Forget Smartphones. IoT Could Be the Next Big Catalyst for These 2 Tech Stocks

Smartphones are no longer a hotbed of growth for chipmakers. The lack of cutting-edge innovation and the overall saturation of the market after years of terrific growth have weighed on the market's growth over the past couple of years.

Smartphone sales increased just 1.3% during the first quarter of 2018, according to Gartner. The situation isn't likely to improve anytime soon. Semiconductor industry bellwether Applied Materials recently said that smartphone chip suppliers are pulling back their capacity investments due to tepid demand.

This is bad news for Qorvo (NASDAQ: QRVO) and Skyworks Solutions (NASDAQ: SWKS), as they get a big chunk of their revenue by supplying chips for smartphones. But the good thing is that they have decided to switch gears just in time to hop on to another big opportunity -- the Internet of Things (IoT) -- which could help them make up for the smartphone slowdown.

Image Source: Getty Images.

IoT is driving Qorvo's transition

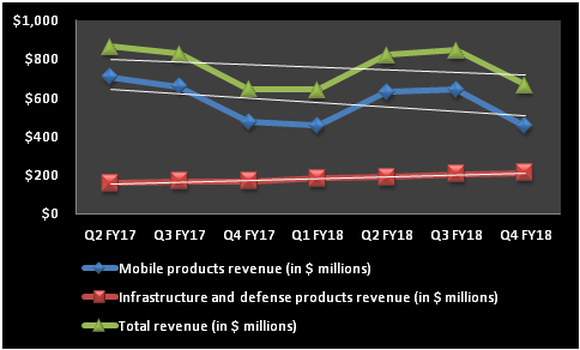

Mobile products make up for three-fourths of Qorvo's top line at present; the smartphone weakness means that it has hit a rough patch in recent quarters.

Data from Qorvo's quarterly filings. Chart by author.

Quite clearly, the company has been relying on its infrastructure and defense products (IDP) segment to make up for the mobile shortfall. A 26% year-over-year jump in the IDP business helped Qorvo post a 3.4% annual increase in the top line last quarter, offsetting the 5% drop in mobile.

Qorvo can thank the growing demand for IoT solutions for such massive growth in the IDP business. The company has branched out into supplying chips to enable smart-home solutions, and it has managed to find solid traction in this space. It claims to have scored multiple design wins for its 2.4 gigahertz, 5 gigahertz, and bulk-acoustic-wave (BAW) filters at notable meshed Wi-Fi home networking systems manufacturers.

These filters will play a critical role in connecting various devices within a smart-home setting, as they are meant to solve coexistence and interference challenges that would arise when several devices operate in a small area such as a home. The deployment of wireless mesh networks is expected to grow at almost 14% annually for the next five years as the adoption of smart-home devices increases.

So, the demand for these filters should grow at a fast clip given their application in a mesh network setting. The good part is that Qorvo is partnering with the right players to make a dent in this market. Taiwan-based D-Link, which is a leading provider of wireless LAN (local area network) solutions with nearly 30% market share, has selected Qorvo's 5GHz power amplifiers to extend the coverage range and speed up the performance of its smart-home-focused Wi-Fi systems.

In all, Qorvo has found a nice catalyst in the IoT niche that could help it grow at a fast pace for a long time.

Skyworks is moving beyond Apple

The smartphone slowdown is having an adverse impact on Apple's sales, as its unit sales increased just 3% year over year in the last reported quarter.

Skyworks, which got nearly 40% of its revenue from Apple in the previous fiscal year, is having a hard time growing its revenue thanks to the smartphone slowdown. Its current-quarter guidance suggests that Skyworks' revenue will decline year over year, but there's one ray of hope that investors can pin their hopes on; it's called "broad markets."

Skyworks Solutions puts it nonmobile businesses under the broad markets segment. This segment has gained terrific traction in recent quarters, and it now accounts for 27% of the company's total revenue. In fact, Skyworks recently revealed that its broad markets revenue is tracking a $1 billion annual run rate.

Skyworks expects this business to keep growing at a midteens rate in the future, which looks quite achievable given the strong client base it has created in this space. Its chips are being deployed by companies including Alphabet, GE, Amazon, and Netgear in their smart-home wireless connectivity solutions.

The company's connectivity chips are also being used for automotive purposes, and the company has some important design wins in this space. ZTE has decided to integrate several Skyworks products into its all-in-one connected car platform. This could be a big deal for Skyworks in the long run as ZTE has made quite a name for itself in the connected car space.

The Chinese company has partnered with Qualcomm, T-Mobile, and Rogers Communications, among others, to sell its connected car solutions in various markets. The fact that ZTE has chosen Skyworks to integrate the various elements of a connected car such as diagnostics, vehicle tracking, Wi-Fi hotspots, and other features means that it will get ready access to the former's existing client base.

Patience will pay off

Both Skyworks and Qorvo still get a huge chunk of their revenue from their mobile business, so IoT won't have a huge impact on them in the near term. But investors shouldn't forget that IoT is still in its early phases of deployment, so it could eventually become big enough to drive material gains for both chipmakers.

More importantly, both stocks seem undervalued as they trade at nearly 13 times next year's earnings. By comparison, the industry average multiple is much more rich at almost 30 right now. So, investors looking for two emerging IoT plays at an affordable valuation should definitely consider Qorvo and Skyworks Solutions given the progress that they are making.

More From The Motley Fool

John Mackey, CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends Alphabet (A shares), Alphabet (C shares), Amazon, Apple, and Skyworks Solutions. The Motley Fool owns shares of Qualcomm and has the following options: long January 2020 $150 calls on Apple and short January 2020 $155 calls on Apple. The Motley Fool recommends Gartner, Netgear, and T-Mobile US. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance