Forex News: Fiscal Cliff Negotiations Boost US Dollar Forecast

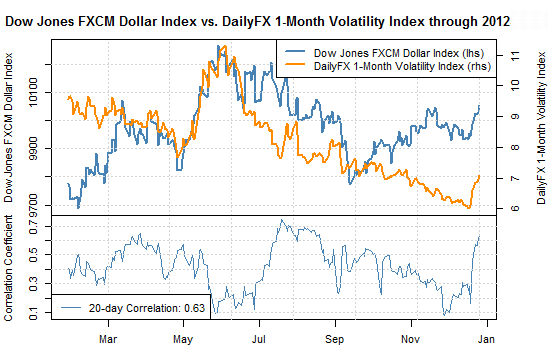

Financial market stress over the so called “Fiscal Cliff” in the United States has led the safe-haven US Dollar (ticker: USDOLLAR) higher against riskier counterparts. The looming deadline has led volatility expectations noticeably above recent lows, and the correlated Dow Jones FXCM Dollar Index similarly trades near key multi-month peaks.

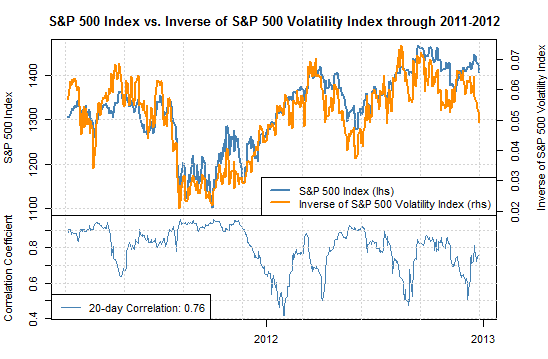

Traders will keep a close eye on whether ongoing fiscal cliff negotiations will produce the breakthrough that many have hoped for. Yet the bounce in the S&P 500 Volatility Index—also known as the “Fear Index”—suggests that many are buying protection against a breakdown in talks ahead of the January 1st deadline.

Why exactly do the Fiscal Cliff negotiations matter? If the US Congress and President do not act, there will be substantive tax increases and spending cuts that go into effect starting January 1. By most estimates, said fiscal austerity would put the United States economy back into recession.

“Going over the cliff” would hurt growth-sensitive asset classes and classic “risk” barometers such as the US S&P 500 and benefit the safe-haven US Dollar. Conversely, a deal that averts the worst of the fiscal cliff spending cuts and tax increases would likely force US Dollar declines.

Popular media tends to overstate the importance of the January 1 deadline—Congress could just as easily pass a retroactive deal that offsets any tax immediate tax increases. Yet its effects on investor risk appetite are quite real, and indeed we’ve seen the S&P 500 work on its fifth-consecutive daily decline as the VIX trades above the psychologically significant 20% mark.

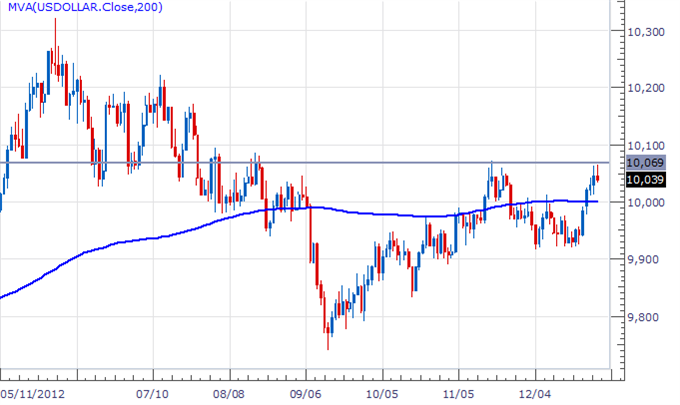

It will be important to watch whether negotiations over the weekend will have an effect on investor sentiment—particularly as the Dow Jones FXCM Dollar Index has stalled at September highs. Its 200-day Simple Moving Average at 10000 marks support on continued failure.

Dow Jones FXCM Dollar Index Daily Chart

--- Written by David Rodriguez, Quantitative Strategist for DailyFX.com

To receive the Speculative Sentiment Index and other reports from this author via e-mail, sign up to David’s e-mail distribution list via this link.

Contact David via

Twitter at http://www.twitter.com/DRodriguezFXFacebook at http://www.Facebook.com/DRodriguezFX

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance