Forex: EUR/USD at May High Despite Fiscal Cliff Standoff

ASIA/EUROPE FOREX NEWS WRAP

Price action in the FX market is very evidently being driven by the European currencies, with the British Pound and the Euro continuing their recent bull run against the safe havens and the commodity currencies, despite several significant roadblocks appearing on the near-term horizon. For today, however, this looks less like a short covering rally but rather additional risk taking into yearend; and with the Federal Reserve easing and the Bank of Japan creeping towards a major stimulus package, central banks deserve a great deal of credit.

Regardless of how markets arrived at their current juncture, what’s important to consider is what the road ahead might be, as exuberance over a calming in Europe seems to be getting back towards those eye-rolling levels (when leaders start declaring that the crisis is over, it tends to rear its ugly head; as the EU’s Jean-Claude Juncker did on Friday by saying “we see light at the end of the tunnel,” hopefully that light isn’t an incoming train), and the US fiscal cliff situation is coming down to the wire.

With respect to the US fiscal cliff/slope, there appear to be two narratives that have formed: first, that President Barack Obama (D) and Speaker of the House John Boehner (R-OH) are finding more and more common ground at each meeting; and second, that those leaders behind the respective negotiators for both sides have dug themselves into their partisan trenches. The only way a deal doesn’t get done is if Republicans do not budge on the issue of taxes; but considering that Republicans lost the Presidential election, lost seats in both the House and the Senate, and lost all three popular votes (Presidential, Senate, and House), it would be a devastating blow to Republicans’ midterm election hopes if they’re viewed as obstructive. In my opinion, a deal will get done, even if it’s done just to save face.

Elsewhere, taking a look at European credit, bond yields are slightly lower following a strong German economic report for December, helping lift the Euro across the board. The Italian 2-year note yield has decreased to 1.807 % (-6.1-bps) while the Spanish 2-year note yield has increased slightly to 2.791% (+0.3-bps). Similarly, the Italian 10-year note yield has decreased to 4.377% (-6.5-bps) while the Spanish 10-year note yield has decreased to 5.243% (-3.2-bps); lower yields imply higher prices.

RELATIVE PERFORMANCE (versus USD): 12:00 GMT

EUR: +0.32%

GBP: +0.28%

CHF: +0.19%

CAD:+0.01%

AUD:-0.28%

JPY:-0.31%

NZD:-0.51%

Dow Jones FXCM Dollar Index (Ticker: USDOLLAR): -0.11% (-0.19% past 5-days)

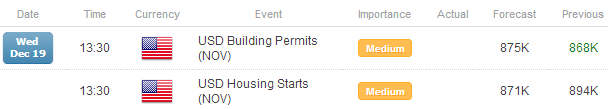

ECONOMIC CALENDAR

See the DailyFX Economic Calendar for a full list, timetable, and consensus forecasts for upcoming economic indicators.

TECHNICAL ANALYSIS OUTLOOK

EURUSD: The post-QE3 September high at 1.3170/75 was smashed through yesterday, and now the pair has traded right into its May 1 high of 1.3280/85. With 1H, 4H, and now daily charts showing overbought readings on their respective RSIs, we are now looking for a top; any dips should look to be bought following the break of the September high at 1.3170/75. Support comes in there, 1.3145 and 1.3075/90. Resistance is 1.3280/85 (breaking now) and 1.3380/85 (mid-March swing high).

USDJPY: The Bull Flag that broke above 82.90 continues to play out, with only two days of reprieve coming for the fast rising pair. Data continues to hurt the JPY side of the equation, and with a heavily anticipated BoJ meeting on the horizon, further rallies could be around the corner. Support comes in at 84.00/20, 83.45, and 81.90.Resistance is 85.50/55 (post-Fukushima earthquake intervention high).

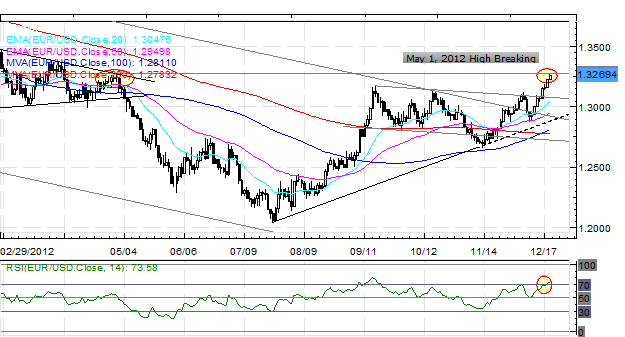

GBPUSD: The pair is pressing 1.6300 now, though with no follow through yet, my levels remain the same. Resistance comes in at 1.6300/10 (post-QE3 announcement high in mid-September) and 1.6350/55 (monthly R2). Support is 1.6170, 1.6110 (20-EMA), and 1.6050 (50-EMA).

AUDUSD:No change from Thursday: “The AUDUSD couldn’t break descending trendline resistance off of the July 2011 and February 2012 highs, which come in at 1.0550/55 today, but that doesn’t mean the uptrend is over just yet. With price holding just below the monthly R2 at 1.0570 and thelong-term Symmetrical Triangle starting to break to the upside, consolidation may be ahead the next few sessions. Support is at 1.0500/15, 1.0460, and 1.0235/80. Resistance is 1.0555/75 and 1.0605/25 (August and September highs.”

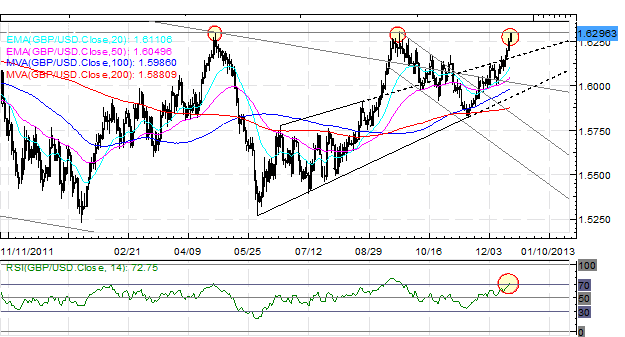

S&P 500: The S&P 500is at a very significant zone of 1445/50 (CORECTED) (descending trendline off of September and October highs, 100% Fibonacci extension off of the November 16 low, the November 23 high, and the November 28 low extension), and a move higher necessarily points to 1470/75. Support comes in at 1425, 1400, 1389 (200-DMA) and 1345/50 (November low).

GOLD: As noted previously, “December is historically a bad month for precious metals. I will continue to look to get long as low as 1675.” While I’m interested in price down here, selling pressure is intense; though I suspect that a retest of the breakout leading up to QE3 in September could draw buying interest again at 1645. Resistance is 1700, 1735 and 1755/58. Support is 1661 (200-DMA) and 1645.

--- Written by Christopher Vecchio, Currency Analyst

To contact Christopher Vecchio, e-mail cvecchio@dailyfx.com

Follow him on Twitter at @CVecchioFX

To be added to Christopher’s e-mail distribution list, please fill out this form

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance