FMC Corp's (FMC) Earnings and Revenues Top Estimates in Q2

FMC Corporation FMC recorded earnings (as reported) of $1.06 per share in second-quarter 2022, down from $1.56 reported in the year-ago quarter.

Barring one-time items, adjusted earnings per share were $1.93, topping the Zacks Consensus Estimate of $1.90. Our estimate for the quarter was $1.91.

Revenues were $1,452.3 million in the quarter, up around 17% from the year-ago quarter’s levels. The top line surpassed the Zacks Consensus Estimate of $1,346.8 million. The figure compares to our estimate of $1,341.6 million.

Revenues were driven by a 14% rise in volumes and an 7% contribution from price. The company benefited from a strong demand environment and price gains in all regions amid significant cost and currency headwinds.

FMC Corporation Price, Consensus and EPS Surprise

FMC Corporation price-consensus-eps-surprise-chart | FMC Corporation Quote

Regional Sales Performance

Sales climbed 26% year over year in North America in the quarter, driven by a double-digit growth in demand for both herbicides and insecticides.

Sales in Latin America rose 42% year over year in the reported quarter on higher volumes and significant price increases in soy, corn, cotton and sugarcane.

In EMEA, sales rose 15% year over year organically driven by strong pricing and higher demand for Exirel insecticide and Verimark insecticide as well as selective herbicides.

Revenues went up 4% year over year in Asia, partly aided by higher demand for Benevia insecticide in India for application on fruits and vegetables.

Financials

The company had cash and cash equivalents of $591.5 million at the end of the quarter, down roughly 19% year over year. Long-term debt was $2,731.7 million, up around 3.8% year over year.

Guidance

For 2022, FMC raised its revenue outlook to the range of $5.5-$5.7 billion (from $5.25-$5.55 billion), indicating a rise of 11% at the midpoint from 2021 levels. Sales are expected to be driven by higher volumes and prices in all regions partly offset by foreign currency headwinds in EMEA and Asia.

The company also narrowed adjusted EBITDA guidance to the band of $1.36-$1.44 billion for 2022 (compared with $1.32-$1.48 billion expected earlier), indicating a 6% rise at the midpoint from 2021 levels.

FMC also narrowed adjusted earnings per share forecast for 2022 to the range of $7.00-$7.70 (compared with $6.70-$8.00 expected earlier), suggesting an increase of 6% at the midpoint from the 2021 level.

Free cash flow for 2022 is now projected to be $565-$685 million.

For third-quarter 2022, revenues are projected in the band of $1.31-$1.39 billion, reflecting an increase of 13% at the midpoint compared with the prior-year quarter’s levels. Adjusted earnings are forecast in the range of $1.00-$1.20 per share, representing a decline of 23% at the midpoint from the prior-year quarter’s levels. The company also expects adjusted EBITDA in the range of $235-$255 million for the quarter.

The company also sees fourth-quarter revenues in the range of $1.39-1.51 billion, reflecting a 2% rise at the midpoint compared with the prior-year quarter’s levels. Adjusted earnings are forecast in the range of $2.18-$2.70 per share, representing a rise of 13% at the midpoint from the prior-year quarter’s levels. It also expects adjusted EBITDA in the range of $411-$471 million for the quarter.

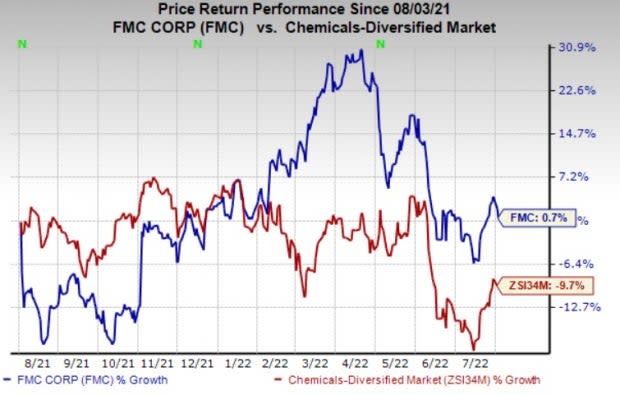

Price Performance

FMC’s shares are up 0.7% in the past year compared with an 9.7% decline of the industry.

Image Source: Zacks Investment Research

Zacks Rank & Other Key Picks

FMC currently carries a Zacks Rank #3 (Hold).

Better-ranked stocks worth considering in the basic materials space include Cabot Corporation CBT, ATI Inc. ATI and Albemarle Corporation ALB.

Cabot, currently carrying a Zacks Rank #1 (Strong Buy), has an expected earnings growth rate of 22.5% for the current fiscal year. The Zacks Consensus Estimate for CBT's earnings for the current fiscal has been revised 0.8% upward in the past 60 days. You can see the complete list of today’s Zacks #1 Rank stocks here.

Cabot’s earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, the average being 16.2%. CBT has gained around 32% over a year.

ATI, currently carrying a Zacks Rank #2, has a projected earnings growth rate of 1,069.2% for the current year. The Zacks Consensus Estimate for ATI's current-year earnings has been revised 12.5% upward in the past 60 days.

ATI’s earnings beat the Zacks Consensus Estimate in the last four quarters. It has a trailing four-quarter earnings surprise of roughly 128.9%, on average. ATI shares are up around 26% in a year.

Albemarle has a projected earnings growth rate of 247% for the current year. The Zacks Consensus Estimate for ALB’s current-year earnings has been revised 7.8% upward in the past 60 days.

Albemarle’s earnings beat the Zacks Consensus Estimate in each of the trailing four quarters, the average being 20%. ALB has gained roughly 18% in a year. The company has a Zacks Rank #2.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ATI Inc. (ATI) : Free Stock Analysis Report

Albemarle Corporation (ALB) : Free Stock Analysis Report

FMC Corporation (FMC) : Free Stock Analysis Report

Cabot Corporation (CBT) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance