Forget Mylan, Invest in These 3 Generic/Drug Stocks Instead

One of the biggest generic makers of the world, Mylan N.V. MYL continues to face tough times. Mylan's stock has lost 12.4% in the year so far against 4.5% gain recorded by the industry.

Mylan’s share price had declined significantly in 2016 as the company drew flak for over pricing its epinephrine auto-injector, EpiPen, which is approved for the treatment of severe allergic reactions. Things started to look up when the biosimilars portfolio started gaining traction.

However, the company’s generic business in North America continues to face challenges.

Concurrent with the second-quarter results, Mylan lowered its annual outlook as a result of the change in expected complex product launch and utilization assumptions, resizing of product opportunities in the United States, and the negative impact of the restructuring and remediation program in Morgantown on operations.

Due to the ongoing challenges in North America, Mylan is now evaluating strategic options. Competition and pricing pressure continue to adversely impact the generic pharmaceutical market in the United States.

Moreover, Mylan suffered a blow after rival Teva Pharmaceutical Industries Ltd. TEVA recently won FDA approval for the first generic version of EpiPen and EpiPen Jr (epinephrine) auto-injector for the emergency treatment of allergic reactions, including those that are life-threatening (anaphylaxis), in adults and pediatric patients. The approval is a significant boost for Teva but will eat into EpiPen sales of Mylan as the generic will obviously be priced lower.

The company’s efforts to get approval for Advair generic have also hit a roadblock as the FDA issued a complete response letter to its ANDA for generic Advair Diskus yet again in June 2018, citing labeling and CMC comments. Although the company responded to the CRL in mid-July and expects a decision in three months, the CRL was a big disappointment given Advair’s market potential.

Mylan currently carries a Zacks Rank #4 (Sell). In this scenario, it is probably best to avoid Mylan and invest in some other drug/generic stocks with a favorable Zacks Rank and healthy portfolio/pipeline.

Our Picks

Dublin, Ireland-based Mallinckrodt plc MNK is a specialty biopharmaceutical with a worldwide presence. The company develops, manufactures, markets and distributes branded and generic specialty pharmaceutical and biopharmaceutical products and therapies. The hospital franchise (Inomax and Ofirmev) is gaining traction, which is positively impacting sales. The company also upped its annul guidance. The Sucampo buyout will diversify the company’s portfolio, given Amitiza’s potential. The company is currently streamlining its business to focus better on its innovative medicines and therapies like terlipressin and StrataGraft. The recent restructuring efforts are encouraging and should boost the bottom line.

Mallinckrodt currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Mallinckrodt’s stock has increased 29.5% in the year so far compared with 4.4% rally of the industry.

Evoke Pharma EVOK is a specialty pharmaceutical company focused primarily on the development of drugs to treat GI disorders and diseases. The company is developing a nasal spray formulation of metoclopramide, Gimoti, for the relief of symptoms associated with acute and recurrent diabetic gastroparesis in adult women.

Last month, the FDA accepted the company’s NDA for Gimoti and set a target goal date under the Prescription Drug User Fee Act (PDUFA) of Apr 1, 2019. Its approval will boost growth prospects.

Evoke currently carries a Zacks Rank #2. The stock has rallied 30.6% year to date compared with 4.5% rise of the industry.

Endo International plc, ENDP is a global specialty pharmaceutical company focused on branded and generic pharmaceuticals. The company is in the process of redefining its business due to withdrawal of opioid pain medication, Opana ER (oxymorphone hydrochloride extended release) from the market, following FDA’s request in June 2017. The focus now is on sterile injectables and Xiaflex.

Endo recently launched glycopyrrolate injection, the generic version of Robinul. In July, Endo launched ertapenem for injection, the authorized generic of Invanz. These new launches should boost sales.

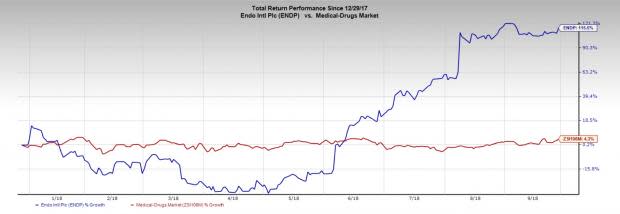

Endo currently carries a Zacks Rank #2. Endo’s stock has gained 115.5% in the year so far compared with its industry’s 4.3% rise.

Bottom Line

While Mylan attempts to recover from the recent setback, investors could consider the abovementioned stocks with solid growth prospects.

Wall Street’s Next Amazon

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Endo International plc (ENDP) : Free Stock Analysis Report

Mallinckrodt public limited company (MNK) : Free Stock Analysis Report

Evoke Pharma, Inc. (EVOK) : Free Stock Analysis Report

Mylan N.V. (MYL) : Free Stock Analysis Report

Teva Pharmaceutical Industries Ltd. (TEVA) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Yahoo Finance

Yahoo Finance