Forget Amazon: Three other E-Commerce Stocks You Can Buy for Your Investment Portfolio

Investors may have expected e-commerce to slow down after the global pandemic.

However, this has not been the case.

According to EMarketer, global e-commerce sales grew from US$4.98 trillion to US$5.82 trillion from 2021 to 2023, showing no signs of slowing down.

This trend is underscored by Amazon’s (NASDAQ: AMZN) first-quarter beat in fiscal year 2024 (FY2024), where net sales increased 13% year on year to US$143.3 billion, clearly indicating that e-commerce is here to stay.

Net profit leapt to US$10.4 billion, 225% higher than the prior year.

In line with its strong financial performance, Amazon’s share price has increased by 25% year to date.

However, it is not the only e-commerce player riding this trend.

We will look at three other e-commerce stocks that have displayed significant growth this year.

JD.com (NASDAQ: JD)

JD.com (JD) is a major e-commerce company based in China.

The company’s stock has jumped over 22% this year, comparable to Amazon’s share price gain.

Initially just an e-commerce platform, the company has transformed into a leading technology and service provider with a focus on supply chain management.

Its business can be categorised into five main segments, with its retail division, JD Retail, at the forefront. Beyond retail, JD also engages in the logistics, technology, health, industrial, and property sectors.

In online retail, JD sources products directly from suppliers and sells them to consumers.

Meanwhile, in the online marketplace, JD connects customers with merchandisers, earning a commission on sales.

For fiscal year 2023 (FY2023), the company saw its net revenue inch up by 3.7% year on year, from RMB 1.05 trillion to RMB 1.09 trillion.

Net profit more than doubled to RMB 24.2 million from RMB 10.4 billion in 2022.

The e-commerce giant generated a positive free cash flow of RMB 40.7 billion, an increase from RMB 35.6 billion from the previous year.

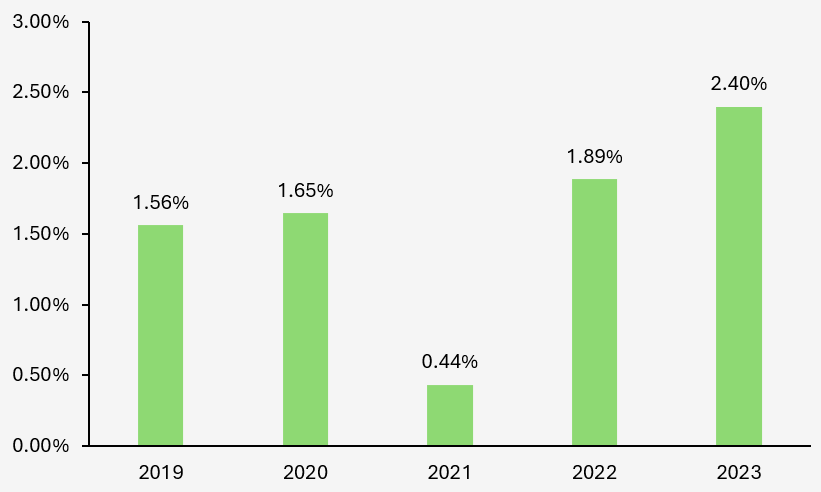

Looking at its revenue composition, its online retail business generated 88.1% of total revenue. The company’s operating margin also improved year on year, from 1.9% to 2.4%.

The graph below shows JD.com’s operating margin over the last five years.

JD’s Operating Margin (Author’s Calculation)

Source: JD’s Annual Report

This growth in operating margin can be attributed to the extensive logistics system the company has developed over recent years.

With over 1,600 warehouses, JD uses advanced technology and logistics expertise to enhance supply chain efficiency.

Furthermore, in 2022, JD also partnered with the Chinese ride-hailing app DADA (NASDAQ: DADA) to boost its on-demand delivery volume.

The company’s expansion into high-growth markets, particularly healthcare and technology, ensures sustained demand for its services despite the dour economic climate in China.

Lastly, JD trades at a relatively low Price to Earnings (P/E) ratio of 15.6x.

This is a significant difference compared to the P/E multiple of its US peers, such as market leader Amazon’s P/E of 64.5x and Etsy’s (NASDAQ: ETSY) P/E of 22x.

This makes JD an attractive stock for value investors.

Coupang (NYSE: CPNG)

Coupang, often referred to as the ‘Amazon of South Korea’, is Korea’s most visited e-commerce website.

Coupang offers a wide array of services, ranging from its flagship “Rocket Delivery” to its online services that facilitate activities such as payments, food delivery, and entertainment.

Under its “Rocket Delivery” service, Coupang promises same-day delivery, with 99% of orders delivered within a day nationwide, powered by its technology infrastructure and logistic operations.

