Forex Correlations: Australian Dollar at Clear Risk as Volatility Near Lows

The Australian Dollar is at risk of an important top against the US Dollar (ticker: USDOLLAR) as exceddingly low forex options market volatility expectations warns of complacency and a sentiment extreme.

Forex Correlations SummaryView forex correlations to the Dow Jones Industrial Average, Crude Oil Futures prices, US S&P 500 Volatility Index, UK FTSE 100, and Spot Gold prices.

S&P 500 | EURUSD | GBPUSD | USDJPY | AUDUSD | USDCAD | NZDUSD | USDOLLAR |

1 Week | 0.62 | -0.62 | 0.77 | 0.55 | -0.84 | 0.91 | 0.27 |

1 Month | 0.58 | 0.35 | 0.44 | 0.56 | -0.44 | 0.55 | -0.37 |

3 Month | 0.48 | 0.40 | 0.23 | 0.48 | -0.58 | 0.52 | -0.41 |

1 Year | 0.54 | 0.55 | 0.23 | 0.77 | -0.80 | 0.70 | -0.59 |

Gold | EURUSD | GBPUSD | USDJPY | AUDUSD | USDCAD | NZDUSD | USDOLLAR |

1 Week | -0.16 | 0.48 | -0.88 | -0.26 | 0.60 | -0.38 | -0.44 |

1 Month | 0.59 | 0.55 | -0.12 | 0.49 | -0.17 | 0.09 | -0.62 |

3 Month | 0.64 | 0.59 | -0.29 | 0.49 | -0.43 | 0.46 | -0.68 |

1 Year | 0.55 | 0.38 | -0.23 | 0.52 | -0.37 | 0.52 | -0.59 |

CrudeOil | EURUSD | GBPUSD | USDJPY | AUDUSD | USDCAD | NZDUSD | USDOLLAR |

1 Week | 0.46 | -0.42 | 0.25 | 0.32 | -0.44 | 0.66 | 0.10 |

1 Month | 0.38 | 0.21 | 0.06 | 0.51 | -0.32 | 0.40 | -0.38 |

3 Month | 0.38 | 0.42 | -0.06 | 0.45 | -0.44 | 0.45 | -0.46 |

1 Year | 0.42 | 0.39 | 0.14 | 0.55 | -0.60 | 0.52 | -0.46 |

US2YR | EURUSD | GBPUSD | USDJPY | AUDUSD | USDCAD | NZDUSD | USDOLLAR |

1 Week | 0.68 | -0.54 | 0.69 | 0.60 | -0.83 | 0.93 | 0.16 |

1 Month | 0.43 | 0.35 | 0.56 | 0.52 | -0.51 | 0.47 | -0.25 |

3 Month | 0.13 | 0.08 | 0.50 | 0.15 | -0.24 | 0.04 | 0.04 |

1 Year | 0.15 | 0.10 | 0.44 | 0.09 | -0.24 | 0.01 | 0.01 |

VIX | EURUSD | GBPUSD | USDJPY | AUDUSD | USDCAD | NZDUSD | USDOLLAR |

1 Week | -0.99 | -0.11 | -0.37 | -0.95 | 0.84 | -0.92 | 0.48 |

1 Month | -0.40 | -0.36 | -0.18 | -0.58 | 0.44 | -0.61 | 0.42 |

3 Month | -0.35 | -0.36 | -0.07 | -0.47 | 0.47 | -0.55 | 0.39 |

1 Year | -0.44 | -0.46 | -0.24 | -0.60 | 0.59 | -0.57 | 0.47 |

Perfect Positive Correlation: | 1.00 | ||||||

Perfect Negative Correlation: | -1.00 | ||||||

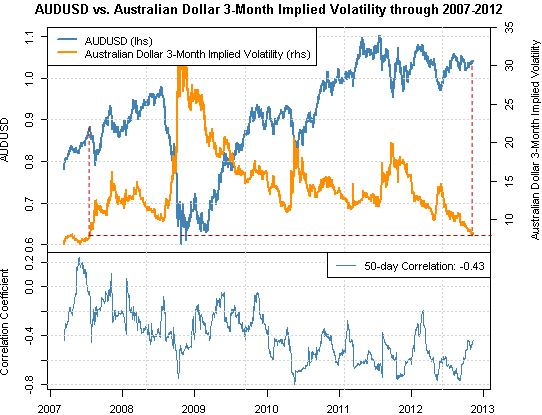

Correlation between Australian Dollar/US Dollar Exchange Rate and 3M Implied Volatility

Australian Dollar/US Dollar Exchange Rate (lhs)Australian Dollar/US Dollar 3-Month Implied Volatility (rhs)Correlation between AUDUSD and 3-Month implied Volatility

A strongly negative correlation between the Australian Dollar/US Dollar pair and the implied volatility prices of AUDUSD options warns that Aussie Dollar strength may ultimately prove unsustainable on a shift in forex market conditions. A bearish short-term technical forecast and uncertain fundamental outlook likewise warn of potential AUD weakness.

Implied volatility is a measure of the prices paid for volatility expectations in options prices, and a higher number shows that traders predict larger moves in the underlying currency. The implied volatility levels of 3-Month AUDUSD options shows that options traders predict the lowest Aussie Dollar exchange rate volatility since 2007.

It was in August that we argued that extremely low AUDUSD volatility warned of a major top, and the pair has since made a series of lower highs. Yet it is more significant to note that volatility has continued to fresh lows and yet the AUDUSD has been unable to break previous peaks.

We see clear risk that the AUDUSD may continue to trade lower through near-term trade, but we may need to see a material shift in volatility expectations before a more sustained Australian Dollar reversal.

--- Written by David Rodriguez, Quantitative Strategist for DailyFX.comReceive future correlation studies and other reports via this author’s e-mail distribution list with this link.

Contact David and follow via Facebook and Twitter:http://www.facebook.com/DRodriguezFXhttps://twitter.com/DRodriguezFX

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance