Fortune Brands (FBHS) Shares Down 38% YTD: What's Ailing It?

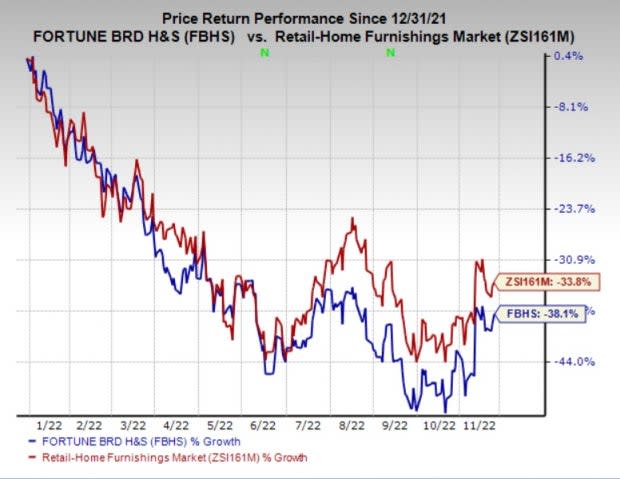

Fortune Brands Home & Security FBHS is grappling with supply-chain constraints, raw-material inflation and weakness in housing market demand. Due to these headwinds, shares of FBHS have lost 38% in the year-to-date period compared with the industry’s decline of 33.8%.

Image Source: Zacks Investment Research

Escalating cost of sales due to raw material cost-inflation continued to be a major cause for concern for Fortune Brands over the last few quarters. In 2021, FBHS’s cost of sales increased 25% year over year despite its cost-reduction initiatives. In the first nine months of 2022, cost of sales climbed 7.1% year over year. Rising cost of sales poses a threat to FBHS’ bottom line. Despite focusing on supply-chain optimization, FBHS is facing constraints on that front and labor shortage.

Slowdown in the US new construction activity due to inflation and rising interest rates is weighing on Fortune Brands’ operations. Due to this headwind and channel-inventory reductions, FBHS lowered its full-year earnings and revenue forecasts. FBHS expects sales to increase 4.5-5.5% from the year-ago reading in 2022 compared with a rise of 6.5-7.5% anticipated earlier. Adjusted earnings are estimated to be $6.20-$6.30 per share in 2022 compared with $6.36-$6.50 predicted earlier.

Persistent weakness in the Water Innovations segment due to inventory destocking and COVID-related shutdowns in China is also weighing on Fortune Brands’ shares. Net sales from the segment declined 14% year over year in the third quarter. For 2022, FBHS expects net sales to decrease 5-6% from the year-ago reading.

Foreign currency headwinds are denting Fortune Brands’ revenues. FBHS has a significant operational presence for its Water Innovations and Cabinet segments in Canada. This exposes the company to forex woes. In the third quarter, foreign exchange issues hurt Water Innovations’ net sales by 1%. A stronger U.S. dollar might depress the company's overseas business results in the quarters ahead.

Zacks Rank & Key Picks

Fortune Brands carries a Zacks Rank #4 (Sell).

Some better-ranked stocks within the broader Retail-Wholesale sector are as follows:

Ethan Allen Interiors ETD sports a Zacks Rank #1 (Strong Buy), at present. ETD pulled off a trailing four-quarter earnings surprise of 36%, on average. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Ethan Allen Interiors’ fiscal 2023 earnings has been revised 20% upward in the past 60 days. Shares of ETD have rallied 23.5% in the past six months.

Walmart WMT currently carries a Zacks Rank #2 (Buy). WMT delivered a trailing four-quarter earnings surprise of 3.8%, on average.

The Zacks Consensus Estimate for Walmart’s fiscal 2023 earnings has moved 3.8% north in the past 60 days. Shares of WMT have gained 21% in the past six months.

O'Reilly Automotive ORLY carries a Zacks Rank of 2, currently. ORLY pulled off a trailing four-quarter earnings surprise of 7.5%, on average.

The Zacks Consensus Estimate for O'Reilly Automotive’s 2022 earnings has been revised 2.9% upward in the past 60 days. Shares of ORLY have appreciated 33.1% in the past six months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Walmart Inc. (WMT) : Free Stock Analysis Report

O'Reilly Automotive, Inc. (ORLY) : Free Stock Analysis Report

Fortune Brands Home & Security, Inc. (FBHS) : Free Stock Analysis Report

Ethan Allen Interiors Inc. (ETD) : Free Stock Analysis Report

Yahoo Finance

Yahoo Finance