Forex: US Dollar Up After Fed Minutes, Before NFPs; Yen Worst Again

ASIA/EUROPE FOREX NEWS WRAP

The US Dollar is the strongest major currency ahead of the crucial Nonfarm Payrolls report for December, as investors around the globe remain enamored by the Federal Reserve’s December meeting Minutes. Yesterday, the US Dollar took a strong turn higher after news broke that the Fed was divided over the duration of its newest QE program, with some policymakers suggesting that QE might come to an end at some point during 2013.

While this has led to a rise in US Treasury yields, it is of my belief that the market reaction behind the US Dollar is nonsensical. We know the exit parameters of the Fed’s QE3 – the Evans Rule – which states that the Unemployment Rate (as measured by U3) has to be below 6.5% or various gauges of yearly inflation rise above +2.5%.

In reality, neither of these situations are likely to play out in 2013. The fiscal cliff resolution raises taxes on many individuals, which should dampen consumption slightly; this in turn will reduce demand-push inflation (prices rise due to increased demand). For the labor market, the recent drop in the Unemployment Rate has coincided with a decline in participation, thus making the drop almost artificial. Instead, looking at the Underemployment Rate (as measured by U6) and the participation rate of middle-aged men, it’s clear that significant structural weaknesses remain. Take yesterday’s ADP Employment Change report, for example: an enormous beat on the headline, yet manufacturing jobs were still shed.

This leads us to today’s Nonfarm Payrolls report for December. Estimates are all over the place, ranging from +80K to +305K; consensus calls for +145K to +153K. Recent trends suggest that these are not only reasonable estimates, but when considered in the scope of jobs growth in 4Q’11 and 4Q’10, anything greater than +190K would be an astonishing accomplishment.

Taking a look at European credit, mixed bond yields have led to a weaker Euro. The Italian 2-year note yield has decreased to 1.614% (-0.1-bps) while the Spanish 2-year note yield has decreased to 2.292% (-7.7-bps). On the contrary, the Italian 10-year note yield has increased to 4.243% (+2.3-bps) while the Spanish 10-year note yield has increased to 4.987% (+1.0-bps); higher yields imply lower prices.

RELATIVE PERFORMANCE (versus USD): 11:20 GMT

EUR: -0.33%

CHF: -0.33%

CAD: -0.45%

GBP:-0.64%

AUD:-0.78%

NZD:-0.49%

JPY:-1.20%

Dow Jones FXCM Dollar Index (Ticker: USDOLLAR): +0.58% (+1.22% past 5-days)

ECONOMIC CALENDAR

See the DailyFX Economic Calendar for a full list, timetable, and consensus forecasts for upcoming economic indicators.

TECHNICAL ANALYSIS OUTLOOK

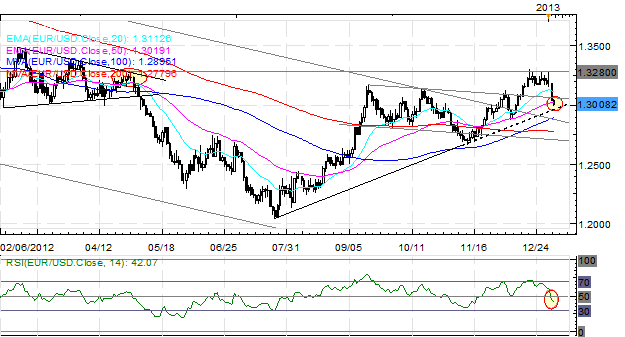

EURUSD: No change: “The pair failed once again at its May highs, posting a massive reversal yesterday (Inverted Hammer) and trading towards the descending trendline off of the September and October highs. The bearish RSI divergence seen on the daily chart (as well as the 4H) is being resolved, setting up a potential buying opportunity in the coming days; however, negative momentum is proving swift.” Support comes in 1.2950/65 (ascending TL off of July and November lows) and 1.2875/95. Resistance is 1.3050/60, 1.3170, 1.3280/85, and 1.3380/85 (mid-March swing high).

USDJPY: Yesterday I said: “The pair has exploded to its highest level since July 2010, leaving the December 2008/January 2009 lows in focus at 87.00/20. Given BoJ policy, any dips seen in the USDJPY are viewed as constructive for further bullish price action (the market remains very net-short).” With 87.00/20 easily broken, the pair is now in a zone that proved to be strong support throughout 2009 and 2010, at 88.15/95. Support comes in at 87.00/20 and 86.00.

GBPUSD: No change: “The pair has fallen back from 1.6300, again, though with no follow through yet, my levels remain the same (they haven’t changed since early-December).” However, the pair is now coming into ascending TL support off of the July and November lows at 1.5985. Support is there and 1.5895 (200-DMA). Resistance comes in at 1.6080/90 (50-EMA), 1.6180, and 1.6300/10 (post-QE3 announcement high in mid-September).

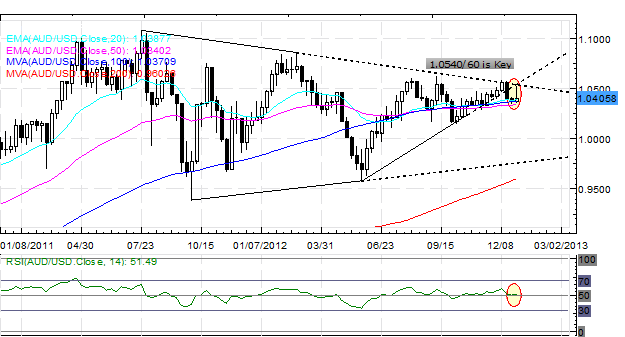

AUDUSD:No change: “The AUDUSD couldn’t break descending trendline resistance off of the July 2011 and February 2012 highs, which come in at 1.0530/55 today, but that doesn’t mean the uptrend is over just yet. With price holding just below the monthly R1 at 1.0535 and thelong-term Symmetrical Triangle starting to break to the upside, consolidation may be ahead the next few sessions.” The Fed Minutes provoked a larger breakdown, but the pair remains above key weekly moving averages. Support is at 1.0340/50, 1.0280/95 (November swing low, 200-DMA), and 1.0145/65. Resistance is 1.0525/35, 1.0555/75 and 1.0605/25 (August and September highs).

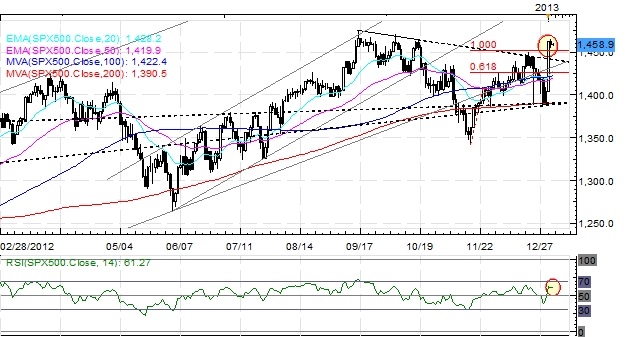

S&P 500: No change: “The S&P 500is back above a very significant zone of 1445/50 (descending trendline off of September and October highs, 100% Fibonacci extension off of the November 16 low, the November 23 high, and the November 28 low extension), and a move higher necessarily points to 1470/75. Support comes in at 1425, 1400, 1390 (200-DMA) and 1345/50 (November low).”

GOLD: Gold is at a make or break level right now, former Symmetrical Triangle support at 1630/40, and its lowest level since August, before the ECB and the Fed’s QE intervention hopes took hold. Additionally, when considering the move off of the September highs, a measured A-B=C-D suggests that a bottom could be in place at these levels as well. Support is there at 1580. Resistance is 1690/95, 1735, 1755, and 1785/1805.

--- Written by Christopher Vecchio, Currency Analyst

To contact Christopher Vecchio, e-mail cvecchio@dailyfx.com

Follow him on Twitter at @CVecchioFX

To be added to Christopher’s e-mail distribution list, please fill out this form

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance