Forex: Yen Weakens on Election Concerns; Euro Lags on Higher Yields

ASIA/EUROPE FOREX NEWS WRAP

The Asia session today was perhaps the most exciting in recent memory, with the Chinese Shanghai stock index surging amid speculation that the new Chinese government would be more lenient towards stimulus, and the Japanese Yen sliding sharply amid comments from a key Bank of Japan policymaker. Overall, the mood of the day is uneasiness, with European and US equity markets looking higher, while bonds and currencies suggesting risk-aversion.

But the BoJ commentary is particularly interesting (with BoJ Deputy Governor Kiyohiko Nishimura saying the central bank was ready for action, when needed), especially with snap elections taking place on December 16, in which former Japanese Prime Minister Shinzo Abe is expected to reclaim his position following promises of unlimited BoJ easing. Seemingly, the role of the BoJ has become a focus point of the Japanese election, given the attention the failing economy has garnered over the past year. Should the US fiscal cliff/slope produce some positive headlines over the coming days, and if the European debt crisis stays on the backburner, then the Japanese Yen could remain weaker for at least through the end of the year.

Taking a look at European credit, peripheral bond yields are higher, underpinning Euro weakness. This price action comes as European equity markets have outperformed, but this has been the cast for the past few weeks: decoupling. As Senior Technical Strategist Jamie Saettele’s research suggests, equity markets are the last major asset class to react to news, while bonds and commodities lead (currencies trail just slightly but are well-ahead of equity markets).

The Italian 2-year note yield has increased to 1.891% (+3.4-bps) while the Spanish 2-year note yield has increased to 2.876% (+9.1-bps). Similarly, the Italian 10-year note yield has increased to 4.447% (+3.6-bps) while the Spanish 10-year note yield has increased to 5.355% (+13.8-bps); higher yields imply lower prices.

RELATIVE PERFORMANCE (versus USD): 13:05 GMT

NZD: +0.23%

CAD: +0.04%

AUD:-0.01%

GBP:-0.01%

CHF:-0.16%

EUR: -0.18%

JPY:-0.28%

Dow Jones FXCM Dollar Index (Ticker: USDOLLAR): +0.11% (-0.32% past 5-days)

ECONOMIC CALENDAR

See the DailyFX Economic Calendar for a full list, timetable, and consensus forecasts for upcoming economic indicators.

TECHNICAL ANALYSIS OUTLOOK

EUR/USD: Yesterday I said: “With price breaking 1.3010/20, I am indeed bullish. However, with 1H, 4H, and daily RSI all at or nearing overbought levels as the pair trades into its weekly R2 at 1.3100 and comes close to 2H’12 highs, there is likely some resistance ahead, if not scope for a pullback.” That has materialized thus far today. With a new high set, a close below 1.3045 would mark a daily Key Reversal, which would force us to switch our bias to bearish for at least for the rest of the week. Resistance is 1.3140/45 and 1.3170/75. Support is 1.3010/20 and 1.2880.

USD/JPY: More range-bound price action as the pair fights diametrically opposite fundamental pressures (US fiscal cliff and Japanese elections), thus leaving my levels and outlook at neutral to bullish now. Support comes in at 81.75, 81.15, and 80.50/70 (former November high).Resistance is 82.90/83.00 and 83.30/55.

GBP/USD:Fresh December highs for the GBP/USD were set yesterday as the pair broke through long-term trendline resistance at 1.6030/45 (descending trendline resistance off of the April 2011 and April 2012 highs), a point of failure on Tuesday and Friday last week. A break of 1.60308/45 also coincides with a tentative break of a downtrend that’s been in place for the past two months, off of the September 21 high. Resistance comes in at 1.6170/80 (late-October highs) and 1.6300. Support is 1.5995/1.6015 (20-EMA, 50-EMA), 1.5930/35 (100-DMA), and 1.5860/65 (200-DMA).

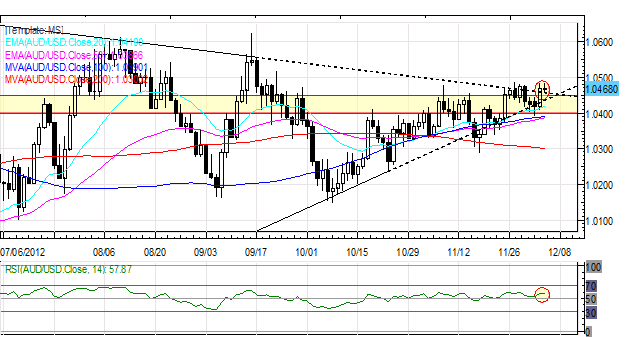

AUD/USD: The AUD/USD has been range-bound the past week, leaving my outlook unchanged since last Wednesday: “As the pair has traded towards its Symmetrical Triangle termination point, and appears to be making a move to the upside; when considered in the big picture, the current pause witnessed the past year or so may be viewed as a consolidation. Support is at 1.0370/1.0405 (trendline support off of the June 1 and October 23 lows) and 1.0235/80. Resistance is 1.0475/90 (November high) and 1.0500/15.”

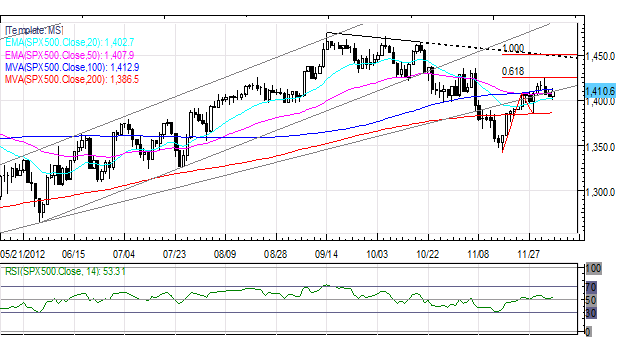

S&P 500: Is the uptrend over? Although the rally off of the 61.8 Fibonacci retracement (June 2012 low to September 2012 high) carried the S&P 500 back into a confluence of resistance at 1400/10 (20-EMA, 50-EMA, 100-EMA), the measured move off of the low suggested a top at 1425 given the 61.8 Fibonacci extension off of the November 16 low, the November 23 high, and the November 28 low extension. Support comes in at 1386 (200-DMA) and 1345/50 (November low). A move higher eyes 1425, 1450, and 1460.

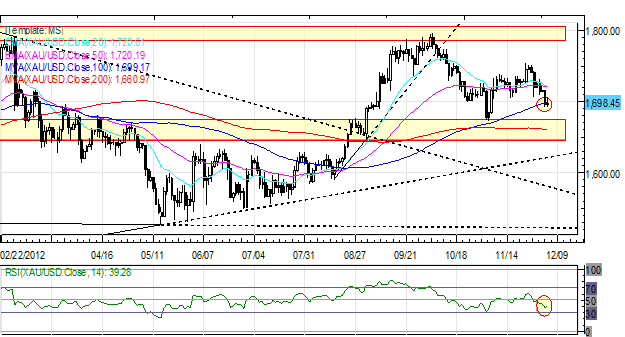

GOLD: Gold has fallen back off of its November and December highs near 1735, mainly on progress over the US fiscal cliff and demand for US Dollars amid the need to diversify away from the Japanese Yen. I still expect the 1700 area to be defended vigorously on declines, and will continue to look to get long as low as 1675. Resistance is 1735, 1755/58 and 1785/1805. Support is 1700 (breaking now), 1690/95 (100-DMA, November low), and 1660/65 (200-DMA).

--- Written by Christopher Vecchio, Currency Analyst

To contact Christopher Vecchio, e-mail cvecchio@dailyfx.com

Follow him on Twitter at @CVecchioFX

To be added to Christopher’s e-mail distribution list, please fill out this form

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance