Forex Analysis: Euro Searching for Support and NZDUSD for Resistance

Yen crosses are stretched by many measures but forcing analysis is of no use and may even tempt one into foolish action. As such, focus heading into next week centers on several Euro crosses and the NZDUSD.

EURUSD

Weekly

Prepared by Jamie Saettele, CMT

FOREX Observation: The EURUSD completed an inverse head and shoulders pattern in early December that had been forming (bottom of left shoulder) since the second week of 2012. Here we are exactly one year later and it is possible that the first big move of 2013 is higher as per the completed pattern. Price is testing the neckline as support now but the classical pattern is considered valid as long as price is above the breakout bar low of 12875. Objectives to think about include where the rally from the 2011 low would consist of 2 equal waves, at 13787 and the traditional h&s objective of about 14260.

FOREX Trading Implication: Focus for now is on initiating a core long. I wrote last night that I was looking to go long on an NFP washout in the mid-12900s. We dipped slightly under 13000 before drifting higher to end the day though. A slight new low can’t be ruled out, especially considering the 3 wave advance from today’s low. A Monday low would be most desirable when one considers weekly seasonality. Speaking of seasonality, failure to put in a low by Tuesday would leave the EURUSD vulnerable on a monthly seasonality basis (high is first day of the month). Bottom line; I’m looking to buy a drop below Friday’s low, probably between 12950/85 on Monday.

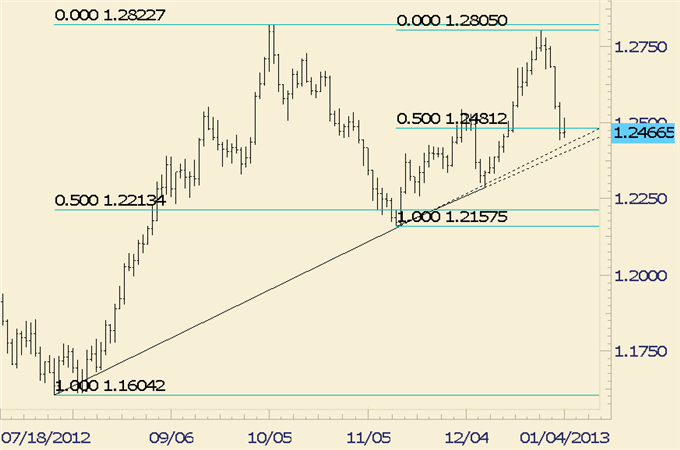

EURUSD

Daily

Prepared by Jamie Saettele, CMT

Euro / Australian Dollar

Weekly

Prepared by Jamie Saettele, CMT

FOREX Observation: The EURAUD seems to be where the EURUSD was in early December. The first attempt on the inverse head and shoulders has failed and price has already retraced slightly over half of the advance from the November low. The EURAUD may be ‘scaling’ to 50% retracements (the advance from the 2011 low retraced slightly more than 50% before turning-see daily chart below). Trendline support comes in at slightly lower levels early next week.

FOREX Trading Implication: Even if am larger sideways pattern is underway from the 2011 low, expect a bounce after a final low (below 12442). The decline from 12805 would then consist of 5 waves.

Euro / Australian Dollar

Daily

Prepared by Jamie Saettele, CMT

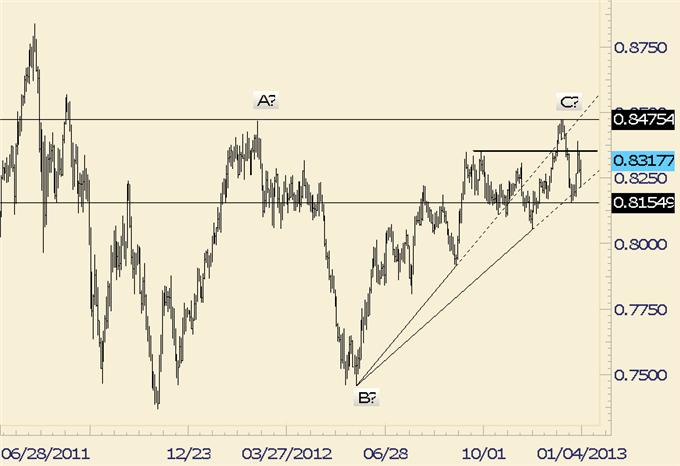

New Zealand Dollar / US Dollar

Daily

Prepared by Jamie Saettele, CMT

FOREX Observation: The NZDUSD false break higher in early December and subsequent impulsive decline has me intrigued in the short side to begin the year. A corrective advance may be underway from 8155, in which case a final foray into 8400 wouldn’t be out of the question.

FOREX Trading Implication: Don’t get caught up with the rally from 8155. Given where the market is (top of multiyear range), the impulsive decline from 8475 is more important. Today’s drift higher brought the NZDUSD into resistance, which extends slightly higher to 8340. I prefer to see how the market reacts early next week before doing anything.

--- Written by Jamie Saettele, CMT, Senior Technical Strategist for DailyFX.com

To contact Jamie e-mail jsaettele@dailyfx.com. Follow him on Twitter @JamieSaettele

Subscribe to Jamie Saettele's distribution list in order to receive actionable FX trading strategy delivered to your inbox.

Jamie is the author of Sentiment in the Forex Market.

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finance

Yahoo Finance