Finisar to Gain From Enhanced Product Offerings, Risks Stay

On Sep 24, we issued an updated research report on Finisar Corporation FNSR, a components and subsystems provider.

Finisar is expanding its broad product line of optical subsystems through dedicated R&D activities to meet the evolving customer needs, which augurs well for its long-term growth. However, the company remains mired in various operating risks, particularly in China that impair its growth potential to some extent.

Healthy Growth Dynamics

With the growing relevance of fiber optics market, Finisar believes that wavelength management and switching technologies will be increasingly important in optical transmission networks. The company remains focused on targeting opportunities where it can use its high-speed data transmission protocols as these technologies are used across multiple data communication and telecommunication applications.

Leveraging its sound engineering expertise and technical knowhow, Finisar aims to maintain a leading position in the optical subsystems and components industry through the acquisition of complementary businesses. Moreover, Finisar believes in low cost and high value-added product manufacturing as a way to enhance its revenues. It has low cost manufacturing units in Ipoh, Malaysia and Wuxi, China, which significantly lowers the cost of production driven by cheap as well as easily available labor. This offers a competitive advantage to Finisar against its rivals and helps it gain solid foothold in the markets where it operates.

China’s telecommunications market is expected to accelerate with the commercial deployment of 5G technology. It is reportedly the largest market in the industry and accounts for a major chunk of the overall orders of optical fibers worldwide. Finisar’s revenues are expected to rise owing to its regional production and strategic presence in its markets.

Risks

Products that are exported overseas account for majority of Finisar’s overall revenues. The lull in data communication demand in the country, along with the recent prohibition of export of a broad category of U.S. products and high tariffs, remain concerns for the company.

Finisar has limited providers of materials for manufacturing its products. Several of them are independent contract manufacturers that supply key components like lasers, modulators and the like. These contracts are generally short term, which means that the supplier can discontinue its service without any penalty. Moreover, the global market conditions have affected the business and finances of several of these suppliers, making it more likely for them to either go out of business or compromise on the quality of the supply materials. These factors are likely to pose a significant threat to the company’s operations.

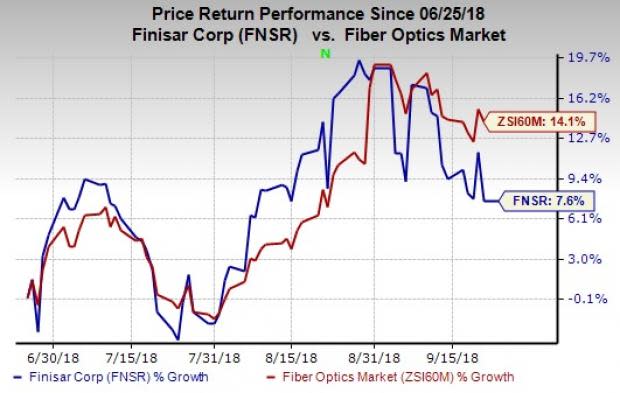

Finisar faces tough competition from financially and technically stronger companies. With increasing market consolidation, the company is likely to face soft margins owing to higher promotional offers and discounts to woo customers. The stock has gained 7.6% compared with 14.1% growth for the industry in the past three months.

Nevertheless, we remain impressed with the inherent growth potential of this Zacks Rank #3 (Hold) stock.

Key Picks

Better-ranked stocks in the broader industry include Ciena Corporation CIEN, Clearfield, Inc. CLFD and QUALCOMM Incorporated QCOM, each carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Ciena has a long-term earnings growth expectation of 15.5%. It surpassed earnings estimates twice in the trailing four quarters with an average positive surprise of 7.7%.

Clearfield beat earnings estimates in each of the trailing four quarters, the average surprise being 52.8%.

QUALCOMM has a long-term earnings growth expectation of 10.9%. It beat earnings estimates in each of the trailing four quarters, the average surprise being 19.8%.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Clearfield, Inc. (CLFD) : Free Stock Analysis Report

QUALCOMM Incorporated (QCOM) : Free Stock Analysis Report

Finisar Corporation (FNSR) : Free Stock Analysis Report

Ciena Corporation (CIEN) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

Yahoo Finance

Yahoo Finance