Forex: Japanese Yen Leads and Threatens Reversals Across All Majors

ASIA/EUROPE FOREX NEWS WRAP

It’s been over a week since this report was last filed for various reasons (Hurricane Sandy displacing me, then heading out to the FXCM Expo), but very little has changed surrounding the major currencies and other assets discussed in this report. But perhaps the most important development has been the continued string of positive US economic data, which has dealt a blow to easing expectations, boosting the US Dollar, while sinking the Euro, Gold, the Japanese Yen, and the S&P 500.

Similar to how the US Dollar has garnered appeal among better data, the commodity currencies, led by the Australian Dollar, have appreciated moderately to begin the first full week of November. The catalyst: the Reserve Bank of Australia kept its key interest rate on hold at 3.25% earlier today, bucking the consensus forecast for a cut to 3.00%. Governor Glenn Stevens noted that “the Board judged that, with inflation expected to be consistent with the target and growth close to trend, but with a more subdued international outlook than was the case a few months ago, the stance of monetary policy remained appropriate.”

With Chinese concerns now subdued further, we turn our attention to Europe where both the British Pound and the Euro are been tempered by softer data: PMI readings were generally weaker for the broader Euro-zone and her larger countries; and British Industrial and Manufacturing data came in below forecasts for September. With the inevitable Spanish bailout being fumbled with by Prime Minister Mariano Rajoy, the Euro has been hit by uncertainty in that regard as well.

Taking a look at credit, peripheral yields are improved, helping insulate further Euro losses. The Italian 2-year note yield has decreased to 2.153% (-5.6-bps) while the Spanish 2-year note yield has decreased to 3.035% (-3.7-bps). Similarly, the Italian 10-year note yield has decreased to 4.929% (-5.0-bps) while the Spanish 10-year note yield has decreased to 5.670% (-4.7-bps); lower yields imply higher prices.

RELATIVE PERFORMANCE (versus USD): 10:50 GMT

AUD: +0.64%

CAD:+0.27%

NZD:+0.19%

JPY:+0.10%

CHF:-0.04%

GBP:-0.05%

EUR: -0.07%

Dow Jones FXCM Dollar Index (Ticker: USDOLLAR): -0.15% (+0.53% past 5-days)

ECONOMIC CALENDAR

See the DailyFX Economic Calendar for a full list, timetable, and consensus forecasts for upcoming economic indicators.

TECHNICAL ANALYSIS OUTLOOK

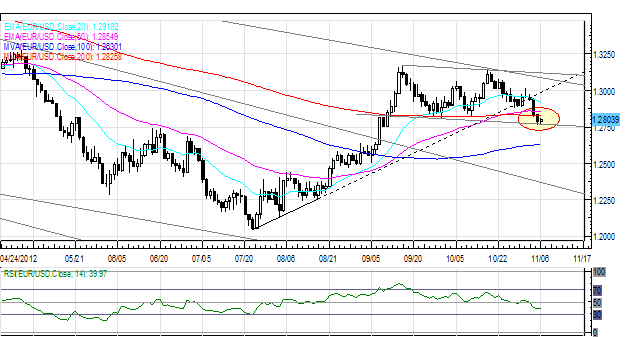

EURUSD: The uptrend off of the July 24 and August 2 lows has broken, but the pair continues to range in a channel (potential Bull Flag) off of the September 17 and October 17 highs, and the October 1 low. The support also comes ahead of 1.2750, mid-June swing highs and the early-September “pause” the EURUSD experienced. Support comes in there, 1.2630/45 (100-DMA), and 1.2400/35. Resistance is 1.2820/30 (mid-October swing low, 200-DMA), 1.2880/1.2900, and 1.3015/20 (last week’s high).

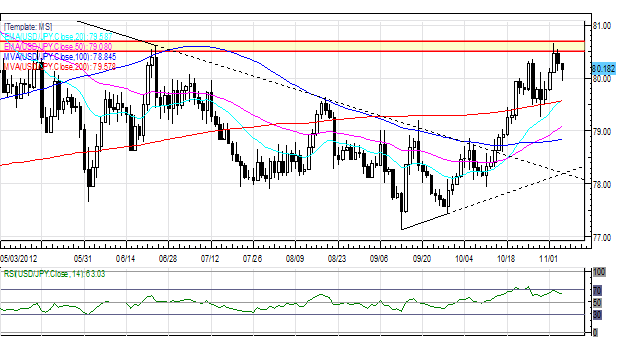

USDJPY: Key resistance in the 80.50/70 zone (mid-June swing high) has held up thus far, though the uptrend continues marked by a series of higher daily highs and higher daily lows since late-September; in fact, the pace has quickened the past week two weeks. Support is 80.00, 79.75/80, and 79.50/60 (20-EMA, 200-DMA). Resistance is at 80.50/70 and 81.75/80 (mid-April swing high).

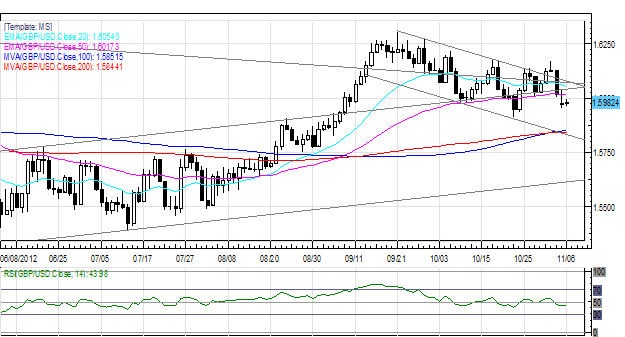

GBPUSD: While the GBPUSD appeared to be moving to breakout of its recent downtrend, an Inverted Hammer on November 1 has biased the pair to the downside. For now, we are neutral if not looking lower. Resistance comes in at 1.6140/55 (20-EMA), 1.6170/80 (last week’s highs), 1.6260 (the former April swing highs by close), and 1.6300. Support is 1.5910/15 (October low) and 1.5840/55 (100-DMA, 200-DMA).

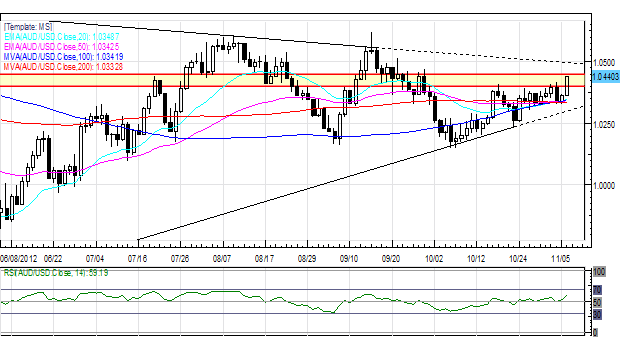

AUDUSD: The RBA surprise has boosted the pair back into key resistance, and a confluence of moving averages is building at support close by at 1.0330/50 (20-EMA, 50-EMA, 100-DMA, 200-DMA). Resistance is at 1.0405/50 (former swing highs and lows, October high) and 1.0500/15. Support comes in at 1.0330/50 and 1.0310/05 (ascending trendline off of June 1 and October 23 lows).

S&P 500: Nothing has changed: “A short-term top is potentially in place after support at 1420/25 (the 61.8% Fibo retracement on June 2012 low to September 2012 high, ascending trendline off of the June 4 and July 24 lows) broke [on October 23] following tests on three occasions the past two weeks.” Targets near 1355 would come into focus if price breaks below the monthly S1 at 1399. Support comes in at 1396/1400 (100-DMA), 1382 (200-DMA), and 1350/55 (monthly S2, ascending channel support off of November 2011 and June 2012 lows). Resistance comes in at 1425 (20-EMA, 50-EMA), 1460, 1470, and 1498/1504.

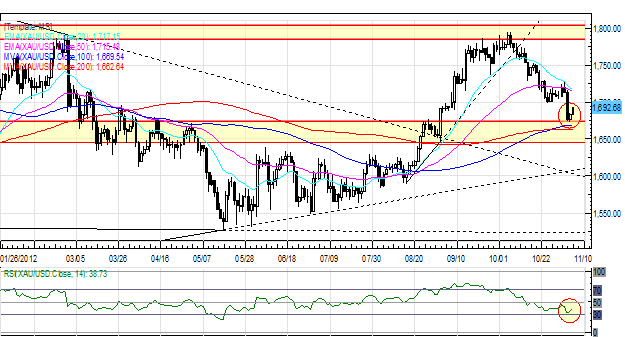

GOLD: Gold continues to hold below 1715 (mid-September swing low) but above 1700…my bias is back to neutral and looking higher. I still expect the 1700 area to be defended vigorously, and look to get long as low as 1680. Resistance is 1700, 1715, 1735, 1755/58 and 1785/1805. Support is 1680, and 1660/70 (100-DMA, 200-DMA).

--- Written by Christopher Vecchio, Currency Analyst

To contact Christopher Vecchio, e-mail cvecchio@dailyfx.com

Follow him on Twitter at @CVecchioFX

To be added to Christopher’s e-mail distribution list, please fill out this form

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance