns that other OPEC members will not respect the production cut and therefore oversupply, since the Qatar diplomatic row.

But will the decline continue? Swissquote Bank thinks so. Here's why:

When looking specifically to Saudi Arabia, the largest oil exporter in the world, we may believe this bearish trend should continue. The Arabic country really needs to have higher oil prices. Fundamentally speaking, its FX reserves have declined 27pc from its 2014 peak. Just in 2017, it has diminished by $36bn.

Current oil prices seem way too low for Saudi Arabia, which is in return obliged to liquidate its FX reserves to assume its running costs. On top of that, Saudi Arabia is willing to let investors buy 5pc of its oil reserves. Yet, at the current oil price, this seems like a deal for bullish buyers. In our view, that means Saudi Arabia is concerned about future oil prices.

In addition, the US shale gas industry is booming back and is putting deeper downside pressures on oil.

As such, Quelenn believes that the oil price should go back below $40 within the next few weeks.

Morgan Stanley: Deteriorating oil supply-demand outlook

Since early March Morgan Stanley note that they've seen a deteriorating outlook for oil supply/ demand dynamics, which has been reflected through commodity markets with Brent Oil prices falling to ~$47/bbl and WTI to $44/bbl.

Analyst Robert Pulleyn said: "Despite the OPEC + Partners (inc Russia) agreement to maintain cuts of 1.8mbpd (1.2mbpd from OPEC + ~600kbpd from Russia and other partners) for 9 months until end of March 2018, we are increasingly concerned over the supply-demand outlook for 2018."

For 2018, the US investment bank now expects the combination of strong Non-OPEC supply growth, driven by US Shale year-on-year growth of 1.1m barrels per day.

As a result, Morgan Stanley expects a negative impact on upstream activity, with specifically fewer offshore project sanctions.

Mr Pulleyn added: "We continue to believe the industry has seen significant progress in reducing project costs, with strong evidence that offshore breakevens have fallen ~50pc since 2014."

Morgan Stanley moves oil services sector back to 'in-line'

Strategists at Morgan Stanley see see three significant changes that caused them to revise our outlook for European Oil Service stocks and move the sector back to In-Line:

The oil price outlook;

The pace of contract awards;

The higher expectations reflected in stocks where share prices have rallied.

The US investment bank said this morning that these three reasons have prompted it to lower its order intake forecasts by 16-24pc for 2017-2020 across its four main offshore-exposed names.

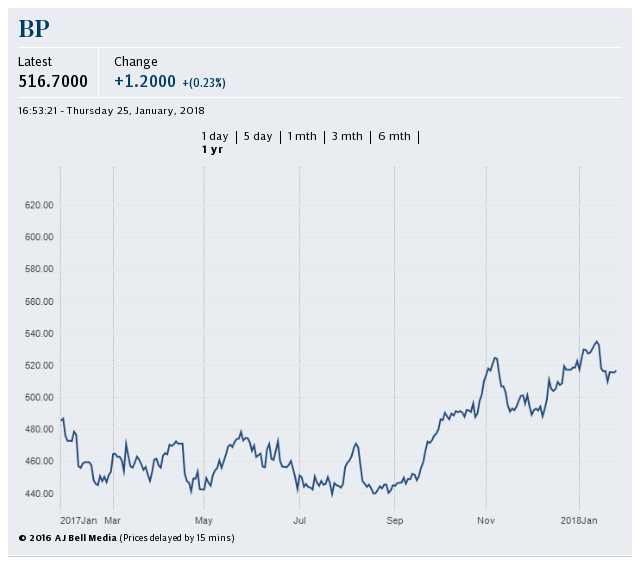

Oil starts to worry stock bulls

The rout in oil prices continues, and the worries this creates are spilling over into equity markets as well, which are looking decidedly unhealthy once again this morning, Chris Beauchamp, of IG, said.

He added: "It is hardly surprising to see BP and Shell lurking near the bottom of the FTSE 100, as investors continue to clear out of oil stocks. The summer lull looks set to continue, with the situation not helped by a lack of heavyweight data. Valuation concerns have combined with the usual indecision displayed by markets in the summer period, leaving equities unable to establish a clear direction. UK shares are hardly the most attractive place for investors – set against the apparent stability of Germany and the strong showing by Emmanuel Macron in France, the travails of the British government, beset by tough Brexit negotiations and without a definitive mandate at home, the UK looks like a market that is only for the brave or foolish."

FTSE 100 sinks to one-week low on oil weakness

London's benchmark index has dropped to a one-week low as persistent oil price weakness continues to weigh.

The blue chip index fell by as much as 0.6pc this morning to 7,404.98, marking its lowest level since last Thursday when it touched 7,377.86.

David Madden, of CMC Markets, said: " Oil has fallen back to levels not seen since mid-November 2016, and traders are worried it could bring about low inflation and diminished growth."

When oil slumped in 90's, Saudis borrowed heavily to maintain spending

When oil slumped in 90s, Saudis borrowed heavily to maintain spending pushing debt >100% of GDP. In following fat yrs debt paid down (viaGK) pic.twitter.com/xYRjOKJAZD

— Holger Zschaepitz (@Schuldensuehner) June 22, 2017

ECB to develop real time money transfer service

The European Central Bank will develop an instant payment settlement service by late next year to facilitate real-time money transfer of small scale transactions, the ECB said in a statement.

Real time transfer facilities are already available for large volume payments but the new service, set to start operating in November 2018, would expand this to all transfers, including retail transactions, at a marginal cost.

"The service will be developed in close cooperation with the banking industry in Europe and will be offered to banks at the low price of a maximum of 0.20 euro cent per payment for at least the first two years of operation," the ECB said.

Report from Reuters

ECB sees solid second-quarter eurozone growth

The European Central Bank has released its latest economic bulletin this morning. Reuters has the latest:

Economic data points to solid growth in the euro zone in the second quarter and indicates a rebound in global growth after a rough patch, the European Central Bank said in a regular economic bulletin this morning.

Inflation will hover near the current level in the coming months and while there is still no convincing upswing in consumer prices, there are early signs of pipeline price pressures in the production and pricing chain, the ECB added.

"Overall, incoming data point to solid growth in the second quarter of 2017," the ECB said in a bulletin that is largely consistent with the outlook presented after its June policy meeting. "Domestic demand is expected to be buoyed by a number of favourable factors."

"Very favourable financing conditions and low interest rates continue to promote a recovery in investment in the context of rising profits and lower deleveraging needs," the ECB added.

Apple supplier Imagination Technologies puts itself up for sale

Shares in Imagination Technology have leapt 17.4pc this morning, putting it on track for its best day this year, after the chip designer put itself up for sale. Our technology editor James Titcomb reports:

Imagination Technologies, the British company that designs the iPhone’s graphics chips, has formally put itself up for sale amid a row with Apple.

Imagination’s shares rose by a fifth in early trading after it said it had “received interest from a number of parties for a potential acquisition of the whole group”.

The company, based in Hertfordshire, was thrown into turmoil in Aprilwhen Apple said it planned to stop using its chip designs, which help power the iPhone, iPad and Apple Watch, by 2019.

Imagination relies on Apple for more than half of its revenues and since then has been engaged in a tense stand-off with the American giant. It has said it does not believe Apple is capable of developing independent graphics technology without using at least some of Imagination’s intellectual property.

Barclays turns negative on European oil and gas producers

Along with lowering its near-term forecasts of oil prices, Barclays has also turned negative on the European oil and gas industry as it believes the sector's outlook has become "increasingly challenged".

The bank said: ""Several companies are struggling to present a compelling medium term growth outlook that has the potential to decouple stock price performance from moves in near-term oil prices."

Barclay cut Genel Energy and Soco International's rating to "underweight", sending shares 3pc and 1.5pc, lower respectively.

Morgan Stanley: European oil services running out of steam

Shares of oil services firms under pressure this morning after Morgan Stanley says it expects the 2018 oil supply overhang in the way of 2019/20 recovery.

The US investment bank expects the nascent recovery offshore as likely to fade at <$50/bbl oil prices with concerns over 2018 supply/demand imbalances weighing.

Analysts said: "The pace of contract awards has proven disappointing versus our prior expectations."

Since peaking in late February, oil prices have dropped around 20pc, completely erasing gains at the end of the year in the wake of the initial OPEC-led production cut. Oil is set for its worst first six months of the year since 1997.

Morgan Stanley lowered the ratings of Subsea7 to "equal-weight" and cut the price target of Aker Solutions, Wood Group and Saipem.

Barclays lowers Brent crude forecasts

As the oil slide continues to rattle markets, Barclays has revised its forecast for Brent crude prices in 2017 to $52 a-barrel - down from $56.

For 2018, the bank has also lowered its forecast to $57 a-barrel, down from a previous forecast of $67.

Oil forecasts tumbling - @Barclays Revises Brent 2017 And 2018 prices to $52 Per Barrel And $57 Per Barrel From $56 And $67 Previously

— Geoff Cutmore (@GeoffCutmore) June 22, 2017

Train operators square off as bidding for West Coast and Southeastern franchises enters final straight

Railway operators around the globe are squaring off in the final stages of a bidding war for two of the UK’s most lucrative rail contracts.

The Department for Transport has announced the shortlist of travel giants in the running to operate the West Coast and Southeastern rail franchises.

The stakes are particularly high in the contest for the West Coast Partnership (WCP) contract as the winner will also be expected to work with HS2 to launch the first services on the multi-billion pound high-speed rail project, which will run from London to Birmingham from 2026.

The franchise is currently operated by Stagecoach and Virgin, who have enlisted the support of French company SNCF in a bid to retain the contract.

Read the full report by Sam Dean here

European bourses open lower as oil slide persists

European shares opened lower this afternoon as commodity-related stocks came under pressure amid a persistent slide in oil prices.

Here's a snapshot of the current state of play in Europe:

Mike van Dulken, of Accendo Markets, explains the latest move lower in oil prices:

"Crude Oil prices have taken another leg lower, falling to their lowest level since August overnight. The move comes as an un-named OPEC member casts doubt over the possibility of deeper production cuts by the group, offsetting a drop in US inventories. Despite recovering some $0.50 overnight, both Brent and US benchmarks remain under significant pressure in the bear market confirmed yesterday, failing to retain $45 and $43 handles respectively."

Iran oil minister says OPEC considering deeper output cuts

Iranian oil minister Bijan Zanganeh said on Wednesday that OPEC members are considering further oil output cuts but should wait until the effect of the current reduced level of production is made clear.

"We are in discussions with OPEC members to prepare ourselves for a new decision," Zanganeh said after a cabinet meeting, according to the website for the Islamic Republic of Iran Broadcasting (IRIB).

"But making decisions in this organisation is very difficult because any decision will mean production cuts for the members."

#OPEC is considering deeper production cuts but should probably wait for a while, #Iran#oil minister tells Shana #OOTT#Saudi#Libya#gaspic.twitter.com/XE5sM5BPdj

— Christopher Johnson (@chris1reuters) June 21, 2017

The reason for the discussion is an increase in the levels of U.S production which OPEC members had not predicted, Zanganeh said.

Report from Reuters

Agenda: Oil languishes near 10-month lows on glut fears

Good morning and welcome to our live markets coverage.

Asian stocks edged higher despite oil slumping to 10-month low overnight amid supply glut fears.

Markets:

-Oil's rout shows signs of easing

-Asia stocks ⬆️

-Gold ⬆️ for 2nd day

-Yen strengthenshttps://t.co/R3vG8ThTSZpic.twitter.com/gYlpHEkRLZ— Bloomberg (@business) June 22, 2017

The MSCI's broadest index of Asia-Pacific shares outside Japan inched up 0.7pc, while Japan's Nikkei climbed 0.1pc.

US crude futures were up 6 cents at $42.59 a barrel. On Wednesday, they settled down at $42.53, after touching their lowest intraday level since August 2016.

Global benchmark Brent slipped 0.1pc, or 5 cents, to $44.77. It closed down 2.6pc on Wednesday after touching a seven-month low. Investors doubt that OPEC-led output cuts would dent a three-year glut offset data showing a drop in US inventories.

Good morning from Berlin. Asia stocks rise despite oil rout. Yen climbs with Gold. US yield curve flattest in almost a decade on hawkish Fed pic.twitter.com/zNtf9ZpnGy

— Holger Zschaepitz (@Schuldensuehner) June 22, 2017

Also on the agenda:

Interim results: Chemring Group

Trading update: Go-Ahead Group, Saga

AGM: ECSC Group, Petropavlovsk, Saga, Union Jack Oil, Adgorithms, Universe Group, Senterra Energy

Economics: Unemployment claims (US), HPI m/m (US), flash manufacturing PMI (US), flash services PMI (US), CB leading index m/m (US), flash manufacturing PMI (GER), flash services PMI (GER), ECB economic bulletin (EU), flash manufacturing PMI (EU), flash services PMI (EU)

Yahoo Finance

Yahoo Finance