Its stock value has rocketed up more than 40% this year.

According to its first quarterly report for 2024, active customers have grown 16% year on year, reaching 21.5 million. This growth in users has translated into a robust performance.

Net sales soared 23% year on year, from US$5.8 billion to US$7.1 billion.

However, net income fell sharply from US$86 million to US$5 million, primarily due to the inclusion of the losses incurred from Coupang’s latest acquisition of the luxury e-commerce platform Farfetch.

Excluding the impact from Farfetch, net income stood at US$98 million.

Coupang’s acquisition of FarFetch highlights Coupang’s strategic intent to expand internationally.

This acquisition positions the company as a leader in the US$400 billion global personal luxury goods segment.

Free cash flow for the quarter came in at US$1.5 billion, a US$1 billion increase year on year.

Like Amazon’s Amazon Prime loyalty programme, Coupang also has its own membership service, Coupang WOW.

Coupang WOW offers several perks, such as free shipping, 30-day free returns, and access to an online streaming platform.

These benefits have contributed to a considerable rise in membership numbers.

WOW membership programme had 14 million paid members at the end of 2023, an increase of 27% from 2022.

This loyalty scheme ensures recurring business for the company.

Lastly, the development of Coupang Pay, Coupang’s fintech ecosystem, further enhances customer experience by streamlining transactions and securing user base retention.

eBay (NASDAQ: EBAY)

eBay is recognised as one of the world’s largest e-commerce platforms, with a gross merchandise value of more than US$73 billion in 2023.

eBay’s share price has grown considerably this year, rising by 18.8% year to date.

Unlike JD or Coupang, eBay conducts its business in several countries worldwide. The platform operates globally, reaching over 190+ markets and serving 132 million buyers last year.

Differing from Amazon, which acts primarily as a direct seller, eBay functions as an auction house while also facilitating consumer to consumer (C2C) transactions.

Furthermore, with its auction system, eBay distinguishes itself from other marketplaces by carving its own niche.

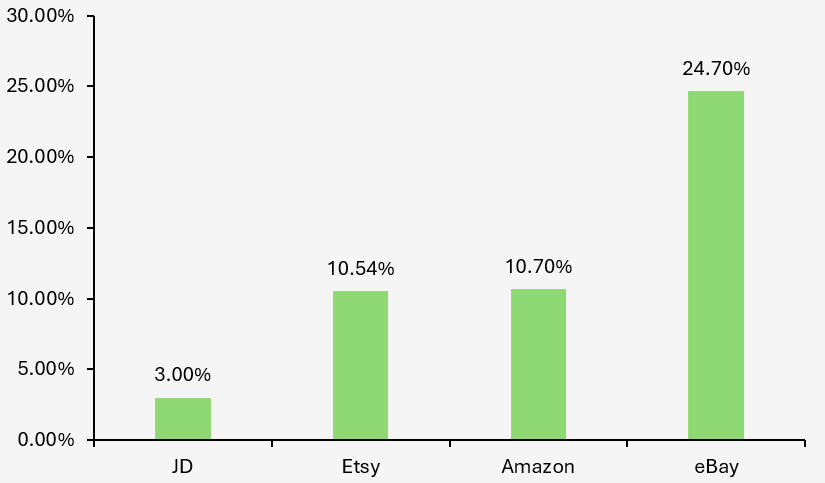

This C2C model allows eBay to operate without the high costs associated with maintaining physical inventories and warehouses, contributing to its competitive operating margins.

Operating Margin of E-commerce Companies 2024 (Author’s Calculation)

Following the first quarter of 2024, eBay’s revenue witnessed a slight year on year uptick of 2%, moving from US$2.51 billion to US$2.56 billion.

However, net income declined over 20% year on year, dropping from US$569 million to US$439 million.

Still, the company generated a healthy free cash flow of US$472 million.

Further bolstering its appeal to investors, eBay declared a cash dividend of US$0.27 per share, which will be payable on June 14 this year. This is a slight increase from US$0.25 paid out the previous year.

This marks the fifth consecutive year that eBay has raised its dividend payout, cementing its reputation as a reliable dividend stock.

Dive into the future of technology with our newest FREE report, “The Rise of Titans.” Discover how the big 7 US tech stocks can be your ticket to huge long-term gains. Download your copy today and see how easy it is to supercharge your portfolio.

Follow us on Facebook and Telegram for the latest investing news and analyses!

Disclosure: Aw Kai Rui does not own any of the stocks mentioned in this article.

The post Forget Amazon: Three other E-Commerce Stocks You Can Buy for Your Investment Portfolio appeared first on The Smart Investor.