Forex: Euro Maintains Rebound; Yen Back to Recent Lows After October CPI

ASIA/EUROPE FOREX NEWS WRAP

High beta currencies and risk-correlated assets are treading water this morning as the month comes to a close, often a day of profit taking and book rebalancing that results in volatility and some less certain trading conditions. But perhaps the most uncertainty in the market right now isn’t out of Europe or the United States: Japan’s economic and political climate is creating a hostile trading environment for the Japanese Yen.

While the Euro is up above 1.3000 again versus the US Dollar on the back of a +0.22% performance today, the big mover is the Japanese Yen, which has fallen by -0.68% against the greenback. The currency market’s second reserve currency has fallen by nearly -5% since its November highs (weighted against the Australian Dollar, the Euro, the New Zealand Dollar, and the US Dollar), and more downside is likely given recent data and political grandstanding ahead of snap elections in mid-December.

The October Consumer Price Index showed that year-over-year inflation pressures were unchanged, bolstering Japanese opposition leader, and likely next Prime Minister of Japan, Shinzo Abe’s stance that the Bank of Japan needs to undertake an unlimited easing approach, in order to boost growth and bring inflation back to the BoJ’s medium-term target of +1.0%. Although current PM and former BoJ Governor Hiroshiko Noda has promised to step up efforts to boost the economy, Mr. Abe is currently leading in polls, making long-term prospects for Yen strength – even amid global risk-aversion – less and less likely.

Taking a look at European credit, peripheral bond yields are mixed but mostly higher, perhaps some profit taking as the Euro remains elevated. The Italian 2-year note yield has increased to 1.957% (+6.5-bps) while the Spanish 2-year note yield has increased to 2.841% (+12.4-bps). Similarly, the Italian 10-year note yield has decreased to 4.537% (-0.9-bps) while the Spanish 10-year note yield has increased to 5.367% (+6.4-bps); higher yields imply lower prices.

RELATIVE PERFORMANCE (versus USD): 11:55 GMT

EUR: +0.22%

CHF: +0.13%

GBP:+0.07%

CAD:-0.02%

AUD:-0.10%

NZD: -0.22%

JPY:-0.68%

Dow Jones FXCM Dollar Index (Ticker: USDOLLAR): +0.06% (+0.06% past 5-days)

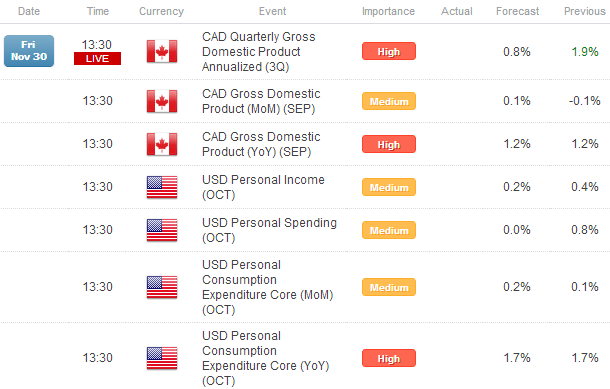

ECONOMIC CALENDAR

See the DailyFX Economic Calendar for a full list, timetable, and consensus forecasts for upcoming economic indicators.

TECHNICAL ANALYSIS OUTLOOK

EUR/USD: No change: “A daily Hammer [on Wednesday] has the pair on the cusp of 1.3000 again, but my bias remains neutral, awaiting resolution of 1.3010/20 to the upside and 1.2800/40 to the downside. Below, support comes in at 1.2740/45. Above, resistance is 1.3140/45.”

USD/JPY:Failure of the Evening Star candle cluster (bearish reversal pattern) resulted in only minor downside pressure (as expected), but now the pair is trading back towards its highest levels since April. Signs of progress on the US fiscal cliff/slope will remove credit risk from the USD-side of the pair, which is bullish for the USD/JPY, while continued political tensions in Japan and threats of unlimited Bank of Japan easing have heightened both central bank risk and political risk to the JPY-side of the pair, which is bullish for the USD/JPY. Accordingly, with fundamentals and technical aligning neatly, support comes in at 81.75, 81.15, and 80.50/70 (former November high), while resistance is 82.90/83.00 and 83.30/55.

GBP/USD: A daily Hammer on Wednesday alongside continuation on Thursday, and the GBP/USD is back above long-term trendline resistance at 1.6035/55 (descending trendline resistance off of the April 2011 and April 2012 highs), a point of failure on Tuesday. A break of this level also coincides with a tentative break of a downtrend that’s been in place for the past two months. Resistance comes in at 1.6170/80 (late-October highs). Support is 1.5980/90 (20-EMA, 50-EMA), 1.5915/20 (100-DMA), and 1.5855/60 (200-DMA).

AUD/USD: No change from Wednesday: “As the pair has traded towards its Symmetrical Triangle termination point, and appears to be making a move to the upside; when considered in the big picture, the current pause witnessed the past year or so may be viewed as a consolidation. Support is at 1.0370/1.0405 (trendline support off of the June 1 and October 23 lows) and 1.0235/80. Resistance is 1.0475/80 (November high) and 1.0500/15.”

S&P 500: The view the past few days I’ve maintained: “The rally off of the 61.8 Fibonacci retracement (June 2012 low to September 2012 high) has carried the S&P 500 back into a confluence of resistance at 1400/10 (20-EMA, 50-EMA, 100-EMA). A breakout above this area would suggest a more substantial rebound may yet be ahead.” Indeed, with price trading through following Wednesday’s daily Hammer, targets higher are eyed at 1425 and 1460. Support comes in at 1385 (200-DMA, held yesterday) and 1345/50 (November low).

GOLD: No change as Gold remains range-bound since the US elections: “Fresh November highs are in place after Friday’s rally, and with the US fiscal cliff/slope negotiations grinding slower, there may be some upside yet. I still expect the 1700 area to be defended vigorously on declines, and will continue to look to get long as low as 1675. Resistance is 1755/58 and 1785/1805. Support is 1735, 1700, 1690/95 (100-DMA, November low), and 1660/65 (200-DMA).”

--- Written by Christopher Vecchio, Currency Analyst

To contact Christopher Vecchio, e-mail cvecchio@dailyfx.com

Follow him on Twitter at @CVecchioFX

To be added to Christopher’s e-mail distribution list, please fill out this form

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance