Forget Intel. Here Are 3 Better Chip Stocks to Buy

Last month, I made the decision to sell my shares of chip giant Intel (NASDAQ: INTC). Although the company is exposed to some solid growth markets, like non-volatile memory-based storage drives, data center processors, and the booming computer gaming market, I've grown frustrated with the company's stumbles around its chip manufacturing technology -- something I fear will hurt the company's competitive positioning in the coming years.

Until I see some real improvements in the company's manufacturing technology and can gain confidence that Intel isn't on the verge of seeing its market share and, potentially, its gross profit margin erode meaningfully, I'm staying out of the stock.

But there are companies similar to Intel -- that is, large-cap chip companies that dominate in their respective fields -- that I think are worth considering more closely: Broadcom (NASDAQ: AVGO), Taiwan Semiconductor Manufacturing Company (NYSE: TSM), and Micron (NASDAQ: MU).

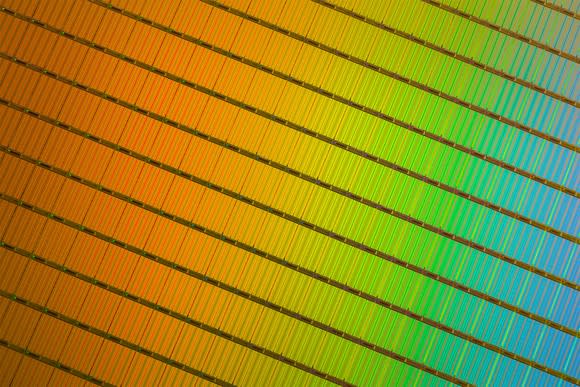

A wafer of 3D NAND memory chips. Image source: Micron.

1. Broadcom

One of the reasons I like Broadcom's business and its stock is that the current CEO, Hock Tan, runs an incredibly tight ship. Tan is judicious about the markets the company plays in -- he keeps Broadcom in markets where the company is either a clear leader or a strong No. 2, with real potential to become the leader.

Not only is Broadcom's position in the markets that it plays in robust, but I also have an immense amount of faith in Broadcom's ability to either defend or even improve its positions in those markets. The company delivers new products like clockwork, and those products are generally best-in-class, allowing Broadcom to maintain its high share positions in those markets while also sustaining or even growing gross profit margins.

Indeed, as a proof point, Broadcom's gross profit margin on a non-GAAP basis has grown from 60.4% in the third quarter of 2016 to 66.6% in the second quarter of 2018. The increasing gross profit margin alongside healthy revenue growth really highlights the strength of Broadcom's business.

2. Taiwan Semiconductor Manufacturing Company

I recently wrote a detailed head-to-head match-up of TSMC and Intel, concluding that if I had to pick one of the two stocks to add to my portfolio, I'd go with TSMC.

In a nutshell, while Intel designs and manufactures its own chips, TSMC is a contract chip manufacturer that builds chips for chip companies that can't build their own.

The two business models are pretty different, and neither one is inherently better than the other, but I think TSMC's strong execution with respect to chip manufacturing technology could enable its customers -- Intel's direct competitors -- to capture share against Intel, which is struggling to bring its next-generation chip manufacturing technology into mass production.

To the extent that TSMC's customers can gain market segment share, TSMC is set to benefit.

However, my attraction to TSMC stock isn't just about its potential to enable Intel's competitors to gain share against Intel. Right now, we're seeing new computing use cases emerge, such as artificial intelligence. Although Intel is trying to go after this market with its own products, there's no guarantee it'll succeed (especially given the company's poor track record of trying to enter new markets).

TSMC, on the other hand, will likely build chips for all of the relevant players in artificial intelligence and other hot new markets, so it doesn't need to bet on a single company's products to succeed. It only needs to count the winner or winners among its ranks.

3. Micron

Micron is one of the hottest stocks in the chip sector today, thanks to the fact that it offers both DRAM and NAND flash memory products -- two very hot commodities in today's market. DRAM prices have been shooting through the proverbial roof as demand outweighs supply (thanks to increases in smartphone DRAM content and the voracious appetite for DRAM in data center servers), and NAND flash continues to grow in popularity as storage products based on that technology increasingly displace mechanical hard-disk drives.

To illustrate just how good the memory boom has been to Micron, look no further than how dramatically the company's operating income has shot up over the last few years:

MU Operating Income (TTM) data by YCharts.

There's always a risk that the industrywide memory supply-to-demand balance could shift unfavorably and hurt all of the participants, Micron included. If demand for memory products slows, or memory manufacturers put in too much capacity, then memory prices could fall substantially, negatively affecting Micron's and others' revenue and profits.

However, given that Micron stock is trading quite cheaply, at a price-to-earnings ratio of just 7.35, and given that current analyst estimates actually seem to call for Micron's earnings per share to decline in 2019, expectations here don't seem outlandish, while upside to current estimates could push the stock up substantially.

Moreover, as a sweetener, Micron recently announced a $10 billion share repurchase program that, if acted upon aggressively, could help to dramatically boost the company's earnings per share for a given level of net income.

Right now, Micron stock looks like a pretty attractive chip stock pick.

More From The Motley Fool

Ashraf Eassa has no position in any of the stocks mentioned. The Motley Fool recommends Broadcom Ltd. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance