First Solar's Financial Strength Is a Huge Asset in Winning Contracts

There's more to solar panels than just efficiency. On top of trying to create modules that convert the most energy from sunlight, solar manufacturers also compete to offer the best warranties for their modules in order to attract customers.

Don't get me wrong: Efficiency in a solar-panel installation is essential. The sun only shines for so many hours a day, and the amount of energy captured by a solar project needs to justify its cost. Manufacturers are in a constant race to offer customers the most efficient solar panels for the lowest price.

Lagging efficiency is why First Solar (NASDAQ: FSLR) decided to shift production in 2016 from its Series 4 modules to the Series 6. Despite their arguably superior real-world performance on overcast days -- and, particularly, in higher-temperature environments than the 25 degrees Celsius common in lab settings -- the company's cadmium telluride (CdTe) Series 4 modules had started falling behind their silicon-based competitors in the efficiency game.

The Series 6 closes the efficiency gap. And now with the first 6's rolling off its Perrysburg, OH production line, solar module buyers will have every reason to focus on FSLR's other competitive advantage: warranties that can be counted on thanks to the company's pristine balance sheet.

Image source: Getty Images.

What's in a warranty?

Back in September, First Solar competitor SunPower (NASDAQ: SPWR) announced its "Complete Confidence Warranty." As the press release stated:

SunPower today announced the launch of the solar industry's best warranty, guaranteeing power performance and product quality for 25 years, through extreme weather, wide-ranging temperatures, panel aging and more. The new warranty makes SunPower E- and X-Series solar panels among the safest long-term energy investments for businesses, homeowners and utilities thanks to the industry's lowest power degradation rate, meaning that SunPower panels deliver more electricity -- and consequently more savings -- over time.

An all-encompassing warranty like SunPower's sounds great to any solar-project buyer -- especially in what is an entirely new and fast-growing industry.

First Solar's own warranty guarantees the performance of its modules for 25 years (via its linear performance warranty), but not the module itself, for which it guarantees a product life of 10 years.

However, for buyers of large-scale solar projects, there's more than meets the eye when it comes to product warranties.

A warranty is only as strong as the company that backs it

The growth of the solar industry has been meteoric in recent years. First Solar's revenues in 2016 came to just below $3 billion, but as recently as fiscal year 2007, the company brought in just over $500 million. Sunpower produced $774.8 million in sales in fiscal 2007, and $2.56 billion last year.

Inevitably, with any new industry, there are bound to be winners and losers -- a fact that shareholders of now-bankrupt Suniva know all too well.

The dynamism of new industries also forces buyers of said technologies to put a premium on financial strength. This is an asset that First Solar has in spades compared to fellow manufacturers SunPower, JinkoSolar, and Canadian Solar:

FSLR Debt to Assets (Quarterly) data by YCharts

In First Solar's 10-K filing for 2016, management lists financial strength as a key differentiator:

Our bankability and financial credibility enable us to offer meaningful module and system warranties after installation, which provide us with a competitive advantage relative to some of our peers in the solar sector in the context of project financing.

Utility-scale solar projects are about so much more than just blanket solar-panel efficiency and costs per watt. When choosing a partner, project buyers also look for solar manufacturers that can provide the operations and maintenance expertise to guarantee the project's long-term profitability.

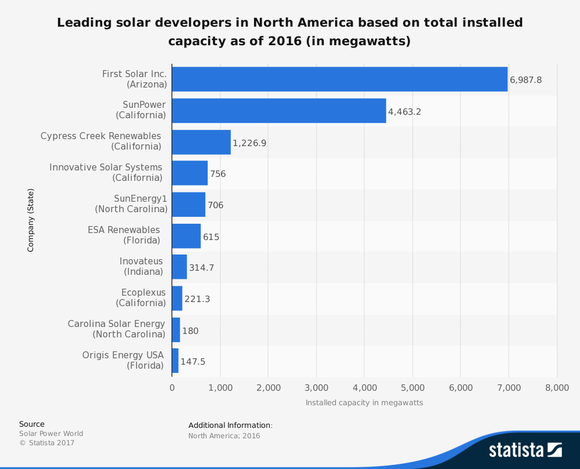

It's little surprise, then, that First Solar has led the industry as the utility-scale solar project developer of choice:

Image source: Statista.

Foolish takeaway

Solar-module efficiency is subject to many caveats, including environmental temperature, light levels, and the age of the module itself. Beyond things like efficiency and costs, manufacturers also compete to provide the best long-term warranties and project-management services. When choosing a supplier for a large-scale solar project, buyers need to know that the manufacturer they've chosen will be there to guarantee the project's success. Perhaps the best way to do this is by possessing the financial strength to ride out lean years and continually invest in new and better modules.

First Solar has proven itself to be a best-in-class manufacturer of solar modules, on all these metrics. It's little wonder, then, that in its third-quarter earnings, First Solar highlighted a staggering current-order backlog through fiscal year 2020 of 5.6 gigawatts' worth of modules -- up from 3.1 GW at the same time last year. It's also worth noting that, as of the end of Q3, First Solar had long-term operations and maintenance contracts with client utilities to manage 7 GW of projects, for which it will recognize $600 million in revenue over the next 12 years.

With the advent of its Series 6 modules, which will bring its efficiency up to par, First Solar's balance sheet should give it the edge it needs in the utility-scale market.

More From The Motley Fool

Sean O'Reilly owns shares of First Solar. The Motley Fool recommends First Solar. The Motley Fool has a disclosure policy.

Yahoo Finance

Yahoo Finance