Forex: Gold, Japanese Yen Gain After US Election; Fiscal Cliff in Focus

ASIA/EUROPE FOREX NEWS WRAP

Finally, the divisive and toxic US Presidential Election cycle is over; President Barack Obama will remain in office for four more years. Regardless of political variety preferred, this means only one thing, with Democrats retaining control of the Senate and the Republicans retaining control of the House of Representatives: an immediate shift of focus and high likelihood of continued uncertainty surrounding the impending automatic spending cuts and tax increases, dubbed the “fiscal cliff” by Federal Reserve Chairman Ben Bernanke.

Something discussed over the past several weeks has been the idea that the election would serve as a referendum to each side’s respective ideas on how to fix the country’s worsening debt problems. Thus, with a Democrat favoring a combination of spending cuts and higher taxes on wealthier individuals winning the Presidency, a solution will be tilted in this direction if anything happens at all. At the end of the day, a six month extension or an agreement in full should be expected by January 1: US politicians are no different than their European counterparts, who time and time again have pushed back the tough decisions in order to save face in front of an eroding electorate; the economy’s blood will not be on their hands.

In the near-term, the shift of capital away from riskier assets and into safe havens, not just the US Dollar but the Japanese Yen and precious metals as well, signals that deadlock is the knee-jerk reaction to the election results. As we witnessed last August, when Standard & Poor’s stripped the US of its hallowed ‘AAA’ rating, the Japanese Yen, Gold, and Silver stand to be among the best performers should US debt concerns ramp up once more. The S&P 500 is looking shaky as well, having erased yesterday’s gains in the overnight.

Elsewhere, taking a look at credit, peripheral yields are slightly weaker, underpinning Euro weakness on the day. The Italian 2-year note yield has increased to 2.097% (+0.2-bps) while the Spanish 2-year note yield has increased to 2.996 % (+1.7-bps). Likewise, the Italian 10-year note yield has increased to 4.883% (+0.5-bps) while the Spanish 10-year note yield has decreased to 5.611% (-1.1-bps); higher yields imply lower prices.

RELATIVE PERFORMANCE (versus USD): 13:00 GMT

JPY: +0.27%

NZD:+0.12%

AUD:+0.03%

CAD:+0.02%

GBP:-0.13%

CHF:-0.26%

EUR: -0.37%

Dow Jones FXCM Dollar Index (Ticker: USDOLLAR): -0.06% (+0.60% past 5-days)

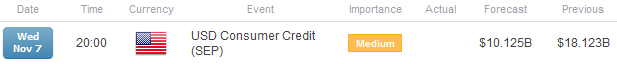

ECONOMIC CALENDAR

See the DailyFX Economic Calendar for a full list, timetable, and consensus forecasts for upcoming economic indicators.

TECHNICAL ANALYSIS OUTLOOK

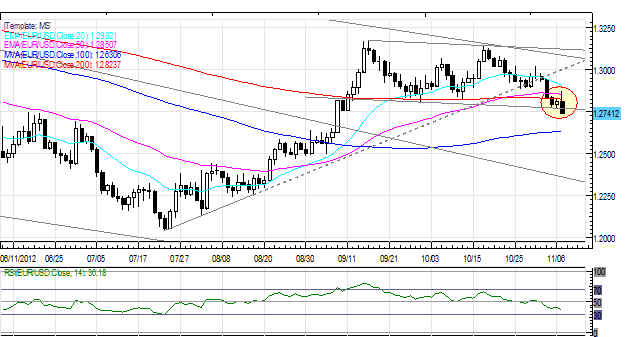

EURUSD: Late-September and early-October swing lows have broken and a deeper retracement is looking possible now that the consolidation is failing off of the September 17 and October 17 highs, and the October 1 low. Daily support comes in at 1.2750, mid-June swing highs and the early-September “pause” the EURUSD experienced. Support comes in there (breaking now), 1.2630/45 (100-DMA), and 1.2400/35. Resistance is 1.2820/30 (mid-October swing low, 200-DMA), 1.2880/1.2900, and 1.3015/20 (last week’s high).

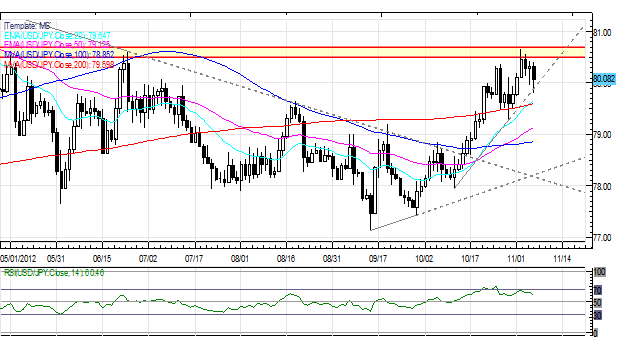

USDJPY: No change from yesterday: “Key resistance in the 80.50/70 zone (mid-June swing high) has held up thus far, though the uptrend continues marked by a series of higher daily highs and higher daily lows since late-September; in fact, the pace has quickened the past week two weeks. Support is 80.00, 79.75/80, and 79.50/60 (20-EMA, 200-DMA). Resistance is at 80.50/70 and 81.75/80 (mid-April swing high).”

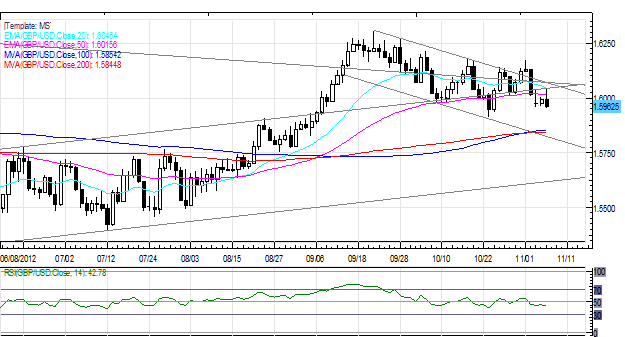

GBPUSD: No change from yesterday: “While the GBPUSD appeared to be moving to breakout of its recent downtrend, an Inverted Hammer on November 1 has biased the pair to the downside. For now, we are neutral if not looking lower. Resistance comes in at 1.6140/55 (20-EMA), 1.6170/80 (last week’s highs), 1.6260 (the former April swing highs by close), and 1.6300. Support is 1.5910/15 (October low) and 1.5840/55 (100-DMA, 200-DMA).”

AUDUSD: Although the AUDUSD traded back to its highest level since late-September, an Inverted Hammer is forming on the daily chart at key resistance, suggesting a near-term dip is possible; confirmation tomorrow is required. Support is close by at 1.0330/50 (20-EMA, 50-EMA, 100-DMA, 200-DMA) and 1.0310/05 (ascending trendline off of June 1 and October 23 lows). Resistance is at 1.0405/50 (former swing highs and lows, October high) and 1.0500/15.

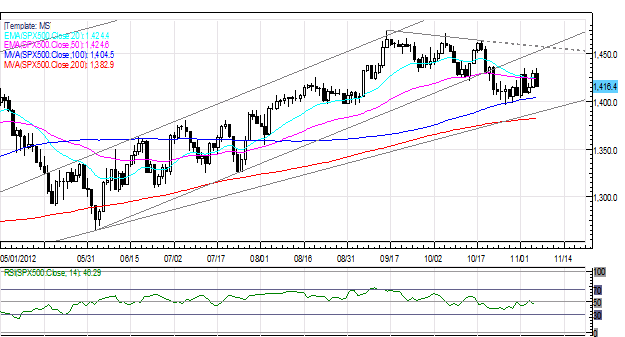

S&P 500: Nothing has changed: “A short-term top is potentially in place after support at 1420/25 (the 61.8% Fibo retracement on June 2012 low to September 2012 high, ascending trendline off of the June 4 and July 24 lows) broke [on October 23] following tests on three occasions the past two weeks.” Targets near 1355 would come into focus if price breaks below the monthly S1 at 1399. Support comes in at 1396/1400 (100-DMA), 1382 (200-DMA), and 1350/55 (monthly S2, ascending channel support off of November 2011 and June 2012 lows). Resistance comes in at 1425 (20-EMA, 50-EMA), 1460, 1470, and 1498/1504.

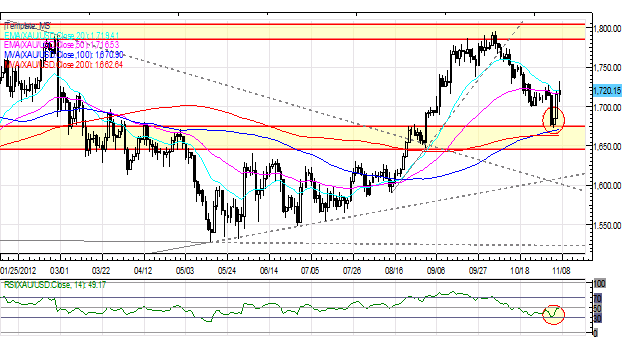

GOLD: Gold has rebounded to fresh November highs and is back above 1715; my bias is back to neutral and increasingly bullish. I still expect the 1700 area to be defended vigorously, and look to get long as low as 1680. Resistance is 1700, 1715, 1735, 1755/58 and 1785/1805. Support is 1680 and 1660/70 (100-DMA, 200-DMA).

--- Written by Christopher Vecchio, Currency Analyst

To contact Christopher Vecchio, e-mail cvecchio@dailyfx.com

Follow him on Twitter at @CVecchioFX

To be added to Christopher’s e-mail distribution list, please fill out this form

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance