Forex: Euro Rally Continues as European, US Fiscal Cliff Sentiment Improves

ASIA/EUROPE FOREX NEWS WRAP

Despite weakness in high beta currencies, risk-correlated assets on the whole are performing nicely today, as investors dump safe haven assets amid improving sentiment in Europe and the United States. The Euro takes the title of top performer this morning, with the EUR/USD rallying back towards 1.3000, as investors are exhibiting behavior that would suggest uneasiness about the sovereign debt crisis is fading: just take a look at Italian and Spanish bond yields (see below). The relative outperformance by the Euro to its peers, and by European equity markets likewise, is of little surprise then; bonds diverged the past few days, and considering they tend to lead, today could be a period of recoupling.

Perhaps the starkest change in sentiment comes from the United States, where just one day after Senate Majority Leader Harry Reid, a pro-tax hike Democrat, called the lack of progress made the past twelve days on the fiscal cliff/slope or so “discouraging,” House of Representatives Speaker John Boehner, an anti-tax hike Republican, said that a budget agreement could be reached “sooner rather than later.” This piggybacks off of the comments made by President Barack Obama yesterday, which said that a deal could be reached to avoid the $607 billion of tax hikes and spending cuts due to hit in 1Q’13.

While businesses may not like the outcome, which will more or less target wealthier Americans and raise taxes on higher income earnings, it will provide some certainty as to the tax structure for the coming fiscal year. That in and of itself will spur more risk taking; hence, we’ve seen risk-correlated assets such as the S&P 500 rally quite sharply the past few days. Furthermore, a solidified plan would reduce credit risk to the US Dollar, perhaps explaining why the commodity currencies and precious metals are struggling.

Taking a look at European credit, peripheral bond yields are mixed but mostly lower, but perhaps the Euro and European equity markets are playing catch up for the past few days. The Italian 2-year note yield has increased to 1.839% (+2.2-bps) while the Spanish 2-year note yield has decreased to 2.623% (-2.5-bps). Likewise, the Italian 10-year note yield has decreased to 4.524% (-5.4-bps) while the Spanish 10-year note yield has decreased to 5.249% (-5.2-bps); lower yields imply higher prices.

RELATIVE PERFORMANCE (versus USD): 13:00 GMT

EUR: +0.31%

CHF: +0.27%

NZD:+0.15%

GBP:+0.08%

CAD:+0.07%

JPY: -0.06%

AUD:-0.17%

Dow Jones FXCM Dollar Index (Ticker: USDOLLAR): -0.04% (-0.60% past 5-days)

ECONOMIC CALENDAR

See the DailyFX Economic Calendar for a full list, timetable, and consensus forecasts for upcoming economic indicators.

TECHNICAL ANALYSIS OUTLOOK

EUR/USD: A daily Hammer yesterday has the pair on the cusp of 1.3000 again, but my bias remains neutral, awaiting resolution of 1.3010/20 to the upside and 1.2800/40 to the downside. Below, support comes in at 1.2740/45. Above, resistance is 1.3140/45.

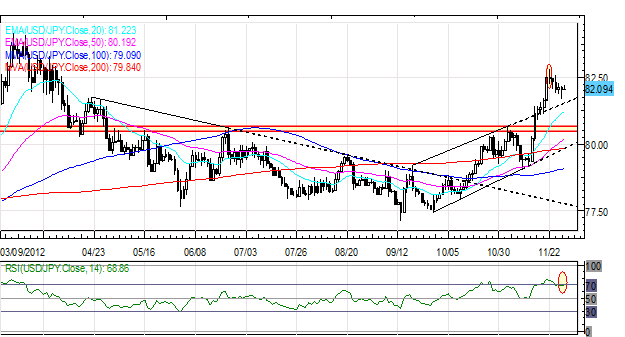

USD/JPY: No change from Monday: “While the Evening Star candle cluster has failed to materialize, the Doji / Shooting Star candle on Wednesday, when considered alongside the daily RSI starting to contract from its already-overbought levels, the USD/JPY looks near-term bearish. Support comes in at 81.75, 81.15, and 80.50/70 (former November high). Resistance is 82.90/83.00 and 83.30/55.”

GBP/USD: A daily Hammer yesterday and the GBP/USD is back testing long-term trendline resistance at 1.6035/55 (descending trendline resistance off of the April 2011 and April 2012 highs), a point of failure on Tuesday. A break of this level coincides with a tentative break of a downtrend that’s been in place for the past two months. Resistance comes in at 1.6170/80 (late-October highs). Support is 1.5980/90 (20-EMA, 50-EMA), 1.5910/15 (100-DMA), and 1.5855/60 (200-DMA).

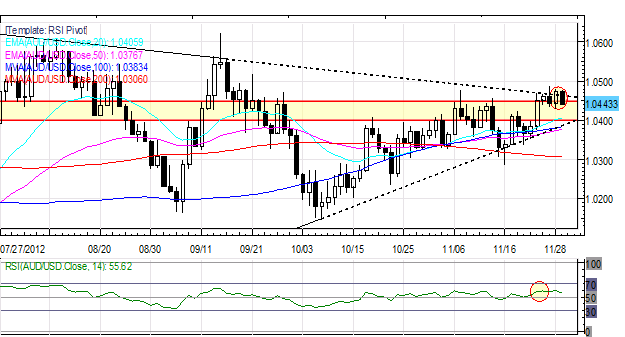

AUD/USD: No change from yesterday: “As the pair has traded towards its Symmetrical Triangle termination point, and appears to be making a move to the upside; when considered in the big picture, the current pause witnessed the past year or so may be viewed as a consolidation. Support is at 1.0370/1.0405 (trendline support off of the June 1 and October 23 lows) and 1.0235/80. Resistance is 1.0475/80 (November high) and 1.0500/15.”

S&P 500: The past view days I’ve maintained: “The rally off of the 61.8 Fibonacci retracement (June 2012 low to September 2012 high) has carried the S&P 500 back into a confluence of resistance at 1400/10 (20-EMA, 50-EMA, 100-EMA). A breakout above this area would suggest a more substantial rebound may yet be ahead.” Indeed, with price trading through following yesterday’s daily Hammer, targets higher are eyed at 1425 and 1460. Support comes in at 1385 (200-DMA, held yesterday) and 1345/50 (November low).

GOLD: No change: “Fresh November highs are in place after Friday’s rally, and with the US fiscal cliff/slope negotiations grinding slower, there may be some upside yet. I still expect the 1700 area to be defended vigorously on declines, and will continue to look to get long as low as 1675. Resistance is 1755/58 and 1785/1805. Support is 1735, 1700, 1690/95 (100-DMA, November low), and 1660/65 (200-DMA).”

--- Written by Christopher Vecchio, Currency Analyst

To contact Christopher Vecchio, e-mail cvecchio@dailyfx.com

Follow him on Twitter at @CVecchioFX

To be added to Christopher’s e-mail distribution list, please fill out this form

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance