Forex: Political Concerns Hamper the Euro - Is EUR/USD Top in Place?

ASIA/EUROPE FOREX NEWS WRAP

The past several days may very well be looked back upon as a major inflection point in the 1Q’13: the most significant US economic data released beat expectations handily, while even the outlying disappoints come with substantial circumstantial annotations, if only to suggest that any near-term US economic weakness is “transitory,” something the Fed itself said in its policy statement last week. And while the US picture is growing brighter – as noted by the ever-so important rally by US Treasury yields – all of the sudden the situation in Europe looks unstable once more.

This week was already expected to provide volatility across Euro-based pairs, with a highly anticipated European Central Bank meeting on the calendar on Thursday. While no policy change is expected at this meeting, the recent drawdown in the ECB’s balance sheet (via LTRO repayments) as well as the recent rapid appreciation by the Euro, has stoked not only liquidity concerns, but also concerns that Euro-zone exporters’ competitiveness may be eroding at a very fragile time. Accordingly, a more neutral tone is expected this week, if only to offset the prior hawkish tone set forth by the ECB at the January meeting.

When considering the ECB meeting this week in context of the weekend’s events, it is possible that the Euro may have set a top against the US Dollar in the near-term (each currency’s narratives are diverging). The Italian elections due in a few weeks are seeing a closely-contested race, with former prime minister and widely-viewed ‘Euro-negative’ candidate Silvio Berlusconi narrowing the polls. In Spain, a corruption case has rattled the government, with opposition leaders calling for PM Mariano Rajoy’s resignation, an event that would essentially be the market equivalent to the Greek elections last May. At 09:45 EST/14:45 GMT, PM Rajoy and German Chancellor Angela Merkel meet to discuss the events unfolding.

Taking a look at European credit, peripheral yields have shot up, exposing the Euro to weakness on Monday. The Italian 2-year note yield has increased to 1.636% (+5.1-bps) while the Spanish 2-year note yield has increased to 2.742% (+19.9-bps). Similarly, the Italian 10-year note yield has increased to 4.389% (+7.1-bps) while the Spanish 10-year note yield has increased to 5.330% (+15.4-bps); higher yields imply lower prices.

RELATIVE PERFORMANCE (versus USD): 11:50 GMT

GBP: +0.20%

NZD: +0.19%

AUD: +0.19%

CAD:+0.04%

JPY:-0.15%

CHF:-0.34%

EUR:-0.54%

Dow Jones FXCM Dollar Index (Ticker: USDOLLAR): +0.14% (+0.32% past 5-days)

ECONOMIC CALENDAR

See the DailyFX Economic Calendar for a full list, timetable, and consensus forecasts for upcoming economic indicators.

TECHNICAL ANALYSIS OUTLOOK

EURUSD: Consolidation occurring after overshoot towards 1.3700; with the daily RSI uptrend breaking, a pullback towards 1.3500 should not be ruled out. I maintain: “with the daily RSI well into overbought territory, a pullback would be deemed healthy. Dips into 1.3500 are deemed constructive. Support is 1.3615/20 (weekly R2), 1.3540 (weekly R1), and 1.3500. Resistance is 1.3635/60 and 1.3755/85 (weekly R3, monthly R1).”

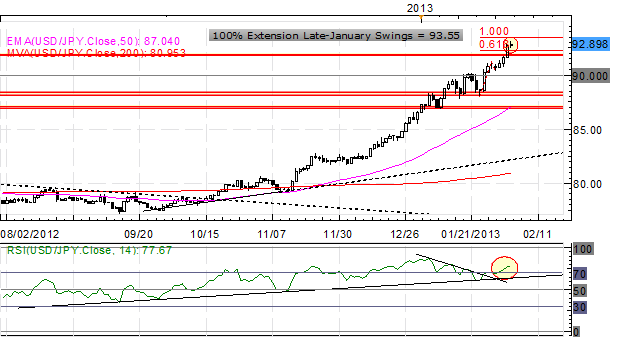

USDJPY: No change: “Further bullish price action as US Treasury yields strengthen and speculation over BoJ policy arises again. Resistance comes in at 92.00/05 (breaking now) (weekly R1), 93.15/20 (weekly R2), and 93.45/50 (monthly R3). Support comes in at 91.00 and 90.00/10 (weekly pivot, monthly R2).”

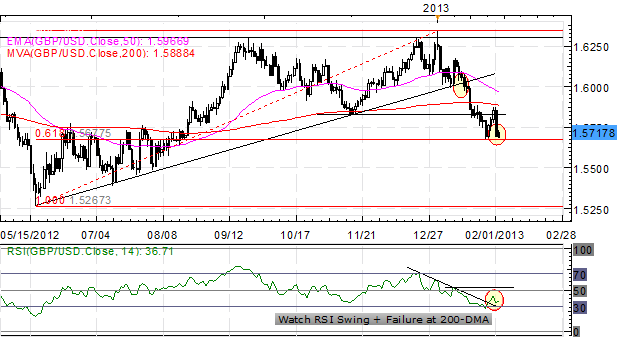

GBPUSD: The pair is holding the 61.8% Fibonacci retracement from the June low to January high, but I maintain: looking to sell rallies in the pair as significant RSI divergence exists. Failure at the former November swings lows at 1.5825 (and subsequently, the 200-DMA at 1.5890) underscores how weak the pair is right now. A break below 1.5675 eyes a move towards 1.5500, and ultimately, 1.5265/70, the June low. Resistance comes in at 1.5825 and 1.5885/90. Support is 1.5675 and 1.5580 (monthly S1).

AUDUSD:No change: “The pair continues to range although it has showed signs of cracking, with both the ascending trendline off of the June low and the October low having been breached, as well as the ascending TL off of the June low and the December low. Accordingly, a weekly close below 1.0460 could signal a deeper retracement towards 1.0350/400, before a greater breakdown towards parity. Support comes in at 1.03800/400 (last week’s low), 1.0340/50 (December low), and 1.0140/50 (October low). Resistance is 1.0460/70 (ascending TL off of the June and December lows, 50-EMA) and 1.0500/15.”

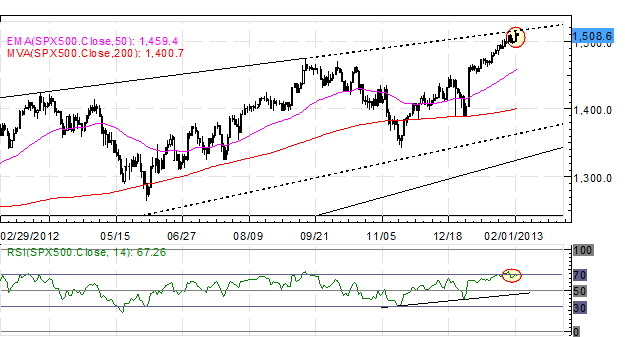

S&P 500: Tuesday I said: “as indicated on the charts the past weeks, noting “nearing the top 1505/1512” – the top was 1504.6. If this breaks, 1520 is in sight.” Indeed, the irrational exuberance has continued, bringing topline Bearish Rising Wedge resistance in focus at 1512/15; the December 2007 highs of 1520/24 could be reached on an overshoot. Bottom line: I’m expecting a crash in the S&P 500 unless volumes accelerate rapidly, given the disconnect from reality.

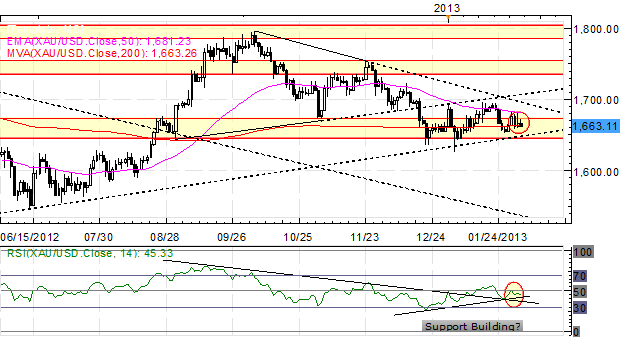

GOLD: The past few weeks I’ve maintained: "When considering the move off of the September highs, a measured A-B=C-D (as expressed on the Daily) suggests that a bottom could be in place at [1630/40].” The rebound has ensued, with the alternative safe haven rallying up to 1690 today. A daily close above 1700 points towards 1722/25 and 1755. Support is 1663 (200-EMA) and 1640/45.

--- Written by Christopher Vecchio, Currency Analyst

To contact Christopher Vecchio, e-mail cvecchio@dailyfx.com

Follow him on Twitter at @CVecchioFX

To be added to Christopher’s e-mail distribution list, please fill out this form

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance