Forex: Euro Continues to Outperform; Investors Wait on BoJ for Next Yen Move

ASIA/EUROPE FOREX NEWS WRAP

After a tremendous amount of excitement in FX markets the past few days, trading conditions are already starting to settle down ahead of the week-long holiday, beginning next Monday. Typically, during the last week of the year, most traders step away from their desks to spend time on holiday; and this leads to substantial drop in volume and market participation rates.

But for now, despite this light news flow that has allowed the S&P 500 to trade back towards its December highs in the overnight, some significant headline risk remains on the horizon.

To start, the Bank of Japan has started its two day policy meeting that is expected to result in substantially more accommodative policy. In fact, newly elected Japanese Prime Minister Shinzo Abe has reportedly told BoJ Governor Masaaki Shirakawa that he wants a +2% yearly inflation target, in what would amount to doubling of the target and even a greater multiplier of quantitative easing. Needless to say, if the BoJ decides to fall in line behind the new prime minister, it will become a fiscal policy tool; and investors might immediately revert to their old ways and shed the Yen, if the threat of intervention becomes tangible.

The other major story affecting FX markets is the fiscal cliff/slope. Certainly, given the performance of high beta currencies and risk-correlated assets the past few weeks, one would be led to believe that a deal may be around the corner – risk-aversion is absent. President Barack Obama’s (D) new plan would raise $1.2 trillion in new revenue (hike taxes above those making $400K per year) and would cut $1.22 trillion in spending, initial reports suggest. Speaker of the House John Boehner (R-OH) would prefer to raise taxes only on those making $1 million or more per year; but a concession of some demands by both sides shows that an amicable resolution is getting closer.

Elsewhere, taking a look at European credit, bond yields are slightly lower, helping boost the Euro marginally. The Italian 2-year note yield has decreased to 1.930 % (-3.4-bps) while the Spanish 2-year note yield has decreased to 2.783% (-4.8-bps). Likewise, the Italian 10-year note yield has decreased to 4.473% (-8.0-bps) while the Spanish 10-year note yield has decreased to 5.322% (-7.3-bps); lower yields imply higher prices.

RELATIVE PERFORMANCE (versus USD): 11:40 GMT

CHF: +0.12%

EUR: +0.11%

JPY: +0.06%

GBP:+0.26%

CAD:-0.12%

AUD:-0.26%

NZD:-0.41%

Dow Jones FXCM Dollar Index (Ticker: USDOLLAR): 0.00% (-0.07% past 5-days)

ECONOMIC CALENDAR

There are no important data on the docket to be released during the US trading session on Tuesday.

See the DailyFX Economic Calendar for a full list, timetable, and consensus forecasts for upcoming economic indicators.

TECHNICAL ANALYSIS OUTLOOK

EURUSD: No change: “Price action Friday led to an enormous breakout in the US session, bucking recent conventional wisdom that afternoon US trading sessions at the end of the week tend to be bland. The same descending trendline off of the September and October highs which served as resistance throughout December broke, allowing for a quick move up towards the post-QE3 September high at 1.3170/75. Now, support is 1.3145, 1.3075/90, and 1.3010/30. Resistance is 1.3170/75 (breaking now) and 1.3280/85 (May high).”

USDJPY: No change: “The Bull Flag on the daily broke on Thursday above 82.90; and the pair peaked near the mid-March highs above 84.00. As noted last week, ‘With the Fed out of the way, the Yen’s fundamentals could help lift this pair higher.’ Now, with the USDJPY at significant resistance and the Japanese elections done, some sideways if not bearish price action could result. Support comes in at 83.30/55, 82.90/83.00, and 81.75.Resistance is 84.00/20 (March high).”

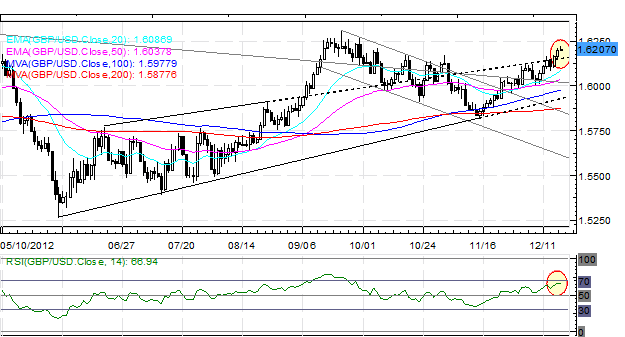

GBPUSD: No change: “Although the GBPUSD put in a reactionary high on Wednesday, it has since broken the mid-October/early-November highs. However, without 1.6300 touched, my levels remain the same. Resistance comes in at 1.6170/80 (breaking now) and 1.6300/10 (post-QE3 announcement high in mid-September). Support is 1.6085/90 (20-EMA), 1.6035/40 (50-EMA) and 1.5975/80 (100-DMA).”

AUDUSD:No change from Thursday: “The AUDUSD couldn’t break descending trendline resistance off of the July 2011 and February 2012 highs, which come in at 1.0550/55 today, but that doesn’t mean the uptrend is over just yet. With price holding just below the monthly R2 at 1.0570 and thelong-term Symmetrical Triangle starting to break to the upside, consolidation may be ahead the next few sessions. Support is at 1.0500/15, 1.0460, and 1.0235/80. Resistance is 1.0555/75 and 1.0605/25 (August and September highs).” Note: this is a weekly chart to highlight how close the AUDUSD to a potential breakout.

S&P 500: The S&P 500 is back at its December highs, but without the FX market following, as the index levels off in a previous zone of failure from 1435/40. Support comes in at 1425, 1400, 1389 (200-DMA) and 1345/50 (November low). A move higher through 1435/40 (descending trendline off of September and October highs, 100% Fibonacci extension off of the November 16 low, the November 23 high, and the November 28 low extension) points to 1450 and 1470/75.”

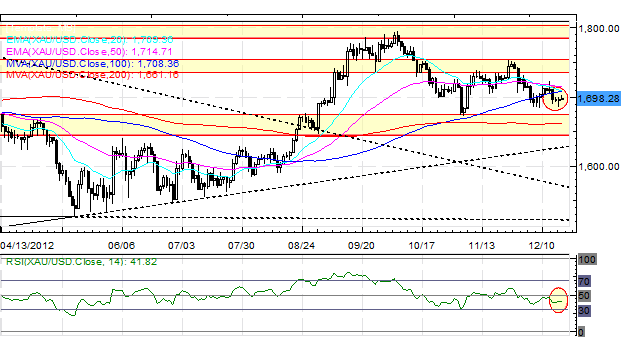

GOLD: No change from Thursday: “Gold has fallen back a bit as the US Dollar has rebounded in the face of another QE package. Now that Gold is back below 1700, I expect buying interest to resume; though it should be noted that December is historically a bad month for precious metals. I will continue to look to get long as low as 1675. Resistance is 1735, 1755/58 and 1785/1805. Support is 1700, 1670/75 (November low), and 1660/65 (200-DMA).”

--- Written by Christopher Vecchio, Currency Analyst

To contact Christopher Vecchio, e-mail cvecchio@dailyfx.com

Follow him on Twitter at @CVecchioFX

To be added to Christopher’s e-mail distribution list, please fill out this form

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance