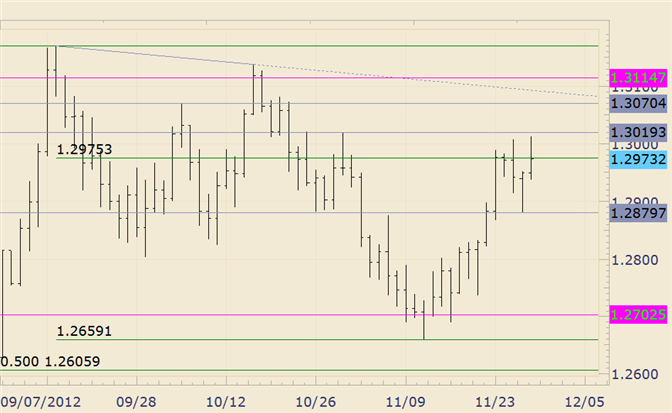

FOREX Technical Analysis: EUR/USD Fails to Break Fibonacci Level AGAIN

DailyBars

Chart Prepared by Jamie Saettele, CMT

FOREXAnalysis: Despite ‘news’, the EURUSD is unchanged on the week. Price closed last Friday at 12975. As I type, the EURUSD is at 12975. What I find interesting, (rather than the ‘news’) is that price has been unable to extend through the 61.8% retracement of the decline from the September high (retracement level is 12975). The market has made it quite clear that this is an important level. Will price reverse and head lower from here? I don’t know. One never knows with certainty what the next move will be but specific conditions are consistent with turns. Failure to extend gains beyond the 61.8% level throughout the week is not bullish. Intraday JS Spikes suggest that price is topping.

FOREX Trading Strategy: I prefer to trade from the short side but near term pattern lacks clarity for a bearish entry. In other words, it’s unclear if the market has topped or is in the process of registering a top at higher levels (13070?).

LEVELS: 12830 12880 12938 13020 13070 13115

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance