Fitbit (FIT) Q1 Loss Wider Than Estimated, Revenues Lag

Fitbit, Inc. FIT reported first-quarter 2020 adjusted loss of 24 cents per share, wider than the Zacks Consensus Estimate of a loss of 22 cents.

The company’s total revenues came in at $188 million, down 30.8% year over year. The figure also missed the consensus estimate of $270 million.

The quarterly results were negatively impacted by the outbreak of COVID-19.

Let’s check out the numbers in detail.

Top-Line Details

During the first quarter, Fitbit sold 2.2 million wearable devices, down 26% year over year.

The average selling price decreased 11% from the prior-year level to $81 per device in the first quarter. This was due to an increase in reserves for product returns, rebates and promotions, as well as price protection related to COVID-19.

Geographically, revenues from the United States accounted for 54% of first-quarter revenues and decreased 24% year over year.

On a year-over-year basis, international revenues declined 37% to $86 million. Americas — excluding the United States — declined 30% to $11 million, APAC was down 47% to $18 million and EMEA was down 35% year over year to $57 million.

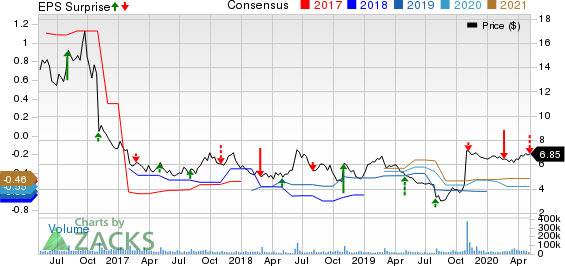

Fitbit Inc Price, Consensus and EPS Surprise

Fitbit Inc price-consensus-eps-surprise-chart | Fitbit Inc Quote

Operating Results

Non-GAAP gross margin was 32%, down 220 basis points year over year. Gross margins were negatively impacted by higher reserves associated with COVID-19. Also, higher ending and obsolescence costs impacted gross margins.

Non-GAAP operating expenses were 146.4 million, down 2.9% from the year-ago quarter. However, research & development, sales & marketing, as well as general & administrative expenses — as a percentage of sales — increased from the year-ago quarter.

Non-GAAP operating loss was $84.9 million compared with a loss of $53.1 million in the year-ago quarter.

Balance Sheet and Cash Flow

Cash and cash equivalents & marketable securities were $427.7 million compared with $518.5 million in the fourth quarter.

Accounts receivables were $182.3 million compared with $435.3 million in fourth-quarter 2019.

Cash flow from operations was ($82) million and free cash flow totaled ($85.5) million in the first quarter of 2019.

Zacks Rank and Stocks to Consider

Currently, Fitbit has a Zacks Rank #3 (Hold). Some better-ranked stocks in the broader technology sector include Akamai Technologies, Inc. AKAM, Inuvo, Inc. INUV and Shopify Inc. SHOP, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Long-term earnings growth for Akamai, Inuvo, and Shopify is currently projected at 12.3%, 30% and 25.8%, respectively.

5 Stocks Set to Double

Each was hand-picked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2020. Each comes from a different sector and has unique qualities and catalysts that could fuel exceptional growth.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Akamai Technologies Inc (AKAM) : Free Stock Analysis Report

Inuvo Inc (INUV) : Free Stock Analysis Report

Fitbit Inc (FIT) : Free Stock Analysis Report

Shopify Inc (SHOP) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance