Forex: GBPUSD- Trading the U.K. Consumer Price Report

Trading the News: U.K. Consumer Price Index

What’s Expected:

Time of release: 12/18/2012 9:30 GMT, 4:30 EST

Primary Pair Impact: GBPUSD

Expected: 2.7%

Previous: 2.7%

DailyFX Forecast: 2.7% to 2.8%

Why Is This Event Important:

Although the headline reading for U.K. inflation is expected to hold steady at 2.7%, the core rate is expected to tick higher in November, and heightening price pressures may spark a bullish reaction in the British Pound as it dampens speculation for additional monetary support. Indeed, it seems as though the Bank of England (BoE) is slowing moving away from its easing cycle as the central bank sees price growth holding above the 2% target over the next two-years, and we may see the Monetary Policy Committee adopt a more neutral tone in 2013 as the region emerges from the double-dip recession.

Recent Economic Developments

The Upside

Release | Expected | Actual |

Jobless Claims Change (NOV) | 7.0K | -3.0K |

BoE/GfK Inflation 12-Month Expectations (NOV) | -- | 3.5% |

GfK Consumer Confidence Survey (NOV) | -30 | -22 |

The Downside

Release | Expected | Actual |

Average Weekly Earnings ex-Bonus (3MoY) (OCT) | 1.9% | 1.7% |

Net Consumer Credit (OCT) | 0.3B | -0.5B |

Retail Sales ex Auto Fuel (MoM) (OCT) | -0.1% | -0.7% |

The uptick in inflation expectations along with the improvement in consumer confidence may encourage businesses to prop up consumer prices, and a faster rate of inflation may heighten the appeal of the sterling as it dampens the BoE’s scope to expand the balance sheet further. However, the slowdown in wage growth paired with the recent weakness in private sector consumption may drag on the CPI, and easing price pressures may drag on the exchange rate as market participants maintain bets for more QE.

Potential Price Targets For The Release

The GBPUSD looks poised to threaten the September high (1.6308) as the pair clears the 23.6% Fibonacci retracement from the 2009 low to high (1.6200), and the bullish sentiment surrounding the British Pound may get carried into the following year as the BoE drops its dovish tone for monetary policy. Although we’re seeing the relative strength index approach overbought territory, the upward trend in the oscillator should carry the exchange rate higher ahead of the meeting minutes as we anticipate the central bank to sound more hawkish this time around.

Forecasts for a faster rate of inflation certainly instills a bullish outlook for the sterling, and the market reaction may pave the way for a long British Pound trade as currency traders scale back bets for additional monetary support. As a result, if we see an uptick in either the headline or core reading for inflation, we will need a green, five-minute candle following the print to generate a buy entry on two-lots of GBPUSD. Once these conditions are met, we will set the initial stop at the nearby swing low or a reasonable distance from the entry, and this risk will establish our first objective. The second target will be based on discretion, and we will move the stop on the second lot to cost once the first trade hits its mark in order to lock-in our gains.

In contrast, the ongoing slack in private sector activity along with slowing wage growth may drag on inflation, and a weak CPU print may dampen the appeal of the sterling as market participants still see scope for more QE. As a result, if price pressures falter in November, we will implement the same strategy for a short pound-dollar trade as the long position laid out above, just in the opposite direction.

Impact that the U.K. Consumer Price report has had on GBP during the last month

Period | Data Released | Estimate | Actual | Pips Change (1 Hour post event ) | Pips Change (End of Day post event) |

OCT 2012 | 11/13/2012 9:30 GMT | 2.4% | 2.7% | +8 | -16 |

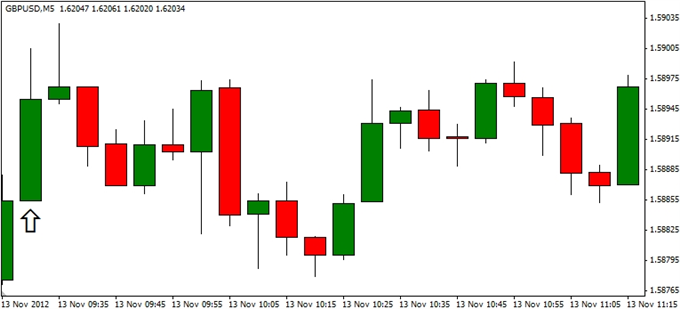

October 2012 U.K. Consumer Price Index

Consumer prices in the U.K. advanced 2.7% in October after expanding 2.2% the month prior, while the core rate of inflation climbed to 2.6% during the same period to mark the fastest pace of growth since January. The higher-than-expected inflation print propped up the British Pound, with the GBPUSD climbing above the 1.5900 figure, but we saw the sterling consolidate throughout the day as the pair closed at 1.5869.

--- Written by David Song, Currency Analyst

To contact David, e-mail dsong@dailyfx.com.

Follow me on Twitter at @DavidJSong

To be added to David's e-mail distribution list, please follow this link.

New to FX? Watch this Video

Questions? Comments? Join us in the DailyFX Forum

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance