Forex: Further Signs of Yen Reversal Ahead of BoJ; Euro Lifted by Nowotny

ASIA/EUROPE FOREX NEWS WRAP

The Japanese Yen continues to claw back its recent losses across the board, so much so that it is on the verge of shedding title of worst performing currency year to date, ceding that title to the British Pound or the Swiss Franc should the Yen market continue to firm. With additional hawkish rhetoric from the government out today – intended to sterilize the effects of the ultra-dovish commentary from Japanese Prime Minister Shinzo Abe – the Yen might be setting the stage for a reversal ahead of the January 22 meeting.

With the Bank of Japan set to replace the Federal Reserve as the liquidity pump for the market, a lot of attention has been brought about to this notion of “currency wars,” a term first coined by Brazilian Finance Minister Guido Mantega in September 2010. The gist: in an attempt to help their economies gain a competitive edge, the major central banks have embarked on a policy path that is directly aimed at devaluing their currencies. This is easily confirmed by comments from various central bankers the past few years, including Fed Chairman Ben Bernanke, who has suggested that a weak US Dollar would be beneficial for the economy; it is of no coincidence that the Fed has undertaken policies that reduce Treasury yields, and thus, the appeal of the US Dollar.

European policymakers have joined the conversation the past few days, with Jean-Claude Juncker, head of the group of Euro-zone finance ministers, saying yesterday that the Euro’s value was “extremely high,” leading to a decline in late trading Tuesday. But today, European Central Bank policymaker Ewald Nowotny said that he doesn’t find the Euro’s value to be of concern in the short-term (which has proved bullish today), but that he doesn’t anticipate it rising over the long-term. Bottom line: don’t expect the ECB to sit back and allow the Euro to appreciate.

Taking a look at European credit, peripheral yields are barely moved, offering neither support nor resistance to further Euro bullishness. The Italian 2-year note yield has decreased to 1.360% (-0.1-bps) while the Spanish 2-year note yield has decreased to 2.411% (-1.1-bps). On the contrary, the Italian 10-year note yield has increased to 4.210% (+0.4-bps) while the Spanish 10-year note yield has increased to 5.060% (+12.0-bps); higher yields imply lower prices.

RELATIVE PERFORMANCE (versus USD): 11:15 GMT

JPY: +0.62%

CHF: +0.32%

EUR: +0.11%

NZD:+0.04

AUD:-0.07%

GBP:-0.09%

CAD:-0.11%

Dow Jones FXCM Dollar Index (Ticker: USDOLLAR): -0.15% (-0.61% past 5-days)

ECONOMIC CALENDAR

See the DailyFX Economic Calendar for a full list, timetable, and consensus forecasts for upcoming economic indicators.

TECHNICAL ANALYSIS OUTLOOK

EURUSD: No change, though the bearish candle yesterday would ideally see follow through on a close below 1.3280: “The pair has continued higher, cutting through the May 2012 high at 1.3280 and running into the next leg up, the March 2012 high at 1.3380/85. Last week I said: “the RSI downtrend on the daily chart has been broken, despite price holding below the May/December highs at 1.3280/3310. Coincidentally, focus is on buying dips.” This remains to be the case even as price has started to catch up to momentum. Support comes in 1.3280/3310, 1.3120/45, 1.3080/85 (50-EMA), and 1.3000 (January low). Resistance is 1.3380/85 (mid-March swing high) and 1.3485 (late-February swing high).”

USDJPY: No change: “The pair’s rally has continued to its highest level since June 2010, essentially leaving the door open for a run above 90.00. Given BoJ policy, any dips seen in the USDJPY are viewed as constructive for further bullish price action (though I would like to clarify that this view is only valid until the BoJ meeting on January 22; the market remains very net-short the JPY, so a near-term top marked by an event seems possible (think the US Dollar bottoming the day after QE3 was announced)). Resistance comes at 89.10/35 (daily high, weekly R1) and 90.10/15 (monthly R2). Support comes in at 88.40 (monthly R1) and 87.00/40 (weekly pivot).”

GBPUSD: No change: “The pair has fallen back from 1.6300, again, though with no follow through yet, my levels remain the same (they haven’t changed since early-December). However, the pair is now coming into ascending TL support off of the July and November lows at 1.6000. Support is there and 1.5900 (200-DMA). Resistance comes in at 1.6085/90 (50-EMA), 1.6180, and 1.6300/10 (post-QE3 announcement high in mid-September).” It should be added that a break below 1.6000 could accelerate through the 200-DMA towards the most recent swing low, at 1.5820/25 set in mid-November.

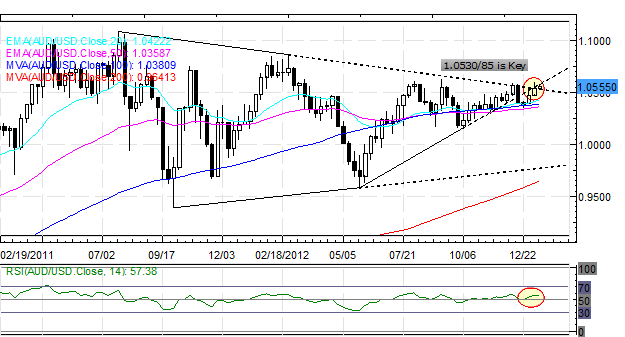

AUDUSD:No change: “The pair has broken the December highs and a break signals a push towards 1.0605/25. However, it’s worth noting that the daily RSI hasn’t pushed into overbought territory on any rally since February 2012. Accordingly, we’ll either see a move to new highs and with RSI confirming the breakout; or further consolidation/pullback is in order before the next leg higher. Support is at 1.0530/50 (weekly pivot, monthly R1), 1.0465/70 (weekly S1), and 1.0400/05 (weekly S2). Resistance is 1.0530/85 and 1.0605/25 (August and September highs).”

S&P 500: For the past several weeks I’ve maintained: “The S&P 500is back above a very significant zone of 1445/50 (descending trendline off of September and October highs, 100% Fibonacci extension off of the November 16 low, the November 23 high, and the November 28 low extension), and a move higher necessarily points to 1470/75.” With these levels to the upside breaking, a move above the September highs points to resistance at 1500 and 1520/25 (December 2007 high); a Bull Flag is potentially forming on lower timeframes (1H, 4H). Support comes in at 1450/55, 1425, 1400, and 1390 (200-DMA).

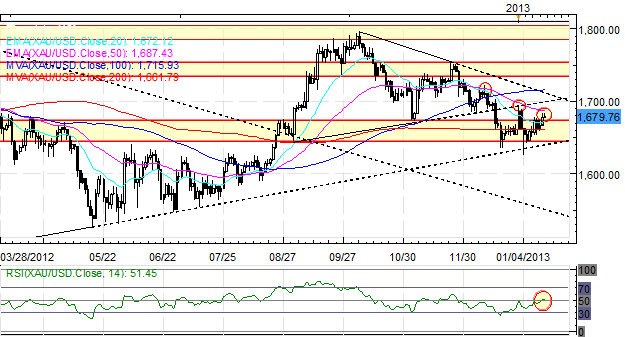

GOLD: No change: “Gold is at a make or break level right now, former Symmetrical Triangle support at 1630/40, and its lowest level since August, before the ECB and the Fed’s QE intervention hopes took hold. Additionally, when considering the move off of the September highs, a measured A-B=C-D (as expressed on the Daily) suggests that a bottom could be in place at these levels as well. Support is there at 1580. Resistance is 1690/95, 1735, 1755, and 1785/1805.”

--- Written by Christopher Vecchio, Currency Analyst

To contact Christopher Vecchio, e-mail cvecchio@dailyfx.com

Follow him on Twitter at @CVecchioFX

To be added to Christopher’s e-mail distribution list, please fill out this form

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance