Forex: Commodity Currencies Rally, but Euro Remains Lower

ASIA/EUROPE FOREX NEWS WRAP

A quiet US trading session is on the horizon in light of the Veteran’s Day holiday, which has bond markets closed and lower volumes expected throughout the day on Monday. Nevertheless, with Asian and European markets fully online, there are have been some noteworthy developments that have influenced price action today worth discussing.

Yesterday, the Samaras-led Greek government had its 2013 budget passed in parliament, clearing the way for Euro-zone finance ministers to vote on the next tranche of Greek aid later on today. Although the event would typically yield a more positive risk horizon, it appears that the measures passed will fall short of pan-European approval. A meeting is set for later today that should provide insight into this process. We expect some sort of intermediate measures to be proposed that keeps Greece afloat over the next few weeks, as the country is expected to run out of money (again) in the next week or so.

The Euro seems to be reflecting this lack of enthusiasm, as the European currencies have trailed their Asia and North American counterparts for most of the day. With the US fiscal cliff squarely in focus – and freshly reelected President Barack Obama convening with Congressional leaders later this week – the Japanese Yen remains well-supported, while Gold and Silver continue to outperform and lead the broader market, as they have since their mid-September highs.

Taking a look at credit, Euro weakness has been reflected by weakness in periphery bonds. The Italian 2-year note yield has increased to 2.318% (+2.5-bps) while the Spanish 2-year note yield has increased to 3.139 % (+8.7-bps). Likewise, the Italian 10-year note yield has increased to 4.995% (+3.4-bps) while the Spanish 10-year note yield has increased to 5.842% (+5.0-bps); higher yields imply lower prices.

RELATIVE PERFORMANCE (versus USD): 11:35 GMT

AUD: +0.45%

NZD:+0.31%

CAD:+0.24%

CHF:+0.16%

EUR: +0.09%

JPY:+0.07%

GBP: -0.05%

Dow Jones FXCM Dollar Index (Ticker: USDOLLAR): -0.09% (-0.15% past 5-days)

ECONOMIC CALENDAR

There are no important data due out during today’s US trading session.

See the DailyFX Economic Calendar for a full list, timetable, and consensus forecasts for upcoming economic indicators.

TECHNICAL ANALYSIS OUTLOOK

EURUSD: No change from Friday: “Late-September and early-October swing lows have broken and a deeper retracement is looking possible now that the consolidation is failing off of the September 17 and October 17 highs, and the October 1 low. Price action remains biased to the downside as the EURUSD has struggled to regain 1.2750, mid-June swing highs and the early-September “pause” the EURUSD experienced. Support comes in there (breaking again), 1.2630/45 (100-DMA), and 1.2400/35. Resistance is 1.2820/30 (mid-October swing low, 200-DMA), 1.2880/1.2900, and 1.3015/20 (last week’s high).”

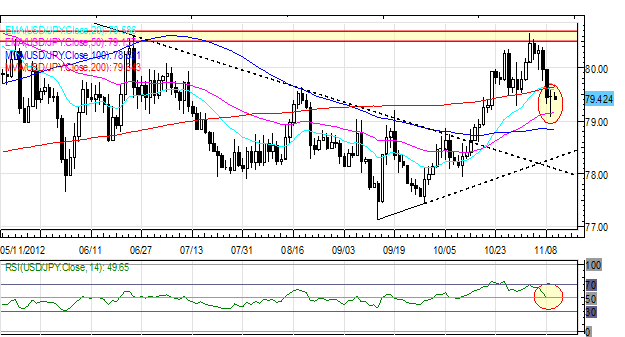

USDJPY: Gold and the USDJPY are signaling that the fiscal cliff concerns are coming back into the picture, with the USDJPY back to its lowest level in a month and Gold back to its highest price over the same time frame. Friday’s Doji/Hammer suggests a pause in the downtrend from key resistance in the 80.50/70 zone (mid-June swing high), although the uptrend from mid-September remains broken. Support is 79.10/30 and 78.60. Resistance is at 79.55/65 (20-EMA, 200-DMA), 80.00, 80.50/70, and 81.75/80 (mid-April swing high).

GBPUSD: No change from Tuesday: “While the GBPUSD appeared to be moving to breakout of its recent downtrend, an Inverted Hammer on November 1 has biased the pair to the downside. For now, we are neutral if not looking lower.” Resistance comes in at 1.5910/15 (October low), 1.6005/15 (20-EMA, 50-EMA) and 1.6170/80 (late-October highs). Support is 1.5845/66 (100-DMA, 200-DMA) and 1.5800/05.

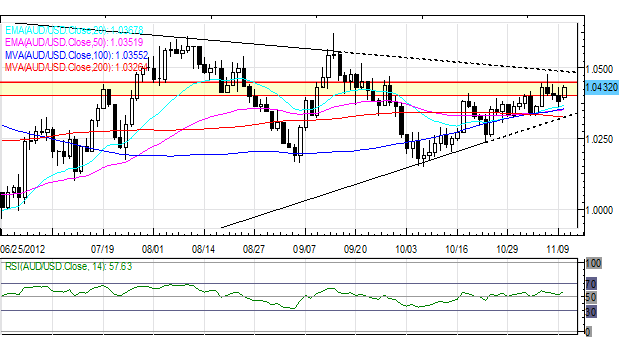

AUDUSD: The pair has rebounded ahead of a confluence of support, and is now back into a key resistance zone that has been of interest for traders numerous times over the past four months. Support is close by at 1.0330/50 (20-EMA, 50-EMA, 100-DMA, 200-DMA) and 1.0310/05 (ascending trendline off of June 1 and October 23 lows). Resistance is at 1.0405/50 (former swing highs and lows, October high) and 1.0500/15.

S&P 500: Last week I said: “Now the pullback is looking deeper: the ascending channel off of the October 4, 2011 and June 4, 2012 lows is breaking. Targets near 1355 are in focus now that price is below 1395. Support comes in at 1375 and 1350/55 (monthly S2, ascending channel support off of November 2011 and June 2012 lows). Resistance comes in at 1383 (200-DMA),1405 (100-DMA), and 1415/20 (20-EMA, 50-EMA).” The Doji on Friday’s chart after an extended move lower, right ahead of support, suggests that some sideways if not bullish price action is possible over the coming days. I’m looking for a low.

GOLD: Gold has rebounded to fresh November highs and remains above 1715; my bias is thus becoming increasingly bullish. I still expect the 1700 area to be defended vigorously, and look to get long as low as 1680. Resistance is 1735 (here now), 1755/58 and 1785/1805. Support is 1700, 1675/80 (100-DMA, November low), and 1660/65 (200-DMA).

--- Written by Christopher Vecchio, Currency Analyst

To contact Christopher Vecchio, e-mail cvecchio@dailyfx.com

Follow him on Twitter at @CVecchioFX

To be added to Christopher’s e-mail distribution list, please fill out this form

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance