FOREX Trading: USD/JPY 8700s Giving Bulls all they Can Handle

Afternoon Technicals (all charts)

FOREX Trading and Technical Analysis Observations

My trading focus remains on the Yen crosses. That’s where the action is so that’s where I’ll play. By any measure-COT, RSI, difference from major moving averages (called the disparity index)-Yen crosses are insanely overbought which raises the risk of ‘snapback’ much like a rubber band that has been stretched too far.

The USDJPY has slipped below 8700 and a drop below yesterday’s 8650 low would create an outside day and present a short opportunity against the high. Initial support is 8565 but a return to 8420/60 (breakout level) isn’t out of the question.

EURJPY weakness is the most ‘impulsive’ and price is nearing initial support at 11350. A break exposes 11250 (12/19 high), 11150 (breakout level March 2012 high), and 11060 (12/21 low).

The AUDJPY and NZDJPY are of interest as well as mean reversion plays but have to yet to show conditions necessary to express a bearish opinion.

Other pairs on the watch list include

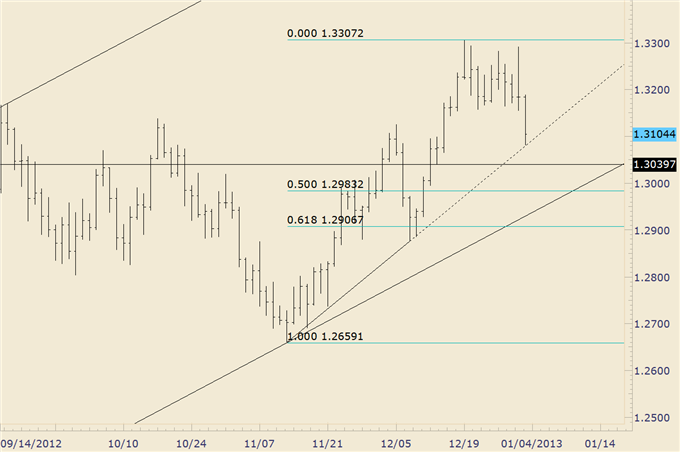

The EURUSD has broken down which opens a run at the trendline that extends off of the July 2012 and November 2012 lows. The 50% and 61.8% retracements of the rally from the November low come in at 12908/84. This is now support.

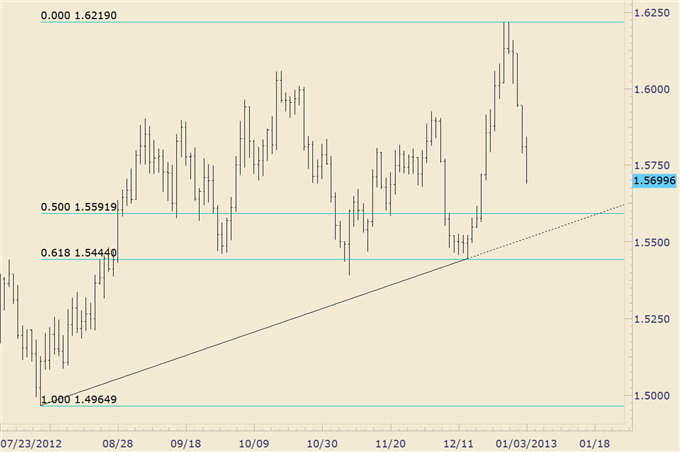

The EURAUD and EURNZD have continued early year weakness. Support for the former is the trendline that extends off of the November and December lows and 61.8% retracement of the rally from 12159 at 12406. Support in the latter comes in at the August-December trendline and 50% retracement of the August-December rally, at 15592.

USDJPY - Daily

Prepared by Jamie Saettele, CMT

EURUSD – Daily

Prepared by Jamie Saettele, CMT

EURAUD – Daily

Prepared by Jamie Saettele, CMT

EURNZD – Daily

Prepared by Jamie Saettele, CMT

--- Written by Jamie Saettele, CMT, Senior Technical Strategist for DailyFX.com

To contact Jamie e-mail jsaettele@dailyfx.com. Follow me on Twitter for real time updates @JamieSaettele

Subscribe to Jamie Saettele's distribution list in order to receive actionable FX trading strategy delivered to your inbox.

Jamie is the author of Sentiment in the Forex Market.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance