Forex Analysis: US Dollar Waits for Sentiment Cues as S&P 500 Stalls

THE TAKEAWAY: The US Dollar is waiting for directional cues from risk sentiment trends as the S&P 500 stalls after hitting a four-month high.

US DOLLAR TECHNICAL ANALYSIS– Prices turned lower from resistance at the top of a rising channel set from mid-September, taking out near-term support at smaller channel bottom to expose the 50% Fibonacci retracement at 10038. A further push below that aims for the 61.8% level at 10009. Near-term resistance is at 10066, the 23.6% retracement, followed by the channel bottom at 10091.

Daily Chart - Created Using FXCM Marketscope 2.0

S&P 500 TECHNICAL ANALYSIS – Prices are testing resistance at 1474.90, the September 14 high. A break upward targets the 100% Fibonacci expansion at 1459.70. Near-term support is at 1470.40, the 76.4% expansion, with a turn back below that targeting the 61.8% level at 1454.50.

Daily Chart - Created Using FXCM Marketscope 2.0

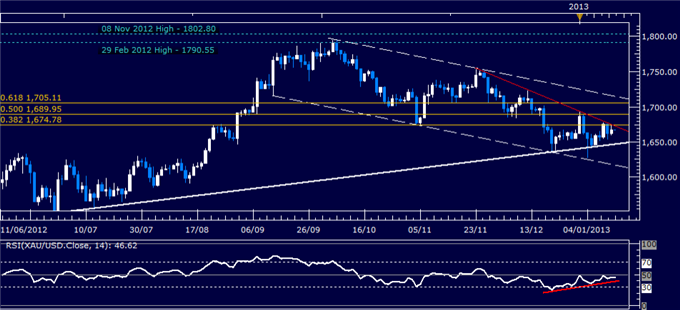

GOLD TECHNICAL ANALYSIS – Prices are wedged between a major rising trend line set from mid-May 2012 and the 38.2% Fibonacci retracement at 1674.78. Resistance is reinforced by a falling trend line established from the November 23 2012 high. A break higher exposes the 50% Fib at 1689.95. Alternatively, a push below the trend line (now at 1645.95) targets the channel bottom at 1616.31.

Daily Chart - Created Using FXCM Marketscope 2.0

Want to learn more about RSI? Watch this Video.

CRUDE OIL TECHNICAL ANALYSIS– Prices took out trend line resistance set from late February, initially exposing support-turned-resistance at 94.61. A break above that targets a rising channel top at 96.01. The trend line (now at 92.84) has been recast as support, with a drop back below that aiming for the 92.00 figure.

Daily Chart - Created Using FXCM Marketscope 2.0

--- Written by Ilya Spivak, Currency Strategist for Dailyfx.com

To contact Ilya, e-mail ispivak@dailyfx.com. Follow Ilya on Twitter at @IlyaSpivak

To be added to Ilya's e-mail distribution list, please CLICK HERE

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance