Forex: Euro Bounce Weak as Short-term Yields Rise on Italian Senate Vote

ASIA/EUROPE FOREX NEWS WRAP

High beta currencies and risk-correlated assets are slightly higher on the day as positive data out of both Asia and Europe has provided a bullish counterweight to ongoing concerns about the US fiscal cliff/slope, the main drag on investor sentiment at present time. The commodity currencies are leading to the upside, with the Australian Dollar benefiting from a superficially strong November labor market reading, and the New Zealand Dollar benefited from a slightly hawkish (relative to expectations) Reserve Bank of New Zealand. But the real story is what’s going on with the Euro.

Since 06:00 EST / 11:00 GMT, the Euro has been under pressure amid sharply rising Italian and Spanish (mainly Italian) bond yields, following a vote of confidence in the Italian senate that has given technocratic Prime Minister Mario Monti a very thin margin. In fact, the fate of the current government very much rests with the old government, considering that former Italian Prime Minister Silvio Berlusconi’s party has decided against partaking in the vote on current Prime Minister Monti’s economic reforms.

By choosing not to vote at all – with or against the Monti-government – Mr. Berlusconi’s party has essentially stepped to the edge of breaking majority without doing so. Needless to say, the prospect of having Silvio Berlusconi back in power following elections next year would not be panned as positive for the Euro. In fact, Mr. Berlusconi has made repeated calls to end austerity, a decision which would not please core Euro-zone countries like Germany.

Taking a look at European credit, peripheral bond yields are higher and rising, allowing for Euro weakness despite signs of appetite for riskier assets elsewhere. The Italian 2-year note yield has increased to 2.103% (+21.6-bps) while the Spanish 2-year note yield has increased to 2.988% (+13.1-bps). Likewise, the Italian 10-year note yield has increased to 4.588% (+15.5-bps) while the Spanish 10-year note yield has increased to 5.498% (+13.8-bps); higher yields imply lower prices.

RELATIVE PERFORMANCE (versus USD): 11:40 GMT

AUD: +0.30%

NZD: +0.25%

JPY: +0.08%

GBP:+0.06%

CAD:+0.03%

EUR:+0.01%

CHF:-0.06%

Dow Jones FXCM Dollar Index (Ticker: USDOLLAR): -0.13% (-0.37% past 5-days)

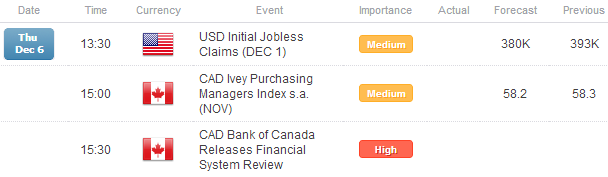

ECONOMIC CALENDAR

See the DailyFX Economic Calendar for a full list, timetable, and consensus forecasts for upcoming economic indicators.

TECHNICAL ANALYSIS OUTLOOK

EUR/USD: No change from Tuesday, although momentum is no longer overextended on shorter-term time frames: “With price breaking 1.3010/20, I am indeed bullish. However, with 1H, 4H, and daily RSI all at or nearing overbought levels as the pair trades into its weekly R2 at 1.3100 and comes close to 2H’12 highs, there is likely some resistance ahead, if not scope for a pullback.”. Resistance is 1.3140/45 and 1.3170/75. Support is 1.3010/20 and 1.2880.

USD/JPY: No change: “More range-bound price action as the pair fights diametrically opposite fundamental pressures (US fiscal cliff and Japanese elections), thus leaving my levels and outlook at neutral to bullish now. Support comes in at 81.75, 81.15, and 80.50/70 (former November high).Resistance is 82.90/83.00 and 83.30/55.”

GBP/USD: No change as the pair is working on three Dojis in a row: “Fresh December highs for the GBP/USD were set [on Tuesday] as the pair broke through long-term trendline resistance at 1.6030/45 (descending trendline resistance off of the April 2011 and April 2012 highs), a point of failure on Tuesday and Friday last week. A break of 1.60308/45 also coincides with a tentative break of a downtrend that’s been in place for the past two months, off of the September 21 high. Resistance comes in at 1.6170/80 (late-October highs) and 1.6300. Support is 1.6000/25 (20-EMA, 50-EMA), 1.5935/40 (100-DMA), and 1.5860/65 (200-DMA).

AUD/USD: The AUD/USD has started to poke out of its major technical pattern, though until 1.0500/15 is cleared, there’s little reason for excitement. My outlook is thus unchanged: “As the pair has traded towards its Symmetrical Triangle termination point, and appears to be making a move to the upside; when considered in the big picture, the current pause witnessed the past year or so may be viewed as a consolidation. Support is at 1.0435/45 (held today, weekly R1, trendline support off of the June 1 and October 23 lows) and 1.0235/80. Resistance is 1.0475/90 (November high) and 1.0500/15.”

S&P 500: No change: “Is the uptrend over? Although the rally off of the 61.8 Fibonacci retracement (June 2012 low to September 2012 high) carried the S&P 500 back into a confluence of resistance at 1400/10 (20-EMA, 50-EMA, 100-EMA), the measured move off of the low suggested a top at 1425 given the 61.8 Fibonacci extension off of the November 16 low, the November 23 high, and the November 28 low extension. Support comes in at 1386 (200-DMA) and 1345/50 (November low). A move higher eyes 1425, 1450, and 1460.”

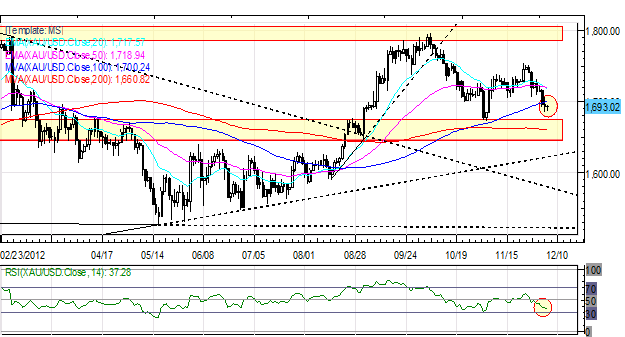

GOLD: No change: “Gold has fallen back off of its November and December highs near 1735, mainly on progress over the US fiscal cliff and demand for US Dollars amid the need to diversify away from the Japanese Yen. I still expect the 1700 area to be defended vigorously on declines, and will continue to look to get long as low as 1675. Resistance is 1735, 1755/58 and 1785/1805. Support is 1700 (breaking now), 1690/95 (100-DMA, November low), and 1660/65 (200-DMA).”

--- Written by Christopher Vecchio, Currency Analyst

To contact Christopher Vecchio, e-mail cvecchio@dailyfx.com

Follow him on Twitter at @CVecchioFX

To be added to Christopher’s e-mail distribution list, please fill out this form

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance