Forex Analysis: Euro Vulnerable Amid Weak Economics, Greek and Spanish Concerns

Fundamental Forecast for the Euro: Neutral

Euro Erases Overnight Gains Following Onslaught of Disappointing Data

Sentiment Remains Vulnerable as Euro Retraces Gains on Light News

With another weak performance over the past five days behind the Euro, it’s important to reflect on the path traveled. In terms of data, Italian and French manufacturing data turned lower over the past months, and the German growth forecast for the coming year was revised lower as well – both clear signs the crisis is having real impacts on the relative core. Even at the European Central Bank press conference following their Rate Decision on Thursday, President Mario Draghi said that the “risks surrounding the economic outlook remain on the downside.” Furthermore, with the medium-term interest rate forecast above the 2% year-over-year target, any growth boost via another rate cut looks unlikely.

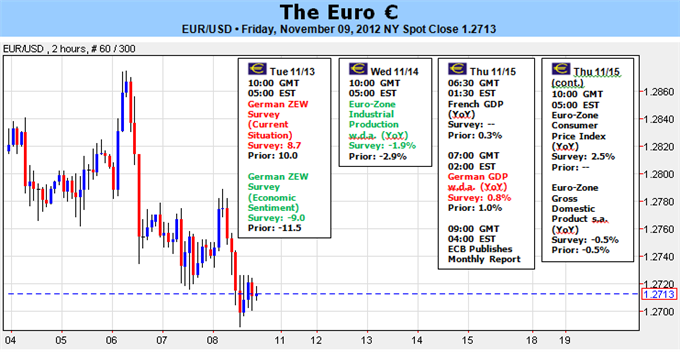

This theme of economic weakness will continue to be a driving factor for the week, and is a main reason why the Euro’s outlook is neutral-to-bearish. We look to Thursday, when French, German, Italian, and broad Euro-zone growth data is due. On Thursday, the preliminary third quarter French GDP figure will come in at 0.0% on a quarterly-basis, the same rate as the previous quarter, and 0.0% on a yearly-basis, from +0.3% y/y in the second quarter. German growth rates are forecasted to tail off as well, with the quarterly figure shown at +0.1% from +0.3% q/q. On a yearly-basis, growth is projected to have slowed to a rate of +0.4% from +0.5% y/y. Rounding out the Thursday individual growth data are the Italian figures, projected to go to -0.5% q/q from -0.8% q/q and to -2.9% y/y from -2.6% y/y.

When we overlay these figures together, we get a very clear picture of what austerity is doing to the European consumer: incomes are falling and aggregate demand is thus dropping. A decline in growth with easing price pressures suggests that demand-pull inflation is absent – shrinking economies are shedding workers, who have less money to spend, thus buy fewer goods, forcing companies to shed more workers, etc. At this point, more monetary stimulus might not do anything more than spur cost-push inflation, the kind central bankers, especially at the ECB due to the German stance on inflation, would prefer to keep absent.

But as events throughout the week showed, ultimately, the concerns over Greece and Spain are going to push-and-pull the Euro back and forth this week, with risks biased to the downside. Protests continued throughout Greece and Alexis Tsipras, the recently absent but not forgotten leader of the anti-austerity, and implicitly anti-Euro (given the European Troika’s parameters) Syriza party, called for elections anew. Recent polling figures suggest that the New Democracy-lead coalition would be out of power, with Syriza gaining control of the government, and the far-right Neo-Nazi party obtaining the third-highest contingent of seats. Needless to say, the markets will not like this, just based on the renewed uncertainty that Greece could default on all of its debt; as a reminder, including derivatives, obligations resulting from a Greek default could total over $1 trillion.

Spain represents the clearest path for some positive news out of Europe. I’ve long discussed the possibility of a Spanish bailout, on the premise of worsening economic data and increased international pressure to see resolution with banking sector woes. As the current state of Greece shows, the international aid path – especially one outlined by the European Troika – is harsh and unwelcoming. If Spain gives in, while it will be positive for market participants’ confidence with respect to the ECB coming into the market, it could mean the end of the current government, as already-disgruntled citizens will be convinced the Rajoy government has given away the country’s sovereignty. Any uptick in the Euro based on Spanish bailout news is another ‘buy the rumor, sell the news’ type of event.

This increasingly negative backdrop, despite the potential for the Spanish bailout, leads us to have a neutral-to-bearish bias for the coming week. In the event that Spain does request a bailout, our forecast becomes bullish immediately, and for at least a few days, although it’s hard to foresee strength beyond the very near-term given exogenous influences gaining steam, as noted earlier. –CV

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance