Forex: Commodity Currencies, Yen Lead Against Weak Euro

ASIA/EUROPE FOREX NEWS WRAP

After Friday’s Nonfarm Payrolls report did little to support the US Dollar in the post-December Federal Reserve meeting Minutes trading world, risk-appetite has seemingly steadied if not contracted to start the first full week of the year. The Japanese Yen has posted a solid rebound versus the world’s reserve currency as well as the European currencies despite gapping lower to start the week, as news headlines over the weekend suggested that new Japanese Prime Minister Shinzo Abe was increasing pressure on the Bank of Japan to endorse a +2.0% yearly inflation target at its next meeting on January 22.

Mainly, the Yen’s rebound can be credited to extremely oversold technical condition, with many Yen-crosses posting multi-month or multi-year highs in the past week. The market also remains biased short the Yen, with the most recent CFTC’s COT report showing net non-commercial futures positioning holding near its lowest levels since July 2007, despite short covering into the end of December. Fundamentally and psychologically speaking, any perceived shift in BoJ policy leading up to the meeting could lead to continued Yen weakness from now until then, whereas the Yen could strengthen once policy is solidified (similar to the US Dollar strengthening after the Fed announced QE3 in mid-September).

Away from the safe havens, the commodity currencies remain well-supported with the New Zealand Dollar notably outperforming, while the Euro has led the European currencies lower (the Swiss Franc is a follower given the EURCHF floor). This more or less has to do with the expectation that the European Central Bank will not implement any new policies this week. As I expressed in the Euro’s Weekly Trading Forecast, each meeting following the initial OMT announcement has led to greater and greater weakness; and now that the market is no longer short the Euro versus the US Dollar, there is significantly more room for weakness in the EURUSD.

Taking a look at European credit, weakness in peripheral bonds has weighed on the Euro today. The Italian 2-year note yield has increased to 1.687% (+4.9-bps) while the Spanish 2-year note yield has increased to 2.350% (+3.8-bps). Likewise, the Italian 10-year note yield has increased to 4.291% (+3.8-bps) while the Spanish 10-year note yield has increased to 5.044% (+2.8-bps); higher yields imply lower prices.

RELATIVE PERFORMANCE (versus USD): 11:45 GMT

NZD: +0.40%

JPY: +0.30%

AUD: +0.14%

CAD:0.00%

GBP:-0.07%

EUR:-0.21%

CHF:-0.25%

Dow Jones FXCM Dollar Index (Ticker: USDOLLAR): -0.02% (+0.66% past 5-days)

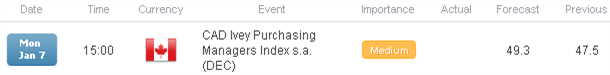

ECONOMIC CALENDAR

See the DailyFX Economic Calendar for a full list, timetable, and consensus forecasts for upcoming economic indicators.

TECHNICAL ANALYSIS OUTLOOK

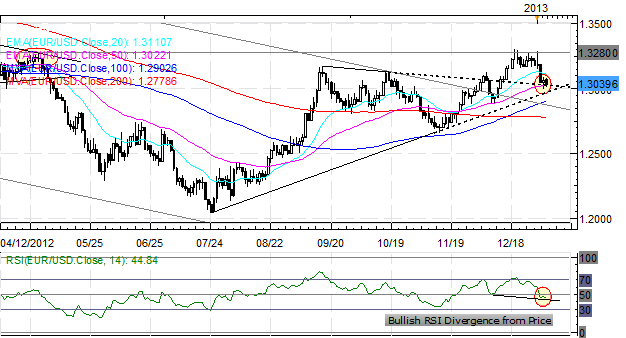

EURUSD: Last week I said: “The pair failed once again at its May highs...trading towards the descending trendline off of the September and October highs.” Further, “the bearish RSI divergence seen on the daily chart (as well as the 4H)” is now resolved; if anything, bullish RSI divergence is forming. With price act the descending TL off of the September and October highs, the pair is at a critical juncture. Support comes in 1.3020/40 (50-EMA), 1.2950/65 (ascending TL off of July and November lows) and 1.2875/95. Resistance is 1.3050/60, 1.3170, 1.3280/85, and 1.3380/85 (mid-March swing high).

USDJPY: No change: “The pair has exploded to its highest level since July 2010, leaving the December 2008/January 2009 lows in focus at 87.00/20. Given BoJ policy, any dips seen in the USDJPY are viewed as constructive for further bullish price action (the market remains very net-short). With 87.00/20 easily broken, the pair is now in a zone that proved to be strong support throughout 2009 and 2010, at 88.15/95. Support comes in at 87.00/20 and 86.00.”

GBPUSD: No change: “The pair has fallen back from 1.6300, again, though with no follow through yet, my levels remain the same (they haven’t changed since early-December). However, the pair is now coming into ascending TL support off of the July and November lows at 1.5985. Support is there and 1.5895 (200-DMA). Resistance comes in at 1.6080/90 (50-EMA), 1.6180, and 1.6300/10 (post-QE3 announcement high in mid-September).”

AUDUSD:The AUDUSD still can’t break the descending trendline resistance off of the July 2011 and February 2012 highs, which come in at 1.0530/50 today, but that doesn’t mean the uptrend is over just yet. However, as noted the past several weeks, the “consolidation…the next few sessions” may be ending. Given the Fed Minutes, any risk-off move could see a drop as low as 1.0145/65. Support is at 1.0340/50, 1.0280/95 (November swing low, 200-DMA), and 1.0145/65. Resistance is 1.0530/85 and 1.0605/25 (August and September highs).

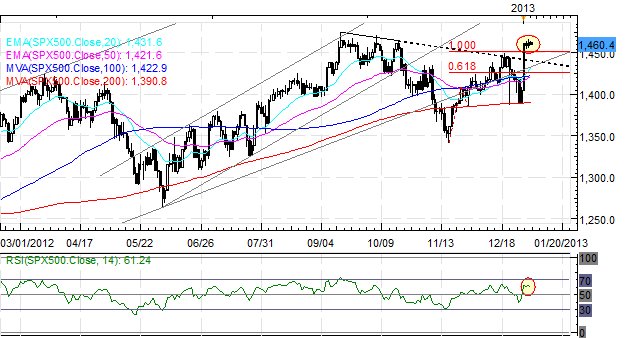

S&P 500: No change: “The S&P 500is back above a very significant zone of 1445/50 (descending trendline off of September and October highs, 100% Fibonacci extension off of the November 16 low, the November 23 high, and the November 28 low extension), and a move higher necessarily points to 1470/75. Support comes in at 1425, 1400, 1390 (200-DMA) and 1345/50 (November low).”

GOLD: TOP CHART: Daily; BOTTOM CHART: Weekly. Gold is at a make or break level right now, former Symmetrical Triangle support at 1630/40, and its lowest level since August, before the ECB and the Fed’s QE intervention hopes took hold. Additionally, when considering the move off of the September highs, a measured A-B=C-D (as expressed on the Daily) suggests that a bottom could be in place at these levels as well. Support is there at 1580. Resistance is 1690/95, 1735, 1755, and 1785/1805.

--- Written by Christopher Vecchio, Currency Analyst

To contact Christopher Vecchio, e-mail cvecchio@dailyfx.com

Follow him on Twitter at @CVecchioFX

To be added to Christopher’s e-mail distribution list, please fill out this form

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance