FMC Corp Collaborates With Nutrien Ag Solutions for Arc Farm

FMC Corporation FMC collaborated with Nutrien Ag Solutions on a pilot program to utilize the new FMC Arc farm intelligence platform.

Notably, the tool offers Nutrien Ag Solutions pest control advisors in California, with real-time pest monitoring and predictions of diamondback moth communities in brassica crops.

Per management, the unique technology is expected to increase the capability of Nutrien Ag Solutions representatives to help farmers manage disruptive diamondback moths through an integrated pest management plan.

Notably, the pilot program was introduced in late May 2020 and will continue through the middle of September.

FMC Arc farm intelligence will visualize the data as detailed maps on a proprietary mobile application. Moreover, FMC intends to refine and validate an advanced pest prediction model for diamondback moths focused on current and historical data.

The company’s shares have moved up 20% in the past year against the industry’s 10% decline.

On its first-quarter earnings call, FMC expected revenues between $4.65 billion and $4.85 billion for 2020, indicating a rise of 3% at the midpoint from that reported in 2019.

The company also expects adjusted earnings per share of $6.05-$6.70 for the year. The guidance suggests an increase of 5% at the midpoint from that reported in 2019.

Moreover, FMC envisions adjusted EBITDA of $1.23-$1.34 billion for 2020, indicating 5% growth at the midpoint versus 2019.

For second-quarter 2020, revenues are projected to be $1.17-$1.23 billion, flat at the midpoint with the second-quarter 2019 number. Adjusted earnings are forecast to be $1.58-$1.74 per share, flat at the midpoint with the second-quarter 2019 figure.

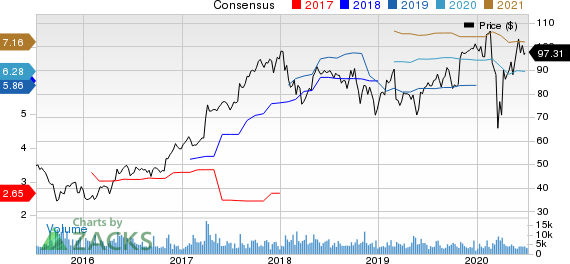

FMC Corporation Price and Consensus

FMC Corporation price-consensus-chart | FMC Corporation Quote

Zacks Rank & Stocks to Consider

The company currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the basic materials space are AngloGold Ashanti Limited AU, Sandstorm Gold Ltd SAND and Harmony Gold Mining Company Limited HMY.

AngloGold has a projected earnings growth rate of 109.9% for the current year. The company’s shares have surged around 71% in a year. It currently has a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Sandstorm Gold has a projected earnings growth rate of 55.6% for the current year. The stock has gained around 74% in a year. It currently has a Zacks Rank of 2.

Harmony Gold has an expected earnings growth rate of 264.3% for 2020. The company’s shares have gained 124% in the past year. It is presently a Zacks #2 Ranked player.

These Stocks Are Poised to Soar Past the Pandemic

The COVID-19 outbreak has shifted consumer behavior dramatically, and a handful of high-tech companies have stepped up to keep America running. Right now, investors in these companies have a shot at serious profits. For example, Zoom jumped 108.5% in less than 4 months while most other stocks were sinking.

Our research shows that 5 cutting-edge stocks could skyrocket from the exponential increase in demand for “stay at home” technologies. This could be one of the biggest buying opportunities of this decade, especially for those who get in early.

See the 5 high-tech stocks now>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

FMC Corporation (FMC) : Free Stock Analysis Report

Sandstorm Gold Ltd (SAND) : Free Stock Analysis Report

AngloGold Ashanti Limited (AU) : Free Stock Analysis Report

Harmony Gold Mining Company Limited (HMY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance