Forex: Euro Concerns Persist, Japanese Yen Rebounds Despite Warning

ASIA/EUROPE FOREX NEWS WRAP

As the week winds down, it’s worth recapping to note that November has been decisively negative, with high beta currencies and risk-correlated assets, such as the Australian Dollar, Euro and S&P 500, losing ground in favor of safe havens such as US Treasuries and the US Dollar. In fact, the Dow Jones FXCM Dollar Index (Ticker: USDOLLAR) is now at its highest level since August 21.

Leading the pack on a negative day has been the Japanese Yen, which is of little surprise when considered in recent historical context, but following yesterday’s developments, the Yen’s rebound is a bit more curious. Yesterday, Shinzo Abe, the opposition leader who is ahead in polls and likely to win the Japanese snap election in mid-December, said that he would pressure the Bank of Japan to embark on an unlimited easing policy.

While I recognize that the market might be a little thin right now with respect to the Yen, i.e. there aren’t enough interested buyers at the current USDJPY level, it’s difficult to envision a scenario in which the Japanese Yen gains ground with Mr. Abe lurking, unless there are concerns circling around the US fiscal cliff. Speaking of which, there is news about the US fiscal cliff: President Barack Obama is meeting with Congressional leaders today to discuss ways to eliminate the sequester, by a few months or indefinitely with a formidable long-term plan.

However, based on price action today in the USDJPY and Gold, it appears that while fiscal cliff (I prefer slope, actually – it’s not like all of that economic activity will be lost on January 1; instead, the damages will come over the course of the quarter) concerns are prevalent, there are also European concerns in the picture.

Taking a look at credit, peripheral bond yields are barely moved, having little impact on the Euros. The Italian 2-year note yield has decreased to 2.231% (-0.8-bps) while the Spanish 2-year note yield has increased to 3.193 % (+0.2-bps). Similarly, the Italian 10-year note yield has decreased to 4.872% (-0.8-bps) while the Spanish 10-year note yield has decreased to 5.859% (-0.9-bps); lower yields imply higher prices.

RELATIVE PERFORMANCE (versus USD): 11:47 GMT

JPY: +0.01%

CAD:-0.10%

GBP:-0.10%

AUD:-0.18%

NZD: -0.20%

EUR:-0.38%

CHF: -0.40%

Dow Jones FXCM Dollar Index (Ticker: USDOLLAR): +0.18% (+0.80% past 5-days)

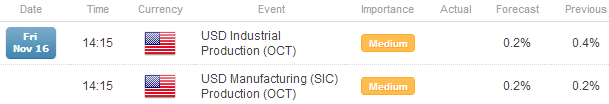

ECONOMIC CALENDAR

See the DailyFX Economic Calendar for a full list, timetable, and consensus forecasts for upcoming economic indicators.

TECHNICAL ANALYSIS OUTLOOK

EURUSD: The EURUSD has failed at its Friday high at 1.2785/90 and has since retraced all of yesterday’s gains. Thus, our levels remain unchanged. Support comes in at 1.2630/45 (100-DMA), and 1.2400/35. Resistance is 1.2750, 1.2800/05 (this week’s high), 1.2820/30 (mid-October swing low, 200-DMA), 1.2880/1.2900, and 1.3015/20 (late-October high).

USDJPY: No change from yesterday: “The USDJPY has moved to the top of trend resistance near 81.15 and has broken above our key 80.50/70 level, leaving the mid-April swing high at 81.75/80 as the next major resistance level. Support comes in at 80.50/70 (former November high) and 79.10/30.”

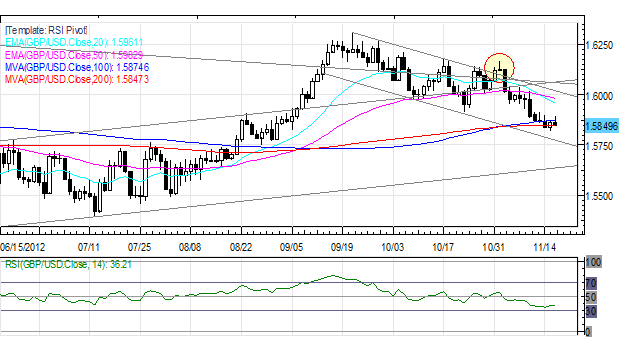

GBPUSD: No change from last Tuesday: “While the GBPUSD appeared to be moving to breakout of its recent downtrend, an Inverted Hammer on November 1 has biased the pair to the downside. For now, we are neutral if not looking lower.” Resistance comes in at 1.5910/15 (October low), 1.5970/90 (20-EMA, 50-EMA) and 1.6170/80 (late-October highs). Support (breaking now) is 1.5845/50 (200-DMA) and 1.5800/05.

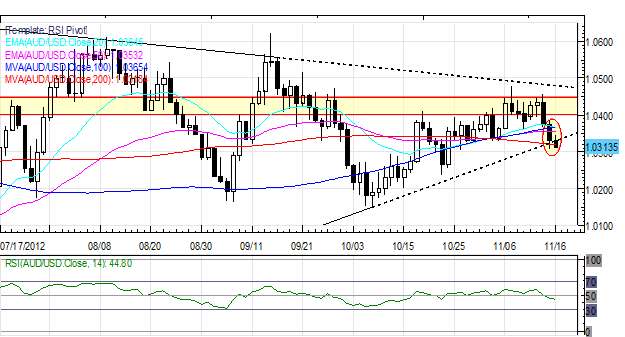

AUDUSD: The AUDUSD failed in the 1.0405/50 zone again on Wednesday, and is now threatening to break below trendline support off of the June 1 and October 23 lows at 1.0315/25. Support is there and 1.0235/80. Resistance is at 1.0355/70 (20-EMA, 50-EMA), 1.0405/50 (former swing highs and lows, October high) and 1.0500/15.

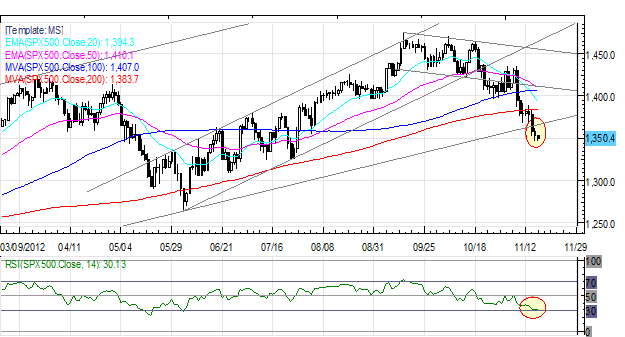

S&P 500: No change, although the S&P 500 is very close to crucial support: “Now the pullback is looking deeper: the ascending channel off of the October 4, 2011 and June 4, 2012 lows is breaking. Targets near 1355 are in focus now that price is below 1395.” Support comes in at 1350/65 (monthly S2, ascending channel support off of November 2011 and June 2012 lows). Resistance comes in at 1383 (200-DMA) and1400/15 (20-EMA, 50-EMA, 100-EMA). If there’s no rebound by the end of this week, a technical bounce could be seen given oversold conditions, but only viewed within the context of a corrective rebound before a bigger sell-off.

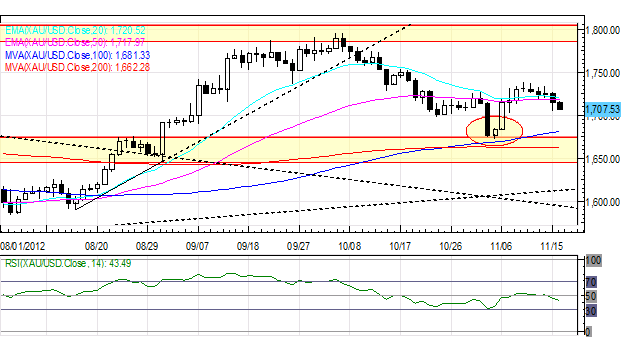

GOLD: Gold has consolidated just below its November highs, though considering that the US Dollar is at its strongest level in over two months, Gold is holding up well. As such, I still expect the 1700 area to be defended vigorously, and look to get long as low as 1675. Resistance is 1735, 1755/58 and 1785/1805. Support is 1700, 1675/80 (100-DMA, November low), and 1660/65 (200-DMA).

--- Written by Christopher Vecchio, Currency Analyst

To contact Christopher Vecchio, e-mail cvecchio@dailyfx.com

Follow him on Twitter at @CVecchioFX

To be added to Christopher’s e-mail distribution list, please fill out this form

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance