Forex: US Dollar Continues to Settle; Chinese Economy in Focus

ASIA/EUROPE FOREX NEWS WRAP

Risk-appetite is neither firm nor soft on Friday, as a myriad of data, news, and commentary has kept traders on the sidelines, leaving the US Dollar mostly unchanged, if not slightly higher on the day. In sum, the lack of demand for riskier assets today during the European session is a bit of a surprise, considering how high beta assets performed during the Asian trading session on Friday: following a better than expected HSCB Flash Manufacturing PMI for December, the Chinese Shanghai Composite closed up by +4.32%.

The Chinese data released overnight shows that the fears of a “hard landing” are in the rearview mirror, and a new conversation is warranted: for how long will China grow approximately +7%; or is a stronger growth around the corner? An indicator for Chinese growth I observe, Iron Ore prices on the Singapore Mercantile Exchange, have rebounded by over +10% since December 4, suggesting that demand for base metals – the commodities needed to build infrastructure – is improving rapidly.

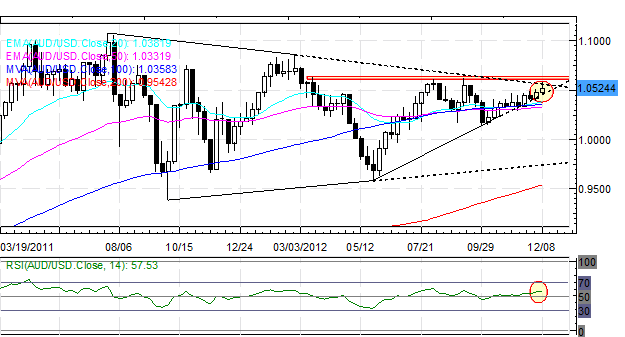

There are ramifications if this trend continues: China’s major trade partners could see a boost, in particular Australia; and this would alleviate growth concerns in the region, allowing the Australian Dollar to appreciate. Accordingly, with the Reserve Bank of Australia in recess during January, Chinese data becomes that much more important over the next few weeks, as they could be a major influential factor when the RBA reconvenes in February: another rate cut, which is still priced in by 58% according to the Credit Suisse Overnight Index Swaps, could put on hold for 1Q’13.

Elsewhere, taking a look at European credit, bond yields are slightly lower, helping keep the Euro elevated. The Italian 2-year note yield has decreased to 1.980 % (-4.2-bps) while the Spanish 2-year note yield has decreased to 2.795% (-3.4-bps). Likewise, the Italian 10-year note yield has decreased to 4.568% (-6.2-bps) while the Spanish 10-year note yield has decreased to 5.341% (-2.6-bps); lower yields imply higher prices.

RELATIVE PERFORMANCE (versus USD): 12:00 GMT

EUR: +0.08%

GBP: +0.04%

CAD: +0.02%

CHF:0.00%

AUD:-0.03%

JPY:-0.16%

NZD:-0.28%

Dow Jones FXCM Dollar Index (Ticker: USDOLLAR): +0.02% (-0.22% past 5-days)

ECONOMIC CALENDAR

See the DailyFX Economic Calendar for a full list, timetable, and consensus forecasts for upcoming economic indicators.

TECHNICAL ANALYSIS OUTLOOK

EURUSD: No change from Thursday: “The same descending trendline off of the September and October highs which served as resistance last week (in combination with the monthly R1) has once again held this week (in combination with the weekly R1). Accordingly, with the Fed ultimately disappointing, consolidation is possible the rest of the week. Resistance remains 1.3075/90 and 1.3145/75. Support is 1.3010/30, 1.2875/90 and 1.2800/20 (late-September/early-October swing low).”

USDJPY: No change: “The Bull Flag on the daily has broken [on Thursday] to the upside, with validation occurring above 82.90; the USDJPY is now on its way towards the mid-March highs above 84.00. With the Fed out of the way, the Yen’s fundamentals could help lift this pair higher.” Support comes in at 83.30/55, 82.90/83.00, and 81.75.Resistance is 84.00/20 (March high).

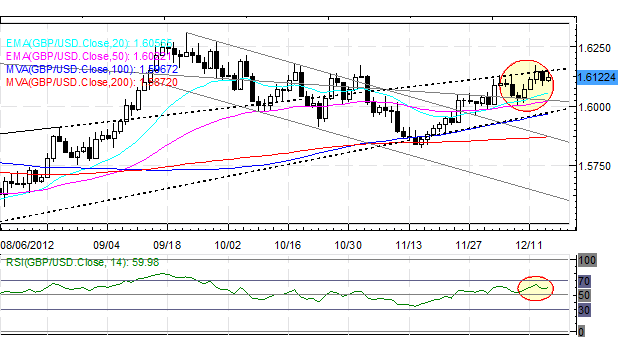

GBPUSD: No change from Thursday: “The GBPUSD traded into a reactionary top following the Fed, at the November high at 1.6170/80 and has since traded lower. Accordingly, my levels remain the same. Resistance comes in at 1.6170/80 and 1.6300/10 (post-QE3 announcement high in mid-September). Support is 1.6055/60 (20-EMA), 1.5960/70 (100-DMA), and 1.5865/70 (200-DMA).”

AUDUSD:No change from Thursday: “The AUDUSD couldn’t break descending trendline resistance off of the July 2011 and February 2012 highs, which come in at 1.0550/55 today, but that doesn’t mean the uptrend is over just yet. With price holding just below the monthly R2 at 1.0570 and thelong-term Symmetrical Triangle starting to break to the upside, consolidation may be ahead the next few sessions. Support is at 1.0500/15, 1.0460, and 1.0235/80. Resistance is 1.0555/75 and 1.0605/25 (August and September highs).” Note: this is a weekly chart to highlight how close the AUDUSD to a potential breakout.

S&P 500: No change from Thursday: “The S&P 500 has set a new December high, breaking above the early-November highs but failing in the key 1435/40 zone. Accordingly, the pair is back at1425, the 61.8% Fibonacci extension off of the November 16 low, the November 23 high, and the November 28 low extension. Support comes in at 1425 (holding now), 1400, 1388 (200-DMA) and 1345/50 (November low). A move higher through 1435/40 points to 1450 and 1470/75.”

GOLD: No change from Thursday: “Gold has fallen back a bit as the US Dollar has rebounded in the face of another QE package. Now that Gold is back below 1700, I expect buying interest to resume; though it should be noted that December is historically a bad month for precious metals. I will continue to look to get long as low as 1675. Resistance is 1735, 1755/58 and 1785/1805. Support is 1700, 1670/75 (November low), and 1660/65 (200-DMA).”

--- Written by Christopher Vecchio, Currency Analyst

To contact Christopher Vecchio, e-mail cvecchio@dailyfx.com

Follow him on Twitter at @CVecchioFX

To be added to Christopher’s e-mail distribution list, please fill out this form

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance