Forex: Euro Fails to Maintain Gains After Greek Deal; AUD, NZD Lead

ASIA/EUROPE FOREX NEWS WRAP

The Australian, Canadian, and New Zealand Dollars are the top performers of today’s session thus far as global risk appetite has been momentarily boosted by a positive outcome to the Greek debt negotiations. After failing to reach a compromise last week, Euro-zone finance ministers were able to agree upon reducing Greece’s debt burden by more than €40 billion, which would cut the country’s debt-to-GDP ratio to 124% by 2020; it is slated to hit 190% in 2014.

While the EUR/USD traded back towards its early-November high of 1.3010 (ultimately topping at 1.3008 on the session), demand for European currencies has been somewhat muted this morning, as the Euro has shed its post-Greek deal gains rather quickly. Curiously, Italian and especially Spanish bond yields have improved while equity markets have fallen back – this is not a typical shakeout.

Our belief is that equity markets are always “late to the party,” meaning that their move is regarded as the least significant when cross-market analysis is considered: with FX markets stable if not suggesting increased demand for high beta currencies; and peripheral bond markets improving (lower yields), it appears that the broad market has ‘bought’ the Greek debt deal (specific figures below).

Elsewhere, it is worth noting that US Congressional leaders finally return to Washington, D.C. today to resume fiscal cliff/slope negotiations after what has essentially been an eleven day holiday. Volatility in precious metals and the USD/JPY could increase during the upcoming US sessions as a result.

Taking a look at European credit, peripheral bond yields are barely lower, decoupling from slight weakness in the Euro and European equity markets. The Italian 2-year note yield has decreased to 1.941% (-1.3-bps) while the Spanish 2-year note yield has decreased to 2.858% (-7.9-bps). Likewise, the Italian 10-year note yield has decreased to 4.734% (-0.8-bps) while the Spanish 10-year note yield has decreased to 5.525% (-5.9-bps); lower yields imply higher prices.

RELATIVE PERFORMANCE (versus USD): 12:50 GMT

NZD: +0.18%

CAD:+0.17%

AUD:+0.14%

GBP:+0.04%

EUR: -0.05%

CHF:-0.13%

JPY: -0.13%

Dow Jones FXCM Dollar Index (Ticker: USDOLLAR): +0.02% (-0.53% past 5-days)

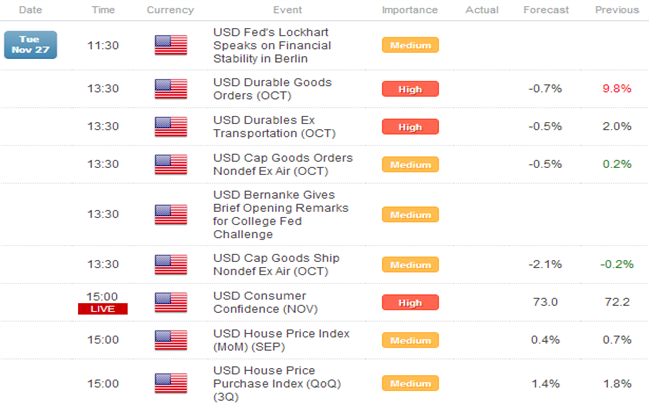

ECONOMIC CALENDAR

See the DailyFX Economic Calendar for a full list, timetable, and consensus forecasts for upcoming economic indicators.

TECHNICAL ANALYSIS OUTLOOK

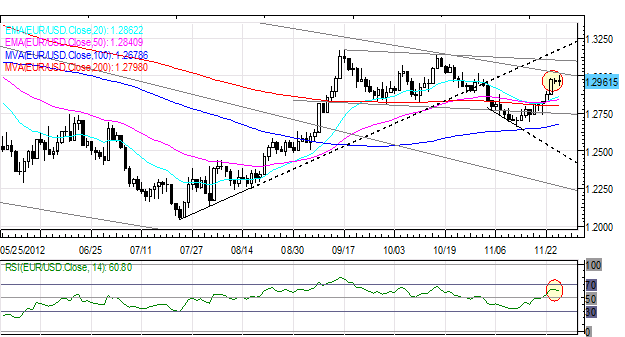

EUR/USD: The pair is slightly lower today but not before testing its November high near 1.3010, after breaking the confluence of resistance at 1.2800/40 (20-EMA, 50-EMA, 100-DMA, early-November high, mid-October swing low) last week. My bias is neutral and awaiting resolution of 1.3010/20 to the upside and 1.2800/40 to the downside. Below, support comes in at 1.2740/45. Above, resistance is 1.3140/45.

USD/JPY: No change from yesterday: “While the Evening Star candle cluster has failed to materialize, the Doji / Shooting Star candle on Wednesday, when considered alongside the daily RSI starting to contract from its already-overbought levels, the USD/JPY looks near-term bearish. Support comes in at 81.75, 81.15, and 80.50/70 (former November high). Resistance is 82.90/83.00 and 83.30/55.”

GBP/USD: No change from yesterday: “Friday’s advance has brought the GBP/USD back into long-term trendline resistance, at 1.6035/55 (descending trendline resistance off of the April 2011 and April 2012 highs). This coincides with a potential break of the downtrend that’s been in place for the past two months, though a retest of former resistance at 1.5975 and ensuing bounce would strengthen the case for a run back towards 1.6300. Resistance comes in at 1.6170/80 (late-October highs). Support is 1.5965/75 (20-EMA, 50-EMA), 1.5895/1.5900 (100-DMA), and 1.5850/55 (200-DMA).”

AUD/USD: As the pair has traded towards its Symmetrical Triangle termination point, and appears to be making a move to the upside; when considered in the big picture, the current pause witnessed the past year or so may be viewed as a consolidation. Support is at 1.0365/85 (trendline support off of the June 1 and October 23 lows) and 1.0235/80. Resistance is 1.0475/80 (breaking now) (November high) and 1.0500/15. Support is 1.0450, 1.0370/1.0405.

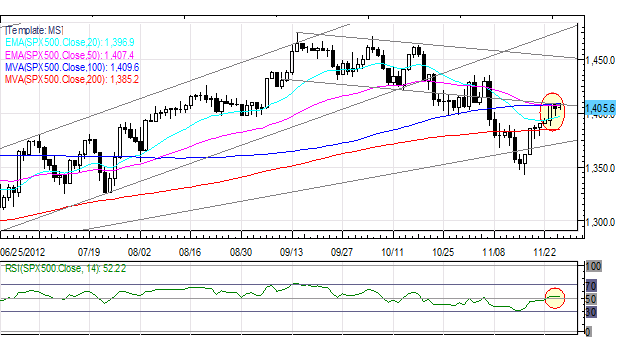

S&P 500: No change: “The rally off of the 61.8 Fibonacci retracement (June 2012 low to September 2012 high) has carried the S&P 500 back into a confluence of resistance at 1400/10 (20-EMA, 50-EMA, 100-EMA). A breakout above this area would suggest a more substantial rebound may yet be ahead. Support comes in at 1385 (200-DMA) and 1345/50 (November low). Resistance comes in at 1425 and 1460.”

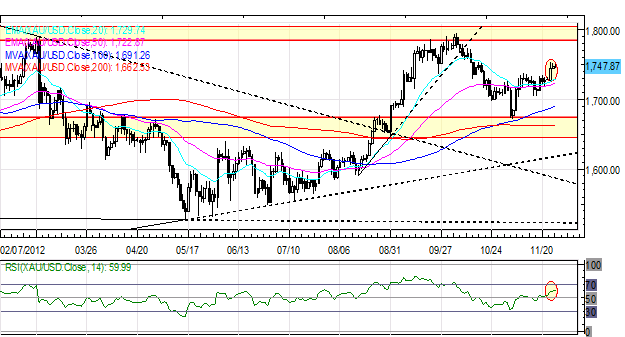

GOLD: No change: “Fresh November highs are in place after Friday’s rally, and with the US fiscal cliff/slope negotiations grinding slower, there may be some upside yet. I still expect the 1700 area to be defended vigorously on declines, and will continue to look to get long as low as 1675. Resistance is 1755/58 and 1785/1805. Support is 1735, 1700, 1685/90 (100-DMA, November low), and 1660/65 (200-DMA).”

--- Written by Christopher Vecchio, Currency Analyst

To contact Christopher Vecchio, e-mail cvecchio@dailyfx.com

Follow him on Twitter at @CVecchioFX

To be added to Christopher’s e-mail distribution list, please fill out this form

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance