FOREX Technical Analysis: EUR/USD Reversal is Possible after Fed

DailyBars

Chart Prepared by Jamie Saettele, CMT

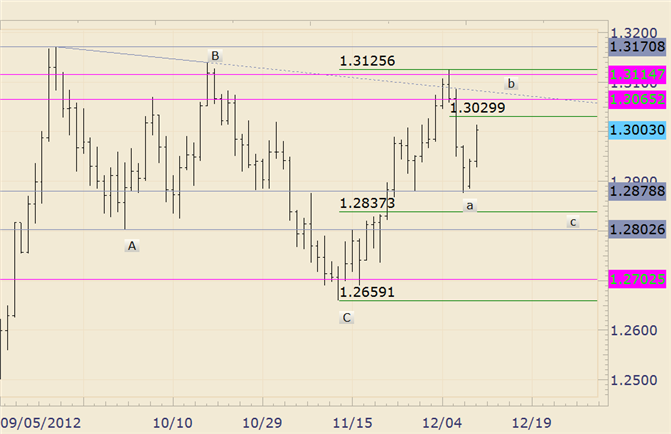

FOREXAnalysis: There is no change to the call for a slightly higher EURUSD. “Look higher from the current level towards 13030 (61.8% retracement). Given event risk, I’d not be surprised to see an emotional market that spikes through that level and into 13065. Interim resistance is expected at 12975. Ultimately, the rally from Friday’s low is expected to prove corrective before lower prices are registered later in the month.”

FOREX Trading Strategy: I’ve exited longs from Sunday night and the next move is either selling into 13030/65 or buying below 12950. The intraday setup must be ‘right’ and any updates will be released via Twitter @JamieSaettele.

LEVELS: 12923 12941 12982 13030 13065 13126

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance