FTC Challenges Amgen's (AMGN) $28B Acquisition of Horizon

On Tuesday, the Federal Trade Commission (“FTC”) filed a lawsuit in Federal Court to halt biotech giant Amgen's AMGN $28 billion acquisition of Horizon Therapeutics HZNP.

Last December, Amgen announced that it will acquire Horizon Therapeutics for $116.50 per share in cash or $27.8 billion. The acquisition will add a complementary portfolio of rare disease drugs like Tepezza, Krystexxa and Uplizna to AMGN’s diverse portfolio. The deal was the largest pharmaceutical transaction announced in 2022.

Per the FTC, if the acquisition is allowed to go through, a large cap giant like Amgen could leverage its position with insurance companies and pharmacy benefit managers to entrench the monopoly positions for two of Horizon's two key products — Tepezza (approved for treating thyroid eye disease) and Krystexxa (approved for treating chronic refractory gout). Per the agency, the drugs currently face little to no competition in the market and are sold at very high prices to patients.

In response to the above lawsuit, Amgen issued a statement that it was disappointed by the FTC’s decision and does not believe that the merger poses any competitive issues. The firms plan to work with the court on a schedule that would allow the transaction to close before this year’s end, against the previously set target of June 2023-end.

The FTC deciding to stop the transaction marks a change from its usual practice. Usually, the agency allows such transactions to move forward so long as the companies divest any overlapping drugs/medicines. In response, shares of Amgen and Horizon Therapeutics were down 2.4% and 14.2% on May 16.

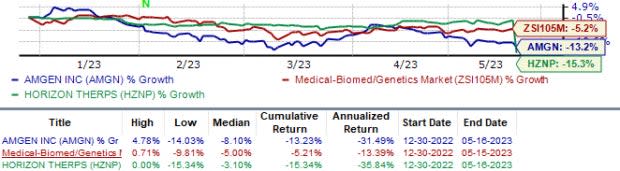

In the year so far, Horizon Therapeutics’ shares have declined 15.3% while Amgen’s shares have lost 13.2%. During the same period, the industry has dropped 5.2%.

Image Source: Zacks Investment Research

The announcement comes just days after several third-party articles had reportedly stated that the FTC was preparing to block the Amgen/Horizon Therapeutics deal.

Senator Elizabeth Warren wrote to the FTC in late January 2023 expressing her concerns about pharmaceutical deals including the Amgen purchase of Horizon Therapeutics. The Senator accused both Amgen and Horizon Therapeutics to have been engaged in “brazen price increases on drugs that face little or no competition”.

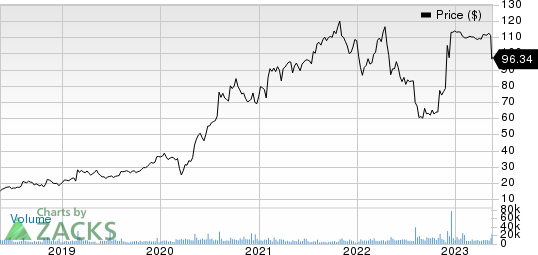

Amgen Inc. Price

Amgen Inc. price | Amgen Inc. Quote

Horizon Therapeutics Public Limited Company Price

Horizon Therapeutics Public Limited Company price | Horizon Therapeutics Public Limited Company Quote

Zacks Rank & Stocks to Consider

Both Amgen and Horizon Therapeutics currently carry a Zacks Rank #3 (Hold). A couple of better-ranked stocks in the overall healthcare sector include ANI Pharmaceuticals ANIP and Ocuphire Pharma OCUP. While ANI Pharmaceuticals sports a Zacks Rank #1 (Strong Buy), Ocuphire carries a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, estimates for ANI Pharmaceuticals’ 2023 earnings per share have increased from $2.42 to $2.61. Shares of ANI Pharmaceuticals are up 10.1% in the year-to-date period.

Earnings of ANIP Pharmaceuticals beat estimates in each of the last four quarters, delivering an average earnings surprise of 68.64%. In the last reported quarter, ANI Pharmaceuticals’ earnings beat estimates by 244.12%.

In the past 60 days, estimates for Ocuphire Pharma’s 2023 loss per share have improved from 29 cents to 24 cents. During the same period, the loss estimates per share for 2024 have narrowed from 86 cents to 81 cents. Shares of Ocuphire Pharma have surged 38.5% in the year-to-date period.

Earnings of Ocuphire Pharma beat estimates in three of the last four quarters while missing the mark on one occasion. On average, the company’s earnings witnessed a surprise of 23.85%. In the last reported quarter, Ocuphire Pharma’ earnings beat estimates by 42.34%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Amgen Inc. (AMGN) : Free Stock Analysis Report

Horizon Therapeutics Public Limited Company (HZNP) : Free Stock Analysis Report

ANI Pharmaceuticals, Inc. (ANIP) : Free Stock Analysis Report

Ocuphire Pharma, Inc. (OCUP) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance