Forex: Sentiment Remains Vulnerable as Euro Retraces Gains on Light News

ASIA/EUROPE FOREX NEWS WRAP

The FX majors were on pace to finish the week strong – the AUDUSD near 1.0500, the EURUSD above 1.2900, and the GBPUSD above 1.6000 – but amid some light but potentially significant developments out of Europe, risk-appetite has completely broken, with the Japanese Yen and the US Dollar surging in the early hours of European trading on Friday.

Mainly, as summarized earlier, the concerns out of Europe are for two main reasons: slowing growth in the core European (not just Euro-zone) countries; and further stagnation in Greece on the policy side of things. To start: French and Swedish Industrial Production came in worse than expected in September, triggering worries that weakening growth prospects are making their way into the traditionally stronger European countries. Alongside some not-so-enthusiastic comments from German officials on growth and further delays in Greek bailout measures, the Euro has been pressured lower for the past four or five hours. Follow through today is up in the air as it is Friday, meaning that liquidity is drastically reduced by the second half of the US trading session, with Asian and European markets offline until Monday.

From the technical side of the market, the breakdown in the S&P 500, which has not be entirely unexpected following the ascending channel break off of the June 4 and July 25 lows, may be nearing a stalling point. Although the broad measure of risk has now fallen out of an ascending channel off of the October 4, 2011 and June 4, 2012 lows, the most significant lows in the S&P 500 in recent memory. Coupled with the fact that the index is starting to resemble the charting pattern from mid-1987 (right before the October crash), I’d be lying if I said I wasn’t starting to get worried about high beta currencies and risk-correlated assets. We’ll explore setups for this trade next week.

Taking a look at credit, Euro weakness has not been reflected in peripheral bond yields. The Italian 2-year note yield has increased to 2.338% (+1.0-bps) while the Spanish 2-year note yield has increased to 3.126 % (+0.2-bps). Similarly, the Italian 10-year note yield has decreased to 4.998% (-0.8-bps) while the Spanish 10-year note yield has decreased to 5.809% (-1.1-bps); lower yields imply higher prices.

RELATIVE PERFORMANCE (versus USD): 11:05 GMT

JPY: +0.29%

NZD:+0.17%

CAD:+0.01%

AUD:-0.01%

EUR:-0.20%

GBP:-0.21%

CHF: -0.22%

Dow Jones FXCM Dollar Index (Ticker: USDOLLAR): +0.03% (-0.24% past 5-days)

ECONOMIC CALENDAR

See the DailyFX Economic Calendar for a full list, timetable, and consensus forecasts for upcoming economic indicators.

TECHNICAL ANALYSIS OUTLOOK

EURUSD: Wednesday I said that: “Late-September and early-October swing lows have broken and a deeper retracement is looking possible now that the consolidation is failing off of the September 17 and October 17 highs, and the October 1 low.” Price action remains biased to the downside as the EURUSD has struggled to regain 1.2750, mid-June swing highs and the early-September “pause” the EURUSD experienced. Support comes in there (breaking again), 1.2630/45 (100-DMA), and 1.2400/35. Resistance is 1.2820/30 (mid-October swing low, 200-DMA), 1.2880/1.2900, and 1.3015/20 (last week’s high).

USDJPY: Gold and the USDJPY are signaling that the fiscal cliff concerns are coming back into the picture, with the USDJPY having lost ground four of the past five days. Price continues to trade lower from key resistance in the 80.50/70 zone (mid-June swing high), and the uptrend from mid-September has broken. Support is 79.10/30 and 78.60. Resistance is at 79.55/65 (20-EMA, 200-DMA), 80.00, 80.50/70, and 81.75/80 (mid-April swing high).

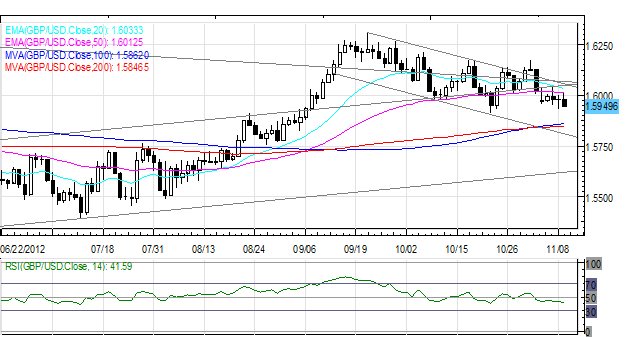

GBPUSD: No change from Tuesday: “While the GBPUSD appeared to be moving to breakout of its recent downtrend, an Inverted Hammer on November 1 has biased the pair to the downside. For now, we are neutral if not looking lower.” Resistance comes in at 1.6015 (50-EMA), 1.6040 (20-EMA), and 1.6170/80 (last week’s highs). Support is 1.5910/15 (October low) and 1.5845/60 (100-DMA, 200-DMA).

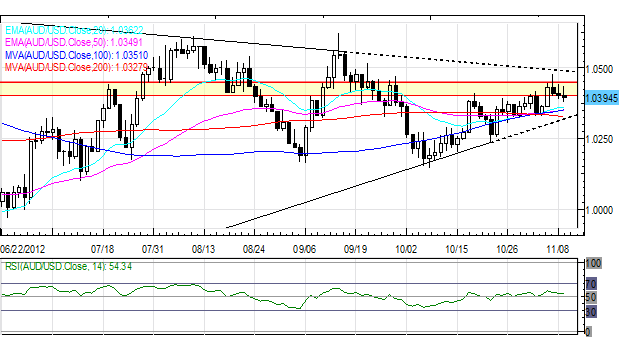

AUDUSD: No change from Wednesday: “Although the AUDUSD traded back to its highest level since late-September, an Inverted Hammer [formed] on the daily chart at key resistance [on Wednesday], suggesting a near-term dip is possible.” Support is close by at 1.0330/50 (20-EMA, 50-EMA, 100-DMA, 200-DMA) and 1.0310/05 (ascending trendline off of June 1 and October 23 lows). Resistance is at 1.0405/50 (former swing highs and lows, October high) and 1.0500/15.

S&P 500: For the past week I’ve noted: “A short-term top is potentially in place after support at 1420/25 (the 61.8% Fibo retracement on June 2012 low to September 2012 high, ascending trendline off of the June 4 and July 24 lows) broke [on October 23] following tests on three occasions the past two weeks.” Now the pullback is looking deeper: the ascending channel off of the October 4, 2011 and June 4, 2012 lows is breaking. Targets near 1355 are in focus now that price is below 1395. Support comes in at 1375 and 1350/55 (monthly S2, ascending channel support off of November 2011 and June 2012 lows). Resistance comes in at 1383 (200-DMA),1405 (100-DMA), and 1415/20 (20-EMA, 50-EMA).

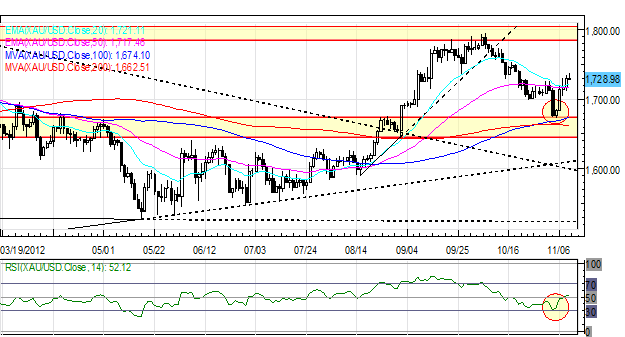

GOLD: Gold has rebounded to fresh November highs and is back above 1715; my bias increasingly bullish. I still expect the 1700 area to be defended vigorously, and look to get long as low as 1680. Resistance is 1735, 1755/58 and 1785/1805. Support is 1700, 1675/80 (100-DMA, November low), and 1660 (200-DMA).

--- Written by Christopher Vecchio, Currency Analyst

To contact Christopher Vecchio, e-mail cvecchio@dailyfx.com

Follow him on Twitter at @CVecchioFX

To be added to Christopher’s e-mail distribution list, please fill out this form

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance