Franklin's (BEN) Q1 Earnings Beat Estimates, AUM Escalates

Franklin Resources Inc. BEN reported first-quarter fiscal 2020 (ended Dec 31) earnings of 70 cents per share, beating the Zacks Consensus Estimate of 67 cents. Results also compare favorably with the earnings of 54 cents per share recorded in the prior-year quarter.

The company’s results display higher revenues and assets under management (AUM). Also, a strong capital position was a positive. However, net outflows and escalating expenses were undermining factors.

Operating income was $392.7 million in the reported quarter compared with the prior-year quarter’s $411.5 million.

Net income was $350.5 million compared with the $275.9 million recorded in the prior-year quarter.

Revenues Climb, Costs Up

Total operating revenues increased slightly year over year to $1.41 billion in the fiscal first quarter, mainly owing to higher investment management and other fees, partly offset by lower sales and distribution fees, along with shareholder-servicing fees. The figure lagged the Zacks Consensus Estimate of $1.43 billion.

Investment management fees inched up 1% year over year to $979.7 million, while other net revenues climbed 6% to $31.5 million. However, sales and distribution fees were down 1% year over year to $351.5 million. Additionally, shareholder-servicing fees dipped 9% on a year-over-year basis to $50 million.

Total operating expenses flared up 2% year over year to $1.02 billion. This upside resulted from higher compensation and benefits, occupancy as well as technology expenses, partly mitigated by lower sales, distribution and marketing, along with general, administrative and other expenses.

As of Dec 31, 2019, total AUM came in at $698.3 billion, up 7% from $649.9 billion as of Dec 31, 2018. Notably, the company recorded net new outflows of $12.3 billion in the quarter. Simple monthly average AUM of $693.8 billion increased 2% year on year.

Stable Capital Position

As of Dec 31, 2019, cash and cash equivalents, along with investments, were $8.6 billion compared with $8.5 billion as of Sep 30, 2019. Furthermore, total stockholders' equity was $10.8 billion compared with $10.6 billion as of Sep 30, 2019.

During the December-end quarter, the company repurchased 4.6 million shares of its common stock at a total cost of $123.6 million.

Our Viewpoint

The company’s global footprint is an exceptionally favorable strategic point as its AUM is well diversified. Though Franklin’s steady capital-deployment activities, rise in AUM and higher revenues raise investors’ optimism, escalating expenses are a concern.

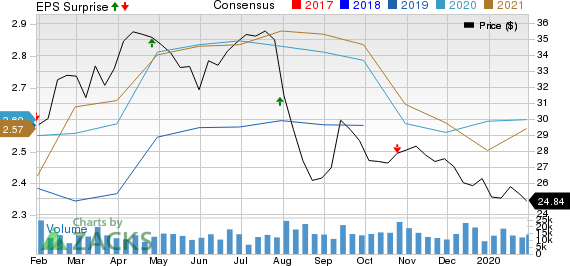

Franklin Resources, Inc. Price, Consensus and EPS Surprise

Franklin Resources, Inc. price-consensus-eps-surprise-chart | Franklin Resources, Inc. Quote

Currently, Franklin carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Competitive Landscape

BlackRock, Inc.’s BLK fourth-quarter 2019 adjusted earnings of $8.34 per share surpassed the Zacks Consensus Estimate of $7.67. Moreover, the figure came in 37.2% higher than the year-ago quarter’s number. Results benefited from an improvement in revenues. Moreover, growth in AUM, driven by net inflows, was a positive. However, higher expenses hurt results to some extent.

Cohen & Steers’ CNS fourth-quarter adjusted earnings of 74 cents per share surpassed the Zacks Consensus Estimate of 67 cents. Also, the bottom line came in 32.1% higher than the year-ago quarter figure. Results benefited from an improvement in AUM and higher revenues. However, rise in expenses was a headwind.

T. Rowe Price Group, Inc. TROW reported a positive earnings surprise of 4.1% in the October-December quarter. Adjusted earnings per share came in at $2.03, outpacing the Zacks Consensus Estimate of $1.95. The reported figure also improved 31.8% from the year-ago figure of $1.54.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +50%, +83% and +164% in as little as 2 months. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Cohen & Steers Inc (CNS) : Free Stock Analysis Report

Franklin Resources, Inc. (BEN) : Free Stock Analysis Report

BlackRock, Inc. (BLK) : Free Stock Analysis Report

T. Rowe Price Group, Inc. (TROW) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance