Forex Analysis: Retail Traders Sell US Dollar - We Favor Gains

Retail forex trading crowds have sold into US Dollar (ticker: USDOLLAR) declines against the Euro, and the important shift favors selling any EURUSD bounces through near-term price action.

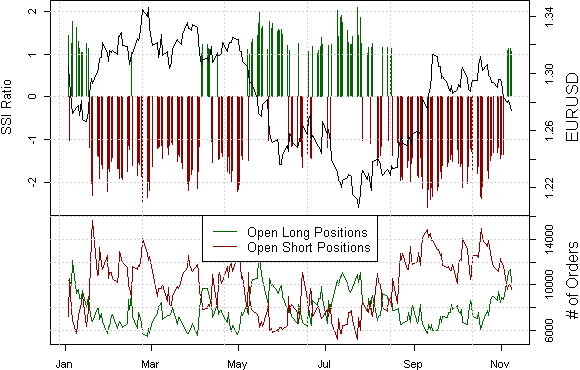

EURUSD - Euro Forecast to Fall Further

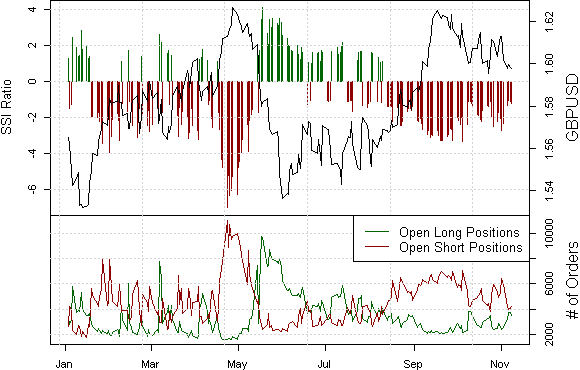

GBPUSD - British Pound Outlook Favors Losses

USDJPY - Japanese Yen Likely Set Significant Top

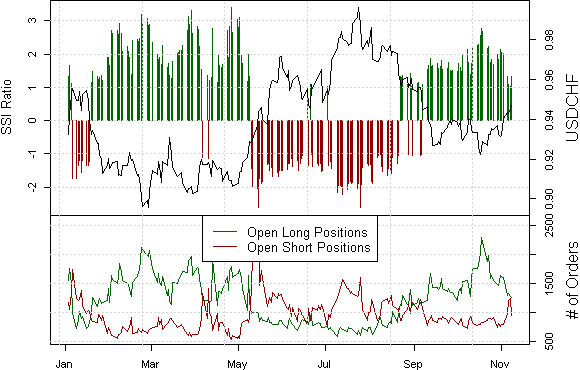

USDCHF - Swiss Franc Outlook Unclear

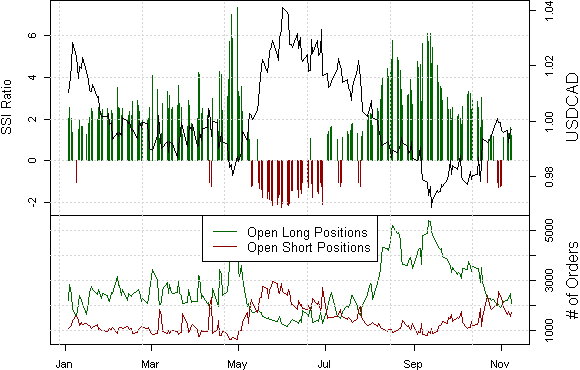

USDCAD - Canadian Dollar Forecast to Strengthen

GBPJPY - GBPJPY Forecast Remains Bullish

Looking for more information on the SSI? Watch avideo guide on the Speculative Sentiment Index from our FXCM Expo

It is important to note that the US Dollar reversal has not coincided with a similar shift in forex volatility expectations, but fairly consistent EURUSD declines may nonetheless offer trend trading opportunities.

We see similar shifts in USD positioning versus the Swiss Franc, while choppy sentiment in other forex pairs makes near-term forecasts less clear.

Our Euro forecast versus the US Dollar (ticker: USDOLLAR) has turned negative as our proprietary retail forex trading sentiment indicator shows the majority of traders have gone long EURUSD for the first time in two months.

Retail trading crowds had previously remained short Euros as it crossed above the $1.25 mark in mid-September, and the fact that they have now flipped in their net trading bias is further confirmation that we may have set a significant EURUSD top.

Our technical strategist forecasts that any important Euro bounces should be sold, and indeed our read of retail sentiment supports our bearish EURUSD outlook.

GBPUSD – A pronounced shift in retail forex trading sentiment warns that the British Pound could continue lower against the US Dollar (ticker: USDOLLAR).

The majority of retail traders first turned short the British Pound in August as the pair crossed above the $1.56 mark in August—giving us a fairly consistent bullish contrarian bias. Yet total long interest surged 59 percent from last week, while shorts dropped a similar 39 percent. Our SSI data shows that a mere 51% of traders are currently short GBPUSD versus 73% last week.

A sustained flip to net-long would give us clear signal that the GBPUSD may break below key range lows, and our technical forecast remains bearish below $1.6174.

USDJPY – Retail forex trading crowds remain aggressively long the US Dollar (ticker: USDOLLAR) versus the Japanese Yen, but we believe that a significant shift in positioning confirms that the USDJPY set a significant bottom through September.

Crowds have most recently bought into the USDJPY’s decline from ¥80.65, but a hold above ¥79.30 would keep our US Dollar/Japanese Yen-bullish forecast intact.

In the meantime we could see choppy trading amidst similarly indecisive crowd sentiment.

USDCHF –Retail forex traders remain long US Dollar (ticker: USDOLLAR) against the Swiss Franc, but a more recent turn in sentiment warns that the USDCHF may have bottomed.

Crowds first turned net-long USDCHF when the pair traded below the SFr 0.95 mark, but the ratio of traders long to those short is now at its lowest since that time.

A further flip to net-short would confirm a shift in our USDCHF trading bias.

USDCAD –Fast shifts in US Dollar (ticker: USDOLLAR) positioning against the Canadian Dollar suggests the USDCAD may fall further through near-term trading.

The majority of retail traders are once again net-long the US Dollar versus its Canadian counterpart (long USDCAD), and a further build in long positions keeps us on the watch for further declines.

Indeed, our technical forecast favors selling USDCAD strength until further notice.

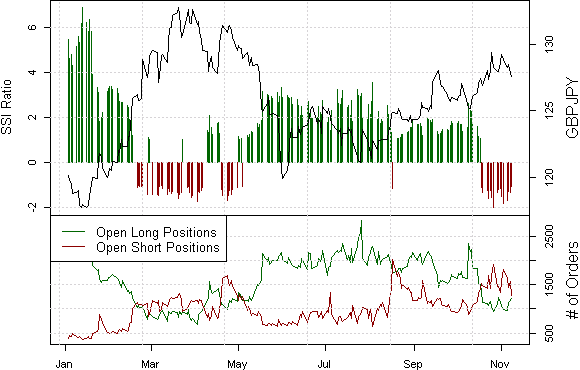

GBPJPY – Retail forex traders continue selling aggressively into British Pound strength against the Japanese Yen, and such clearly one-sided sentiment leaves our short-term forecast in favor of further gains.

Yet it’s important to note that GBPJPY short interest has fallen 25 percent since last week, while long interest has risen by the same. If we see a more sustained shift we may need to abandon our GBPJPY-bullish trading bias.

--- Written by David Rodriguez, Quantitative Strategist for DailyFX.com

To receive the Speculative Sentiment Index and other reports from this author via e-mail, sign up for his distribution list via this link.

New to FX markets? Learn more in our video trading guide.

Contact David via

Twitter at http://www.twitter.com/DRodriguezFX

Facebook at http://www.Facebook.com/DRodriguezFX

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance