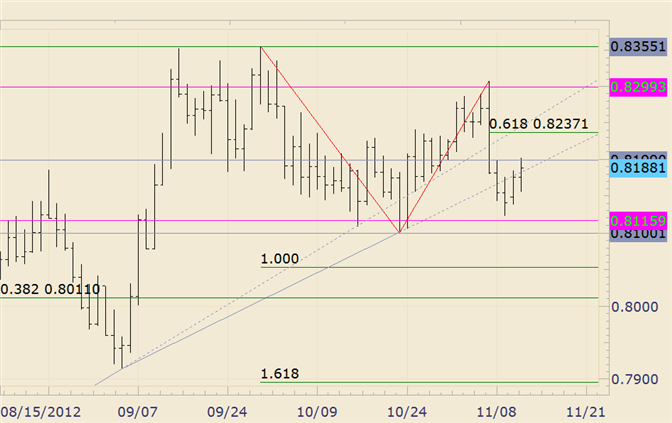

FOREX Technical Analysis: NZD/USD Responds to 8200 Resistance

Daily Bars

Chart Prepared by Jamie Saettele, CMT

FOREXAnalysis: Unlike the AUD/USD, the NZD/USD decline from last week’s top unfolded in a clean impulse (5 waves). The rally from the low should unfold correctively and top before 8309. 8230/37 (former support and 61.8% retracement) is a level that may produce the top.

FOREXTrading Strategy: “A bearish bias is warranted although a bounce into 8230 or sideways trading for several days can’t be ruled out. 8010/55 is an area of interest.” The NZD/USD responded at 8200 today but keep tabs on 8230/37, which is former support and the 61.8% retracement of the decline from the top.

LEVELS: 8011 8054 8115 8200 8230 8260

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance