Fixed Rates Drop Below Floating Rates: What Does It Mean for Homeowners?

One of Singapore's leading home lenders, DBS, just launched a home loan promotion that offers a fixed rate package with an introductory rate of 1.89% (as of July 18, 2019) in the first year. This is noteworthy due to the fact that this fixed rate loan's first year rate is currently cheaper than any floating rates on the market, which are almost always the cheaper option. With this news in mind, we've laid out some important considerations for current and prospective homeowners as they compare the home loan and home loan refinancing options available to them.

Understand the Difference Between Fixed & Floating Rates

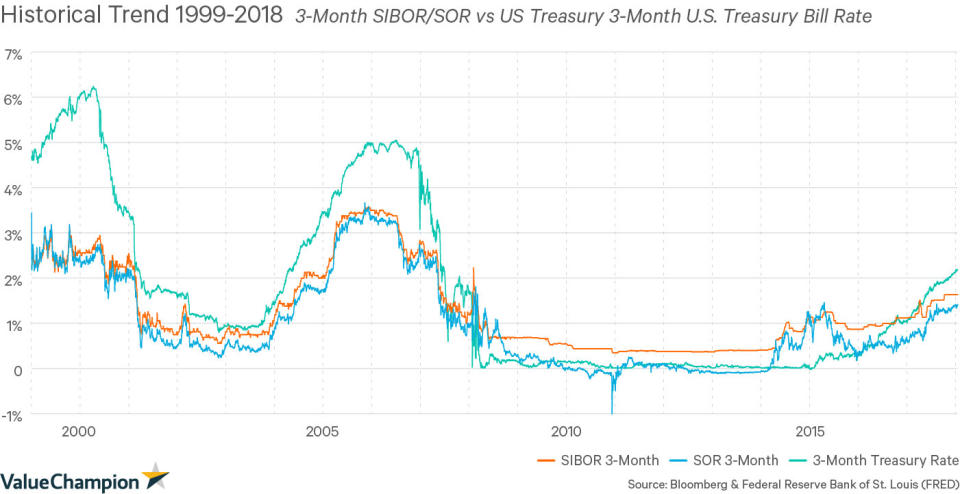

The first thing to consider when comparing home loans or refinancing options the choice between fixed and floating rates. With a fixed rate, borrowers are guaranteed a set interest rate for a number of years. On the other hand, floating rates can change frequently based on market rates. Neither loan type is always more advantageous, it usually depends on the interest rate environment. Generally, when market rates are rising, fixed interest rates may be more expensive than floating rates, but also give borrowers protection against increased mortgage rates. When rates are declining, floating rates may become cheaper if rates fall after the loan is approved, while a fixed rate would stay steady for a set number of years.

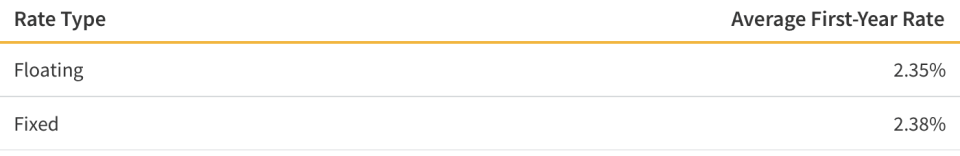

Average Housing Loan Interest Rates As of July 19, 2019

Recently, it appears that home lenders in Singapore are charging a lesser premium for fixed rate loans. This may be a result of the U.S. Federal Reserve's anticipated rate cuts. These cuts are relevant to consumers in Singapore, because interest rates in the country are historically correlated with those in the United States. Therefore a shift in Fed policy may ultimately influence the direction of home loan interest rates in Singapore.

Compare Total Interest During Lock-In Period

While DBS's promotional fixed interest rate is quite competitive with Singapore's other top lenders, consumers would do well to carefully review their options before applying for a loan. For example, the promotional rate offered by DBS increases substantially in the second year of the loan. A better way for consumers to compare the cost of any loan is to consider the loan's total interest cost. With home loans, it is most important to compare the total interest cost during the lock-in period of each loan. The lock-in period is important because it is the period in which borrowers cannot refinance their loan. Following the lock-in period, homeowners could feasibly refinance if their loan's interest rate is no longer competitive.

Weigh the Costs and Benefits of Refinancing

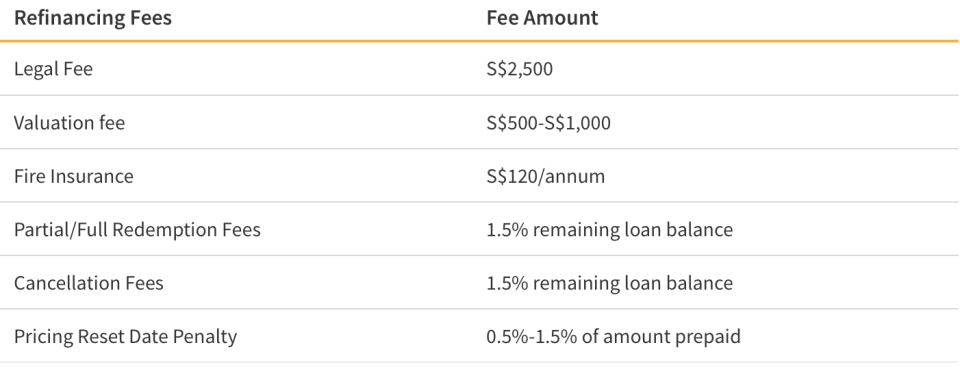

While home loan refinancing is quite popular in Singapore, it is important to clearly understand the associated costs along with the potential savings. For example, some banks will charge partial/full redemption fees or cancellation fees to those that choose to refinance. Additionally, refinancing also often entails valuation and legal fees that can cost several thousand dollars in total.

However, some fees may be avoided by choosing a bank that offers a subsidy or reduced fee amount. Also, if you choose to reprice (instead of refinance) your loan with your current lender, you can avoid some of the fees associated with leaving for a new bank.

Do Your Mortgage Loan Homework

For many individuals, purchasing a home is the biggest investment of their life. Therefore, it is crucial to understand all of the intricacies of your borrowing options before proceeding with a new home loan or refinancing offer. Ultimately, it is possible to save a significant amount of money through proper research and due diligence.

The article Fixed Rates Drop Below Floating Rates: What Does It Mean for Homeowners? originally appeared on ValueChampion's blog.

ValueChampion helps you find the most relevant information to optimise your personal finances. Like and follow our Facebook page to keep up to date with our latest news and articles.

More From ValueChampion:

Yahoo Finance

Yahoo Finance