Fiscal Hawks: Why Is No One Talking About the Deficit?

Some notable fiscal hawks are wondering how Hillary Clinton and Donald Trump intend to pay for their proposed federal spending.

Both Clinton and Trump have promised new government programs worth hundreds of billions of dollars, and Trump has pledged to slash taxes on individuals and businesses by trillions of dollars in the coming decade. However, neither has offered a comprehensive plan for controlling the growth of entitlements or slowing the growth of the national debt.

Related: Big Deficits Loom as Candidates Pile on Spending and Tax Cuts

The U.S. Chamber of Commerce on Monday released an open memo to Lester Holt, the NBC news anchor who will moderate the first debate, urging him to press the candidates to explain how they would go about preserving the country’s entitlement programs and reduce a national debt that recently topped a record $19.5 trillion.

“These programs are fundamental components of America’s social safety net, providing economic security to seniors, the poor, and others,” the memo stated. “However, they’re also the main drivers of our country’s swelling federal debt … In fact, on their current trajectory, entitlements and interest on the debt (which is largely driven by spending on those entitlement programs) will account for 96 percent of all federal revenue in 10 years, according to baseline projections by the nonpartisan Congressional Budget Office.”

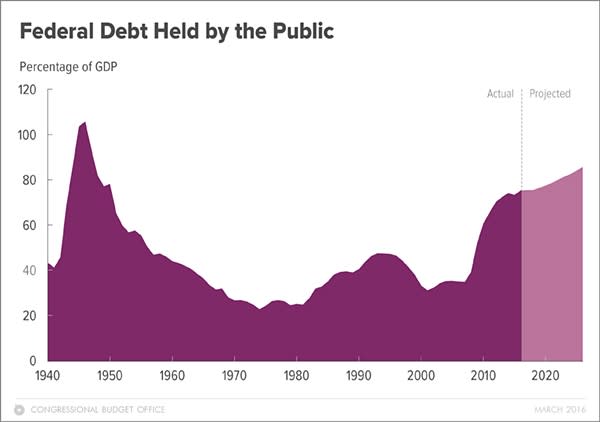

The Congressional Budget Office warned this summer that the national debt is racing well ahead of prior projections and could reach an historic 141 percent of the overall economy by 2046. The CBO now estimates that the fiscal 2016 deficit – the annual shortfall between revenues and expenditures -- will total $590 billion and exceed last year’s deficit by $152 billion. Part of that increase is due to a shift in the timing of some of the government’s payments. But the non-partisan CBO has repeatedly warned that growth in the deficit will gain momentum in the next few years. Without significant action by a new Congress and president, there is danger that the government will return to an era of massive, trillion-dollar annual deficits akin to those of the Great Recession.

Related: CBO Warns Congressional Spending Is Driving Up the Deficit

The Chamber of Commerce memo sparked similar calls from Capitol Hill and from government spending watchdogs and anti-deficit groups for Holt to devote at least part of the hour and a half debate to urgent fiscal issues that many voters say are among their top concerns.

“Both parties agree that our budget process is broken, and now is the time to fix it,” Senate Budget Committee Chair Mike Enzi (R-WY), said in a statement to The Fiscal Times. “Instead of the current budget, which is designed to fail both Congress and the public, it is time to put forth a process that is designed to succeed. This is the only tool that Congress has to control runaway mandatory spending. This is one of the most important challenges facing our country because mandatory spending is literally surging out of control, driving future deficits and debt to unsustainable levels.”

Maya MacGuineas, president of the Committee for a Responsible Federal Budget, noted that the national debt as a share of the economy is at an historic, post-war high. Moreover, interest on the debt is the fastest growing part of the budget and threatens to crowd out other priorities. “And yet neither candidate has a plan to put the debt on a sustainable path or devotes even one penny to reducing its growth,” she said. “The debt touches every part of the budget, and it should receive significant attention in the upcoming debates.”

Eager to appeal to liberal Democrats who have been slow to embrace her campaign, Clinton has proposed a raft of plans to invest in infrastructure, revitalize the economy in Appalachia’s coal country, provide family and medical leave, offer free college tuition to many middle class students, and boost spending for early childhood education. Clinton would offset much of the cost by raising taxes on wealthy Americans by about $1.1 trillion over ten years, but that would still leave a net annual cost of $198.2 billion, according to a tally by the National Taxpayers Union Foundation.

Related: Trump’s Tax Plan Would Cost Trillions, but the Numbers Are a Moving Target

Clinton has also pledged to support an expansion of Social Security benefits, despite concerns about the long-term economic viability of the retirement program.

Trump would spend only a portion of what Clinton has proposed, with much of it going to a robust infrastructure program, a build-up of the military, expanded immigration and customs enforcement, expanded school choice and guaranteed paid maternity leave. Trump has been vague as to how much many of his proposals would cost and how he would pay for them – although he has floated a “penny plan” to cut non-defense discretionary spending by one percent a year to achieve savings. For now, the National Taxpayers Union Foundation has pegged the annual cost of his initiatives at $18 billion, although that is likely far below the actual cost.

Trump has also proposed more than $4 trillion in tax cuts over the coming decade as part of a revised economic package unveiled last week. Trump argues that his new tax cut will be more than offset by long term economic growth and will not add to the debt. He has also pledged to protect entitlements including Social Security and Medicare from cuts, despite their long-term impact on the debt.

Both Clinton and Trump are touting economic growth and middle class relief over fiscal restraint – an approach that undeniably is good politics if not good management of the budget. The result, according to The Wall Street Journal, is a presidential campaign “where neither of the major party candidates is making a serious push to reduce the size and scope of government.”

Related: Trump’s ‘Penny Plan’ Has Appeal, but Experts Say It’s Unworkable

Robert Bixby, the executive director of the Concord Coalition, an anti-deficit group, said in an interview that “What’s driving the budget deficit are things like health care costs and the aging of the population, and we’re just not getting any sort of discussion about those issues – and what it means for the budget. So, I would like to have something like that. But I think so far the debate from both candidates on fiscal policy hasn’t been grounded in reality.”

“The budget really hangs over everything,” he added. “Whatever policy agenda either of the candidates wants to pursue, it will play out against the current budget situation and should be in some ways constrained by the budget situation. In other words, whether you want an expansive agenda or cut taxes, it’s going to have an effect on the budget. So it’s important for the voters to understand whether the candidates have a sense of the budgetary pressures, and hence whether their policy prescriptions are realistic.”

Top Reads from The Fiscal Times:

Yahoo Finance

Yahoo Finance