Forex News: Euro Rises on a Slowing Decline in Composite Output

THE TAKEAWAY: Euro-zone composite output index rises to 48.2, better than expected -> PMI’s indicate a possible recovery in 2013 -> Euro trading slightly higher

Euro-zone composite output declined at the slowest pace in ten months, according to Markit’s Purchasing Managers’ Index. The composite output index for January was reported at 48.2, beating expectations for 47.5 and higher than December’s composite survey at 47.2. The Euro-zone PMI for manufacturing beat expectations at 47.5, the PMI for services also rose to 58.3 in January. A PMI below 50.0 indicates decline in sector activity, and the composite output index has shown a contraction for the past twelve months.

German output in services and manufacturing grew at the fastest pace in a year, while French companies reported the steepest downturn since 2009. Companies across the Euro-zone reported that the rate of decline in new business has slowed in January. However, the rate of job losses hit the highest since November of 2009, according to Markit.

The Euro-zone entered a technical recession in Q2 and Q3 of 2012, and unemployment hit a record high in November. However, ECB President Draghi said the darkest clouds over the Euro-area have receded, and the ECB predicts a recovery in 2013. Today’s PMI release confirmed those expectations. Markit Chief Economist Chris Williamson said, “Forward-looking indicators – such as business confidence and the new orders-to-inventory ratio – also suggest that the rate of decline will continue to slow in the coming months, and a return to growth looks to be on the cards during the first half of 2013.”

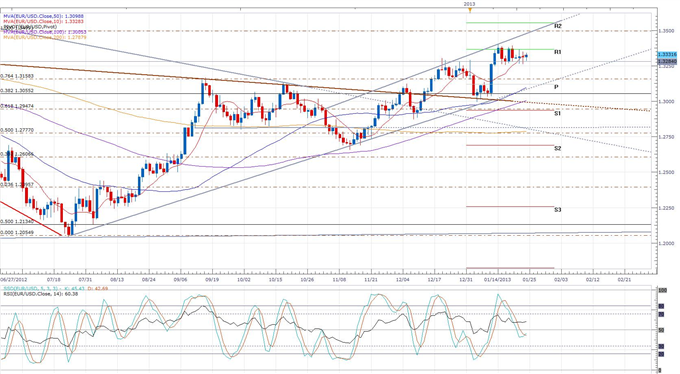

Signs of an improving Euro-zone economy are Euro positive. The single currency rose against the US Dollar following the better than expected German and Euro-zone PMI’s, although EURUSD saw a brief decline after the disanointing French index results. The pair is trading at 1.3330 in Forex markets at the time of this writing. Resistance could be provided by an 11-month high recently set at 1.3404, while the broken resistance line at 1.3284 could continue to provide support.

EURUSD Daily: January 24, 2013

Chart created by Benjamin Spier using Marketscope 2.0

-- Written by Benjamin Spier, DailyFX Research. Feedback can be sent to bbspier@fxcm.com .

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance