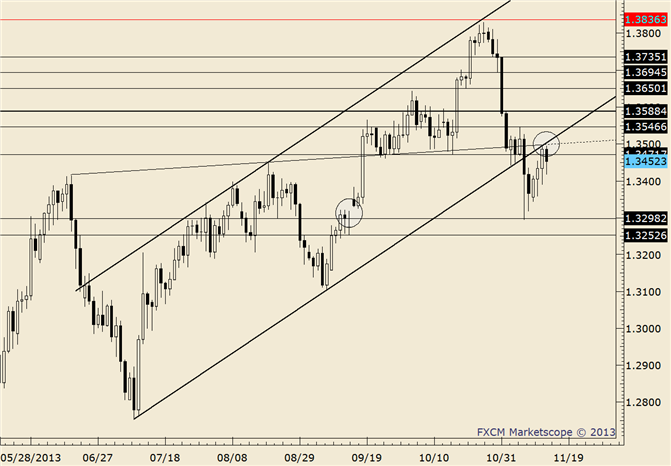

FOREX Technical Analysis: EUR/USD Inside Day Presents Next Opportunity

DailyBars

Chart Prepared by Jamie Saettele, CMT using Marketscope 2.0

FOREXAnalysis: Bulls face a test next week from the 2012 high and 50% retracement of the decline from the 2011 high at 13490. The most recent consolidation yields measured moves of 13495 and 13550 (see daily chart below). More aggressive objectives come in at 13800-13900 (61.8% of decline from 2011 high and where the rally from the 2012 low would consist of 2 equal legs AND channel resistance next week) and 14400-14500 (inverse head and shoulders objective).

FOREX Trading Strategy: 13490-13550 is a level that could produce consolidation or a pullback. Given market conditions however, it’s probably best to position for an extended move towards the more aggressive objectives. The most recent breakout level is now support at 13403 if Monday’s low is broken. Trading through Friday’s high would warrant a long bias against Monday’s low (13423).

LEVELS: 13320 13355 1340313485 1355013600

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance